Decoding Bitcoin's Next Move: What Options Are Telling Us

Bitcoin's recent surge has investors buzzing, but the question on everyone's mind is whether this momentum is sustainable. Could the cryptocurrency break its all-time high, or is a correction on the horizon? Let's dive into the world of Bitcoin options to see what clues they hold about the future price direction.

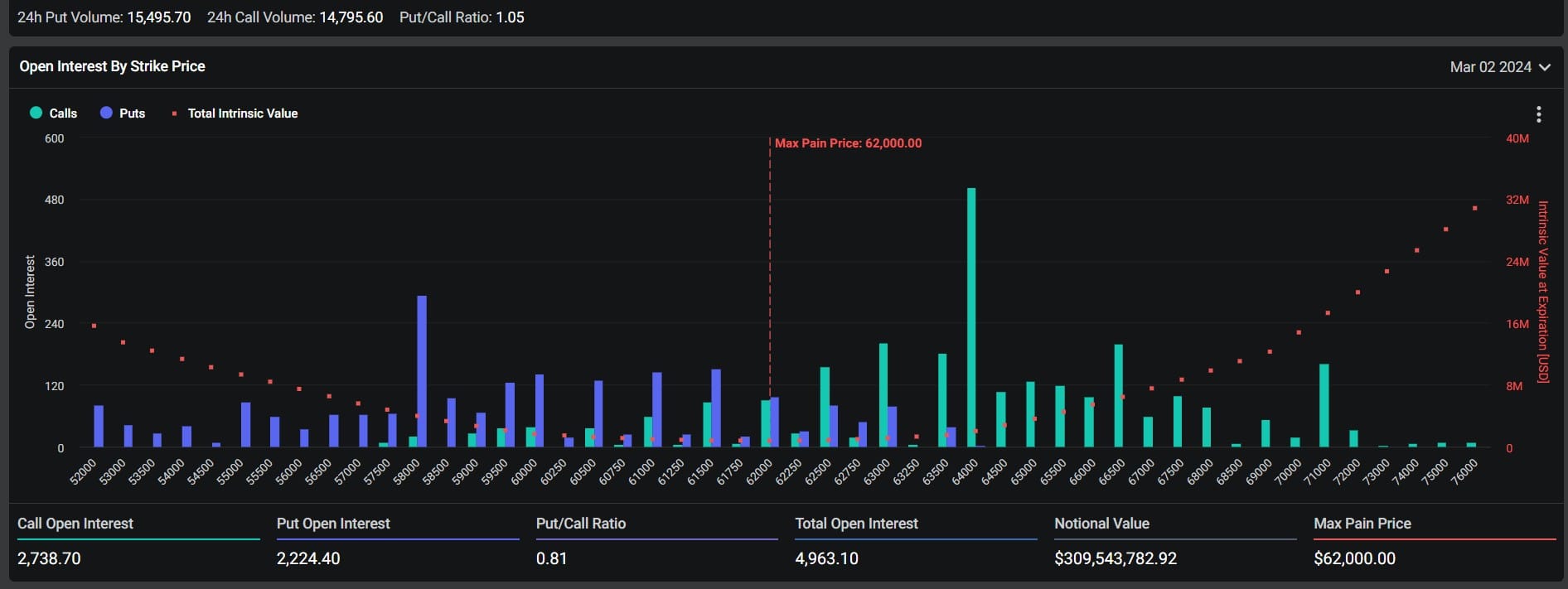

Options Activity: Bulls vs. Bears

A surge in short-dated call options, especially with strike prices above the current market level, indicates bullish sentiment. This suggests that traders are betting on Bitcoin's price to keep climbing. Should Bitcoin approach these strike prices, it could trigger a gamma squeeze that further propels the price upward.

However, the options market also shows signs of caution. High volatility and interest in put options (which bet on a price decline) signal that some traders anticipate a potential pullback. This mix of optimism and fear makes the current market particularly unpredictable.

Thursday, Feb 29, saw unprecedented enthusiasm for crypto options on Deribit. The exchange shattered records, with total options open interest reaching $27 billion and an astonishing $12.4 billion traded in just 24 hours.

Key Levels to Watch

Analysis of open interest reveals key levels that traders are eyeing. Concentrations around $60,000, $65,000, and $70,000 suggest that these could be points of strong support or resistance. A breach above or below these zones could trigger a significant price move in either direction.

So, while a potential liquidity crisis due to Bitcoin's limited supply has been a concern, analysts suggest these fears may be overblown. Short-term holders are starting to offload positions, and despite extreme profit margins for this group, the rally may still have room to run. However, a near-term correction is still possible as market momentum could slow.

The Takeaway

Options provide a window into market sentiment and potential scenarios for Bitcoin's price action. While the strong demand for call options hints at bullishness, lingering uncertainty and the potential for sharp reversals can't be overlooked. Savvy traders will need to monitor strike price concentrations and volatility levels to gauge the likelihood of an upward breakout or a downward correction.

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*