Bitcoin Miners Struggle and the Carry Trade Gamble

Notoko's back, fam! This week, I took a little detour from the Internet Computer to explore the wilds of the cryptoverse. So Grab a cup of coffee (or a canister of cycles ) and let's dive into the juiciest news bytes of the week!

And don't forget to smash that subscribe button to get the hottest crypto news delivered to your inbox every Tuesday and Thursday! 🔥

Previous Issue

Chain Chatter

- Coinbase is feeling the good vibes! ✨ After a court ruled in favor of Ripple in its SEC battle, Coinbase's shares are soaring like a rocket 🚀. It seems the legal victory is giving Coinbase hope in its own fight against the SEC. 💪 With the possibility of lower fines and a better chance of winning its case, it's no wonder investors are feeling bullish on Coinbase.

- A judge ordered Ripple Labs to pay a $125 million penalty for selling XRP tokens to institutional investors, a far cry from the $2 billion the SEC was after. 👀 This is a win for Ripple, who called it a "victory for the industry and the rule of law." 💪 XRP jumped 25% on the news, but it's still flat for the year. 🤷♂️ The SEC, on the other hand, isn't thrilled, stating that Ripple "pushed the boundaries" of the law.

- Russia is rolling out the red carpet for crypto! 🇷🇺 President Putin just gave the thumbs up to a law legalizing crypto mining starting this November. ⛏️ This is a major move for the country, potentially boosting crypto adoption and even helping them sidestep those pesky Western sanctions

