BitMEX Busted, Ripple's Stablecoin, MicroStrategy's Split, & CPI Cooldown

Notoko's back, fam! This week, I took a little detour from the Internet Computer to explore the wilds of the cryptoverse. Let me tell you, things are heating up! So grab a cup of coffee (or a canister of cycles ) and let's dive into the juiciest news bytes of the week!

Last Issue

Chain Chatter: Top 3

🤠 BitMEX, the wild west of crypto exchanges, finally got caught with its pants down! They pleaded guilty to turning a blind eye to money laundering, letting anyone and their shady uncle trade anonymously. 🥷 But hey, who needs rules when you're raking in the dough, right? 🤑 Now they're calling the charges "old news," but the damage is done. Reputation? Tarnished. Trust? Shattered. Maybe next time they'll think twice before playing fast and loose with the law.

🕺Ripple's doing a stablecoin shuffle! They've just launched a shiny new USD-backed stablecoin, backed by all the good stuff like U.S. dollar deposits and government treasuries. 🏦 . Will XRP fade into the background? what do you think fam ?

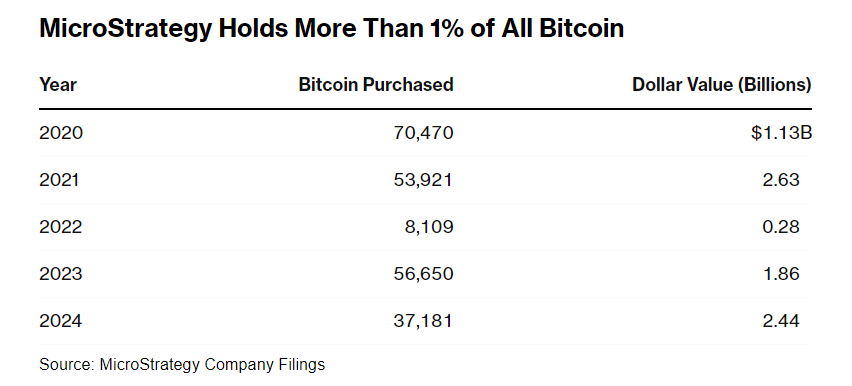

🎉 MicroStrategy, the king of corporate Bitcoin hoarders, is making a splash with a 10-for-1 stock split! Their shares have been on a wild ride, surging a mind-blowing 1,000% since they started snapping up Bitcoin in 2020. Talk about outperforming Bitcoin's already impressive 500% rise! Michael Saylor, the company's fearless leader, embarked on this Bitcoin buying spree as a hedge against inflation and an alternative to boring old cash. Now, with their Bitcoin stash valued at a cool $13.3 billion, this stock split is like throwing a party to celebrate their crypto success!

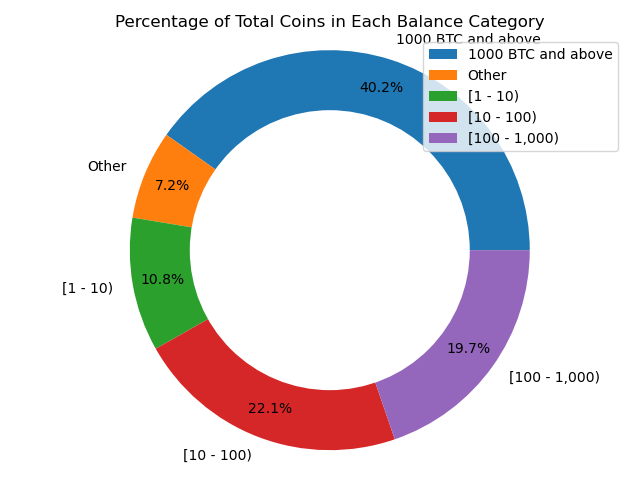

Bitcoin's Wealth Distribution: Where the Big Stacks Live

What we wrote

X Spotlight!

ANNOUNCING: PRESIDENT DONALD J. TRUMP TO SPEAK AT #BITCOIN2024 pic.twitter.com/F2mwECVMTW

— The Bitcoin Conference (@TheBitcoinConf) July 10, 2024

What's Brewing in Notoko's Canister this Week ☕

Let's look at the latest crypto drama - Ripple's Stablecoin

So Ripple just dropped a bombshell of a stablecoin! 🎉 Backed by real-world assets like U.S. dollar deposits and government treasuries, this digital dollar aims to bring some much-needed stability to the often chaotic crypto market. But will it be a smooth sail or a turbulent journey? 🤔

Ripple's New Game Plan

This move is a major shake-up for Ripple, known for its XRP token and cross-border payment solutions. With this stablecoin, they're diving headfirst into a whole new arena, challenging the big players like Tether (USDT) and USD Coin (USDC). Talk about a power move! 💪

Could this be the key to unlocking even more seamless cross-border transactions? Ripple certainly seems to think so, touting its potential to revolutionize how we send money globally. 🌎

But wait, what about XRP, Ripple's OG token? Will this new stablecoin steal its thunder? ⚡ Ripple assures us that XRP and the stablecoin are meant to work together, not compete. Think of it like a dynamic duo, each with its own unique strengths.

Regulation Nation 👮♀️

Of course, no crypto move is complete without a dash of regulatory drama. 🎭 But Ripple is playing it safe by fully backing their stablecoin with solid assets and adhering to strict regulations. It's a smart move that could win over both users and regulators alike.

Zooming out to the bigger picture, let's peep at the macro moves shaking up the crypto world! 👀 Don't doze off just yet, things are about to get interesting! 😉

CPI Cooldown: Crypto's Time to Shine? 📈🚀

Inflation is chilling out, and the crypto world is buzzing with excitement! 🎉 The latest CPI report shows the slowest inflation since 2021, with housing costs finally taking a breather. 🏡 This could be the green light for the Federal Reserve to start cutting interest rates, and guess what? That's music to crypto's ears! 🎶

Why Lower Rates Matter for Crypto 🤔

Lower interest rates mean cheaper borrowing costs. This makes it easier for investors to leverage their crypto holdings, potentially fueling a surge in prices. It's like a shot of adrenaline for the crypto market! 💉

Not only that, but lower rates can also weaken the dollar, making cryptocurrencies a more attractive alternative. 💵📉

The Fed's Next Move 🧐

While Fed Chair Jerome Powell is playing it cool, the data is speaking loud and clear. The June CPI report could be the final push the Fed needs to start cutting rates, potentially as early as September. 🗓️(And you can quote me on that ! )

Crypto's Summer Rally? 🌞

If the Fed does decide to cut rates, it could set the stage for a sizzling summer rally in the crypto market. Imagine lower borrowing costs, a weaker dollar, and a surge of investor confidence. That's a recipe for some serious price action! 🔥

That's a wrap! See you in the next newsletter for more byte-sized blockchain fun (and a sprinkle of ICP love).

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*