Maximizing Profits with Deep ITM Bull Call Spreads

Deep In-The-Money (ITM) Bull Call Spreads offer a powerful strategy for regular income generation in options trading. By buying and selling deep ITM call options, traders can benefit from time decay and the stability of the underlying asset. This guide demystifies the process, helping you leverage Deep ITM Bull Call Spreads to generate consistent returns and maximize your trading potential.

Deep In-The-Money Bull Call Spread

A Deep In-The-Money Bull Call Spread (also known as a deep ITM bull call spread) is an options strategy that involves buying and selling call options that are both deep in-the-money. This is typically executed with the expectation that the underlying asset will not move significantly, and the trader can profit from time decay and potentially from changes in implied volatility.

Here's how it works:

- The trader buys a deep ITM call option with a lower strike price.

- Simultaneously, the trader sells another deep ITM call option on the same underlying asset with a higher strike price.

The deep ITM options will have a high delta, meaning they move more closely with the underlying asset price. The goal here is to take advantage of the faster time decay of the sold call (which has a higher strike price) relative to the bought call (with a lower strike price).

Advantages

Lower risk: Since both options are deep in-the-money, the spread is primarily composed of intrinsic value, which makes it less sensitive to changes in implied volatility and reduces the potential for large losses.

Income Generation: The primary aim is to collect the time value premium from the sold call as it decays faster than the bought call.

Disadvantages

Limited Profit Potential: While losses are limited, so too are the profits. The maximum profit is capped at the net premium received.

Higher Capital Requirement: Deep ITM options are more expensive due to their intrinsic value. Thus, the initial cash outlay can be significant.

Early Assignment Risk: Given that both options are deep ITM, there's a higher risk of early assignment, especially as the options approach their expiration.

When to use

This strategy is best used when the trader believes that the underlying asset will remain relatively stagnant or move slightly, allowing them to collect the premium due to time decay. It is often used in low-volatility environments where the price of the underlying asset is expected to remain within a specific range until the options' expiration.

Option Finder Tool

Let's explore how our in-house option finder tool can help with the Deep ITM bull call spread.

Step 1 - Enter the stock symbol. Over here I am using AAPL as an example.

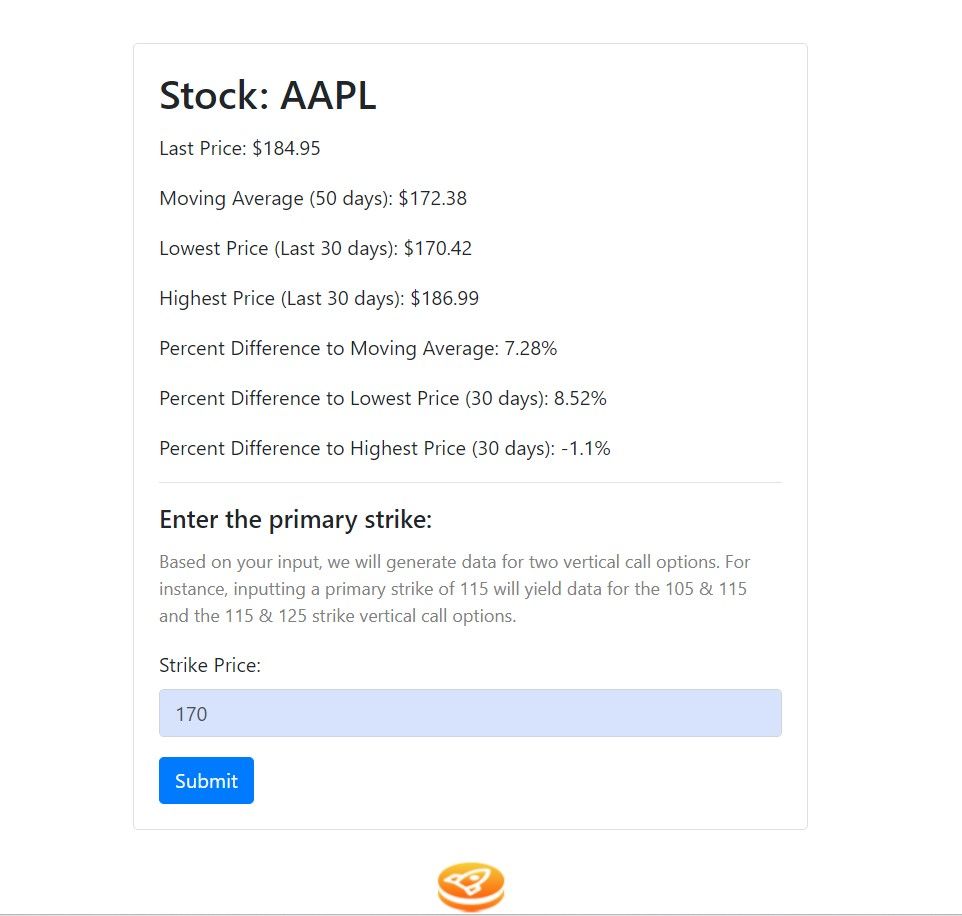

Step 2 - It provides some key information and helps you to pick a strike price for the amount of profit and the risk you are comfortable with.

