Bitcoin ETFs and Price: A Symbiotic Relationship?

The long-awaited arrival of spot Bitcoin ETFs in the United States on January 12, 2024, was a watershed moment for the cryptocurrency industry. These ETFs allow investors to gain exposure to Bitcoin without having to purchase and store the digital asset directly. This has led to a surge in investor interest in Bitcoin, and the price of the cryptocurrency has risen sharply in recent months.

Unpacking the Relationship Between Bitcoin ETF Assets and BTC Price

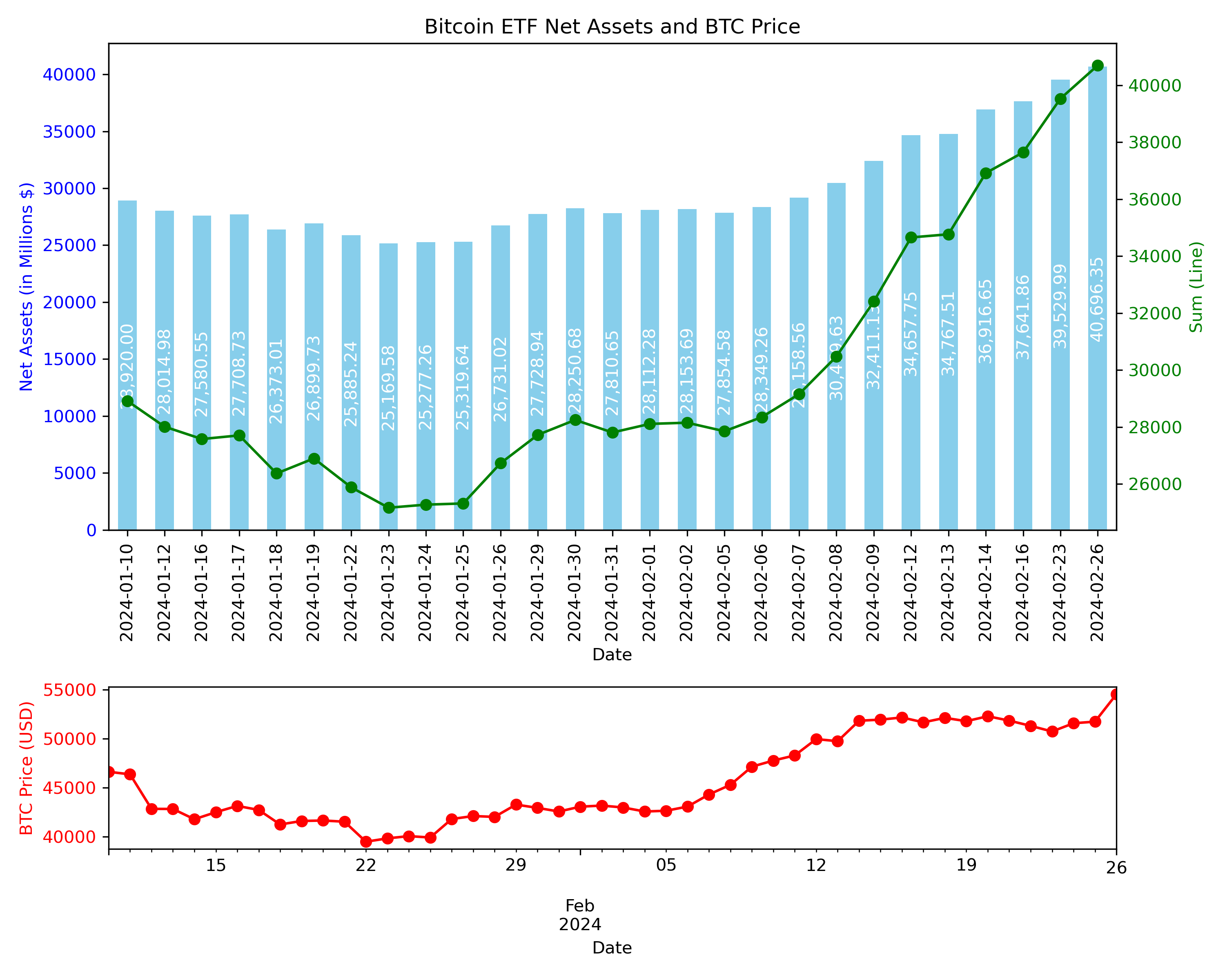

It's been almost 50 days since the Spot Bitcoin ETF launch. Let's look at the relationship between the total assets and Bitcoin price...

The chart presents a compelling visual of Bitcoin ETF net assets and the Bitcoin price trajectory. Despite Bitcoin's notorious volatility, the net assets in Bitcoin ETFs have shown a steady upward trend. This suggests that investors are increasingly viewing Bitcoin as a viable investment vehicle, potentially indicating a strengthening of investor confidence in the digital currency.

There are a few possible explanations for this relationship.

- Increased demand for Bitcoin ETFs could lead to increased demand for Bitcoin itself, as ETF providers need to buy Bitcoin to meet the demand for their shares.

- The launch of Bitcoin ETFs may have brought new investors into the Bitcoin market who would not have otherwise invested in the cryptocurrency.

- The positive media coverage surrounding the launch of Bitcoin ETFs may have boosted investor sentiment, leading to increased demand for Bitcoin.

Beyond Price: ETFs and the Question of Volatility

While the spotlight shines on the price correlation between Bitcoin ETFs and the cryptocurrency's value, their influence could extend beyond mere price action. Bitcoin has long been notorious for its wild price swings, fueled in part by speculative trading and a relatively limited investor pool. The introduction of ETFs presents an interesting dynamic.

ETFs could bring in longer-term investors, potentially tempering some of the short-term fluctuations caused by speculation. However, it's also important to acknowledge that large-scale institutional money flows through ETFs could introduce new sources of volatility. If major investors rapidly buy or sell ETF shares, it could create significant ripples in the Bitcoin market. The long-term impact of ETFs on Bitcoin's volatility remains to be seen, making it a crucial trend for investors and market analysts to monitor closely.

The ETF Race: What's Next After Bitcoin?

The success of spot Bitcoin ETFs has ignited anticipation within the cryptocurrency community. The question on everyone's mind is: which cryptocurrency will be next to gain its own ETF? Here are the top contenders and arguments surrounding them:

- Ethereum (ETH): As the second-largest cryptocurrency by market cap, Ethereum has a strong case. Its wide adoption in decentralized finance (DeFi), NFTs, and its transition to a more energy-efficient proof-of-stake model bolster its appeal.

- Solana (SOL): Known for its lightning-fast transaction speeds and low fees, Solana has emerged as a formidable competitor to Ethereum. However, questions about network reliability and centralization might be hurdles to clear for an ETF.

- The Wildcard: A surprise candidate could emerge. Perhaps a stablecoin ETF, offering exposure to less volatile crypto assets, or a basket-style ETF tracking multiple cryptocurrencies could become a reality.

Conclusion

Looking ahead, the interplay between Bitcoin ETFs and price is poised to shape the asset's trajectory. Growing institutional adoption of Bitcoin could amplify ETF demand and push prices even higher. Additionally, regulatory shifts have the potential to positively or negatively impact this dynamic. While the future remains somewhat uncertain, one thing is clear: Bitcoin ETFs have firmly cemented their position as a powerful force in the cryptocurrency market, making their influence a crucial factor for investors to watch.

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*