Quantum Walks into a Blockchain: Meet Bitcoin’s Future Bodyguard

Forget moon missions and memecoins—2025 is the year Bitcoin met its quantum bodyguard.

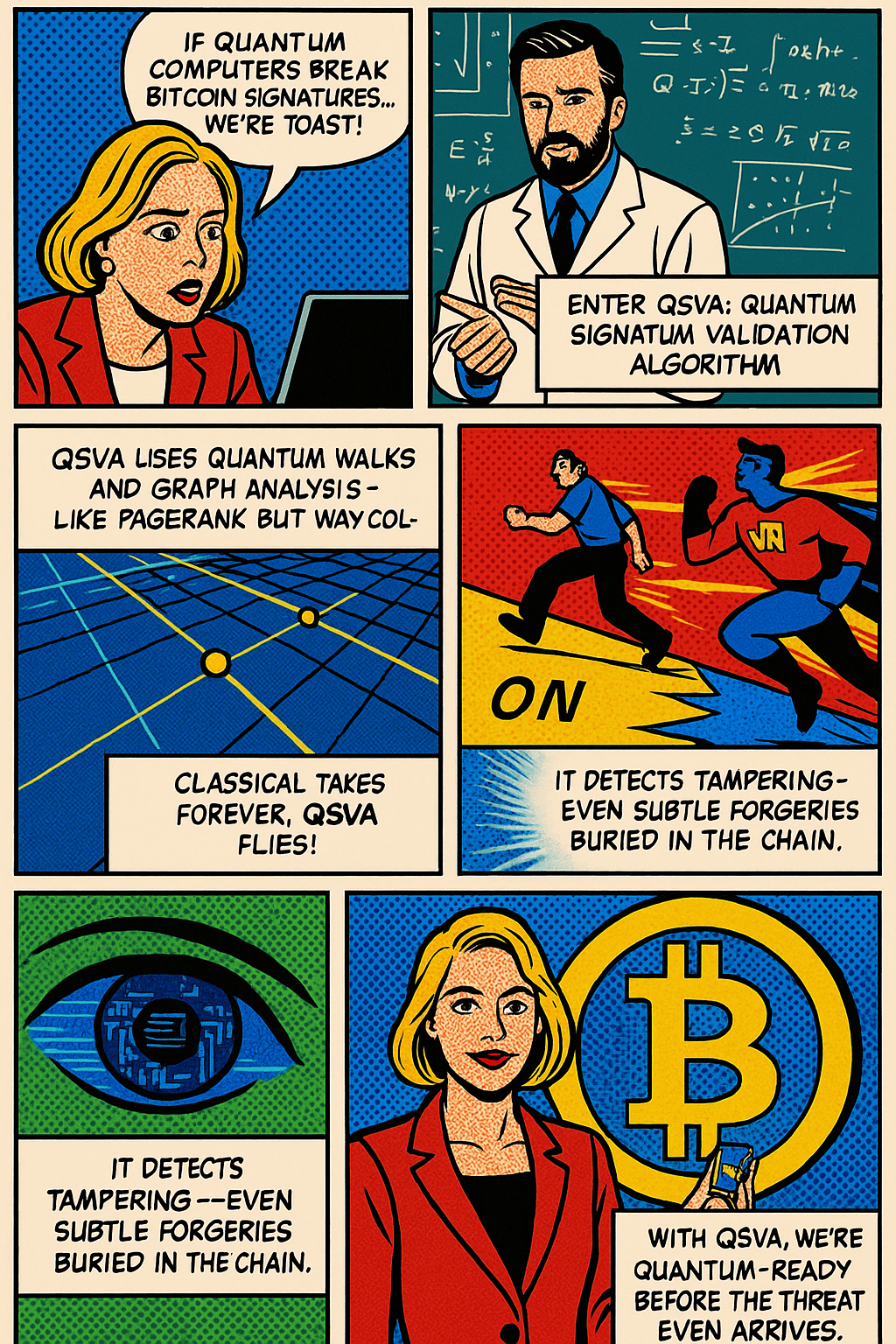

The Quantum Signature Validation Algorithm (QSVA) isn’t a fancy sci-fi pitch—it’s a legit peer-reviewed proposal, that’s ready to slap some quantum brains onto blockchain security.

🎯 What’s the Problem?

Tampering with Bitcoin transaction histories is really hard today… but quantum computers might not play fair in the future.

While Bitcoin’s digital signatures (like ECDSA) are still holding strong, quantum computers could—at some unknown point—tear them apart like a toddler with wrapping paper. So instead of panicking later, this paper says: let’s prepare now.

🚓 Enter QSVA: Quantum Walks with a Badge

QSVA is a proposed quantum algorithm that helps check whether a Bitcoin transaction has been tampered with—even before quantum computers become an actual threat.

How? Through a clever combo of:

- 🌀 Quantum Walks (think: quantum versions of random walks)

- 🔗 Graph Theory (think: transactions mapped as networks)

- 🧮 PageRank-style math (yes, the Google one)

In short: it’s like putting your Bitcoin blockchain under a quantum-powered microscope and asking, “Does this transaction belong here?”

📊 The Trick: Quadratic Speedup

Let’s say you want to validate if a transaction was tampered with. On a classical computer, that’s a slow process—especially when you’re combing through millions of transactions.

QSVA promises to do this in O(√N) time, where N is the number of vertices (transactions) in the graph.

📈 Classical: O(N)

⚛️ Quantum: O(√N)

That’s not just a marginal upgrade—it’s a quadratic speedup.

Imagine upgrading from a bicycle to a Tesla Cybertruck that eats transaction fraud for breakfast.

🔍 How It Works (in Simple Bits)

- Convert Blockchain to a Graph:

Every Bitcoin transaction is a vertex. Links between transactions (like input/output) form edges. Boom—now we have a transaction graph. - Mark the Suspect:

We define a “marked” (possibly tampered) transaction. - Quantum Walk Begins:

Using a Szegedy-style quantum walk, the algorithm “walks” the graph, checking for inconsistencies that would be hard to fake without the right signature. - Validation Output:

If the transaction isn’t tampered, the walk behaves as expected. If it is… 🚨 red flag detected.

👀 What’s the Catch?

- It’s theoretical: We’re not running QSVA on your Ledger Nano anytime soon.

- Assumes Quantum Supremacy: You’d need a robust quantum machine—those aren’t ready for consumer use (unless your name is Schrödinger Musk).

- Graph Construction is Non-Trivial: Turning the entire blockchain into a sparse, directed graph is easier said than done.

🔐 Why It Matters

Most post-quantum crypto talk revolves around replacing ECDSA with new signature schemes. QSVA doesn’t replace—it enhances.

It’s like building a quantum security drone that watches over your current setup, instead of tearing it all down and starting from scratch.

This algorithm could be especially useful during the “quantum transition phase”—when some nodes are quantum-safe and others aren’t.

🧩 Final Blocks

The authors of QSVA aren't predicting doomsday—they're preparing for it like pros. If Bitcoin is to survive the quantum future, it needs new defense layers.

And QSVA? It might just be the first quantum deputy in town.

👷 Stay tuned as we explore how QSVA compares with other post-quantum security schemes (like lattice-based signatures or hash-based signatures). But for now, know this:

QSVA isn’t about fear. It’s about foresight.

Stay Notoko... Stay Quantum protected.

💡 Subscribe to Notoko Bytes for more crypto chaos straight to your inbox! 🚀

Want to feature your brand on Notoko Bytes? 🚀 Contact us at ctrascend@gmail.com for sponsored posts!

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*