For instance, the tool displays the 50-day moving average and the lowest price over the past 30 days. I would opt for a strike price lower than the 50-day moving average in this scenario. My objective is to ensure that the stock price remains above the strike price of the call option I'm selling. If I select a $170 strike, the tool provides two alternatives:

- Purchase a call option with a $160 strike price, and sell one with a $170 strike. This is a relatively conservative approach.

- Purchase a call option with a $170 strike price, and sell another with a $180 strike. This is a more aggressive strategy, particularly considering that the current price is merely 1.1% below the peak price of $186.99.

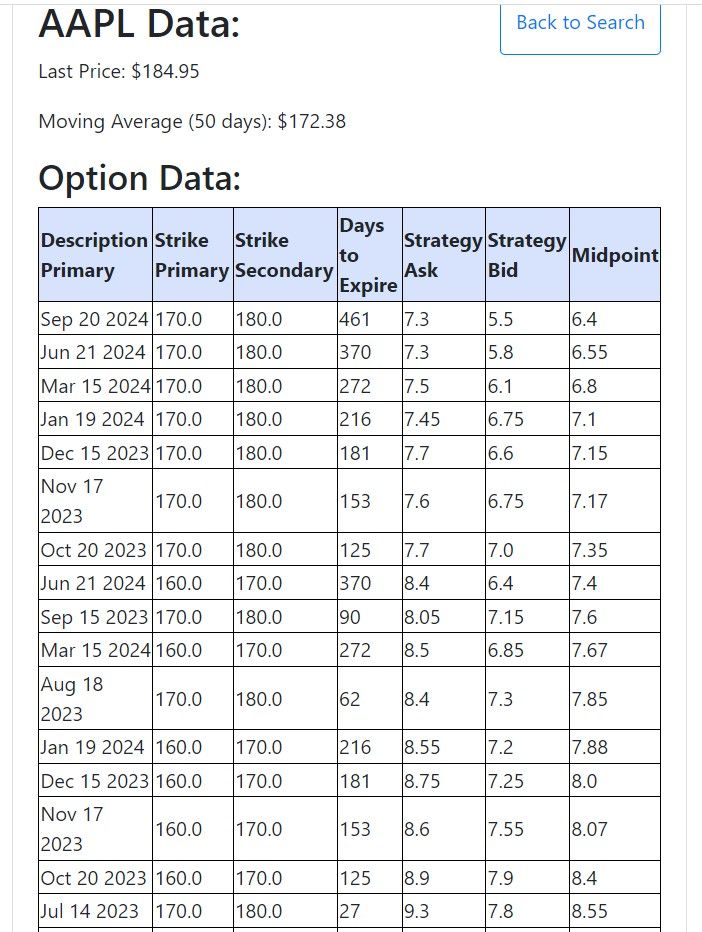

Step 3 - The final step is to select the option. In this stage, my choice will be based on the midpoint. The midpoint indicates the maximum potential profit you can achieve for a $10 spread ($100 per option contract representing 100 shares). However, it's crucial to note that a larger potential profit often comes with a longer time-to-expiration.

For instance, consider the midpoint of 6.4 - 10 = 3.6, which equates to $360 for a single-option contract. This figure represents your maximum potential profit, provided the price remains above $180 at the option's expiration date, in this case, September 20, 2024 (461 days away).

Consequently, you're looking at a potential profit of 56%, albeit promising, that comes with a lengthier time-to-expiration.

It's important to remember that time decay operates differently based on how far an option is from its expiration. Options further from their expiration date experience slower time decay, whereas those closer to their expiration date see this process accelerate.

Conclusion

In conclusion, the Deep In-The-Money Bull Call Spread offers an insightful strategy for traders navigating the intricate landscape of options. By utilizing this approach, you can leverage the stagnancy of the underlying asset, profiting from time decay and potential shifts in implied volatility.

Disclaimer

The contents of this article are strictly for informational and educational purposes only. They do not constitute financial advice or a recommendation to buy or sell any stock, options, or other financial instruments. Investing in stocks and options involves significant risk and is not suitable for all types of investors.

The examples and scenarios provided in this article are hypothetical and for illustrative purposes only. They do not represent actual trading or forecast future performance. The accuracy, completeness, or relevance of the information provided is not guaranteed.

Investors should consider their financial situation, risk tolerance, and investment objectives before making any investment decisions. Past performance of any securities or strategies does not guarantee future results or success.

Investors should always consult with a licensed and qualified financial advisor or conduct their own thorough research before making investment decisions. The author(s) and the publisher of this article disclaim any liability for any loss that may occur from reliance on the information provided.

No part of this article should be interpreted as legal or financial advice. The users are solely responsible for the consequences of their own investment decisions.*