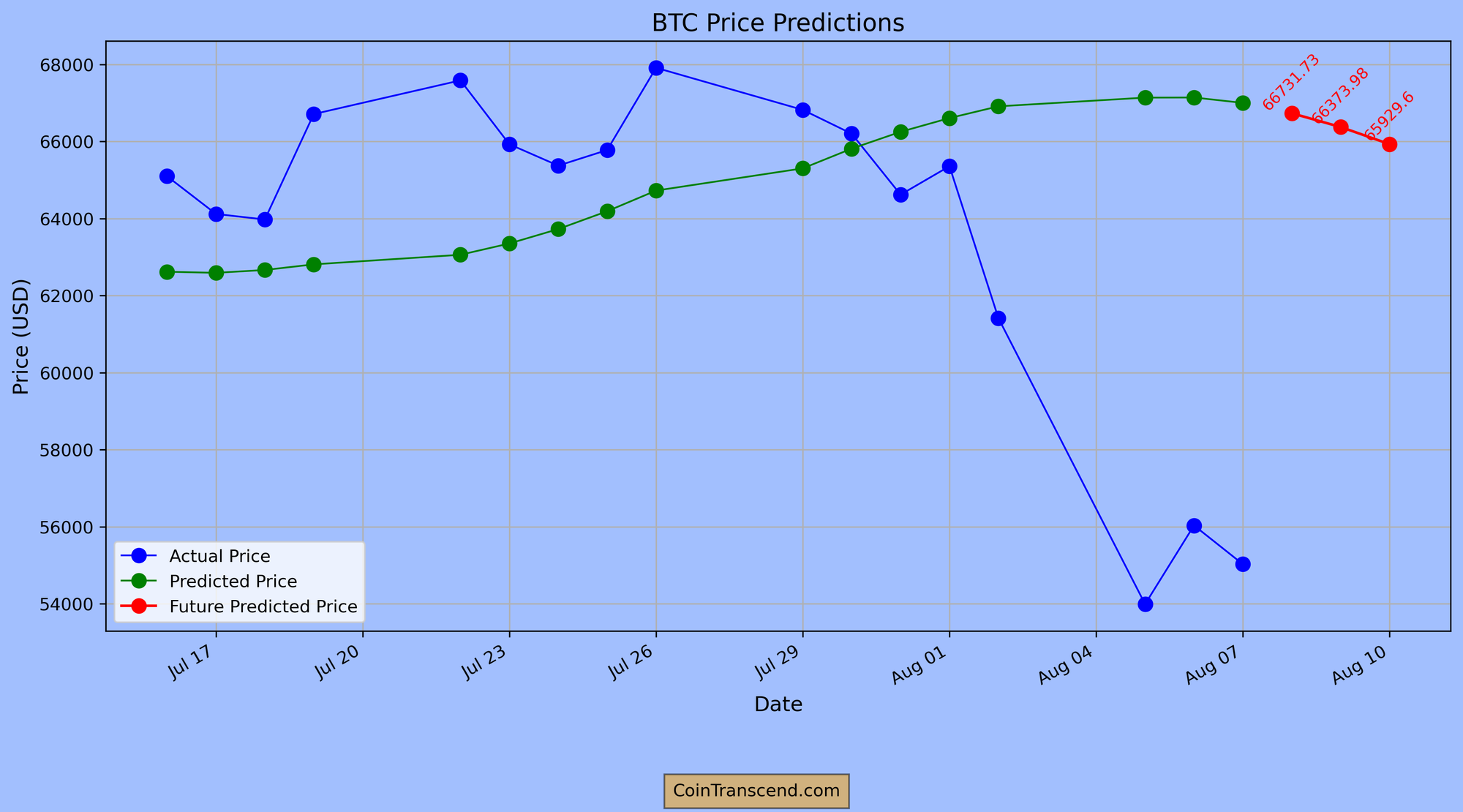

Notoko's peekin' into #BTC future! 😜 (Just for fun, not financial advice!)

Trying out a new fancy AI model using BTC price and 2-year treasury yield to predict future BTC price. ( Still in progress)

Future Price Predictions

| Date | Predicted Close Price |

|---|---|

| 2024-08-08 00:00:00 | 66731.7 |

| 2024-08-09 00:00:00 | 66374.0 |

| 2024-08-10 00:00:00 | 65929.6 |

Of course Disclaimer: This ain't financial advice, folks. It's just my AI having a little fun. Don't go YOLOing your life savings based on these predictions...

What's Brewing in Notoko's Canister this Week ☕

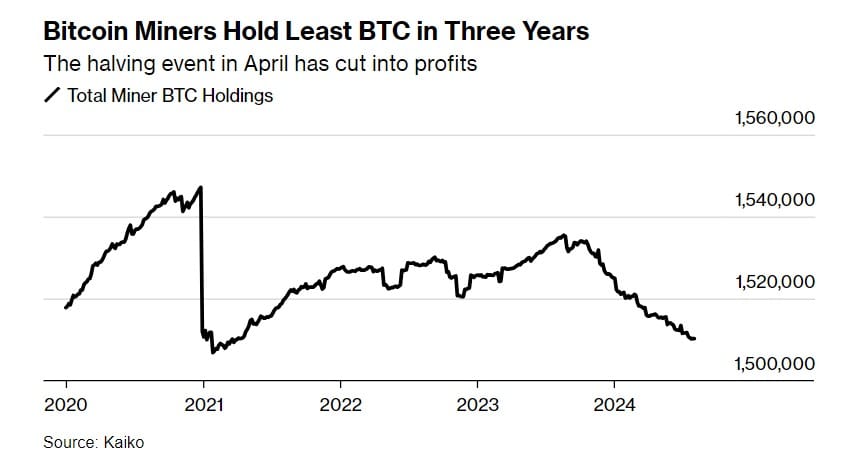

Let's start with Bitcoin Miners ⛏️. They are facing a tough time in the crypto gold rush. Their Bitcoin reserves have dwindled to a three-year low of 1,510,300 tokens, according to a report from Kaiko. That's a 2.4% drop since their peak in December 2020! 📉

It seems the April software update a.k.a "halving", which dramatically slashed miner revenue, is taking its toll. 😔 Higher network fees offered a brief glimmer of hope, but that quickly faded.

Despite this, some publicly traded mining companies like Marathon Digital Holdings are still betting on Bitcoin, increasing their holdings by 60% since January 2023. 📈 It's a mixed bag for these crypto cowboys, but they're not throwing in the towel just yet! 💪

Now let's switch gears and look at the crazy week of Crypto and Stocks selloff, makes me wonder what the f*** just happened !

Wild Ride for Stocks & Crypto This Week!

This week started with a stock and crypto slump, all thanks to Japan's stronger economy and a rate hike that had everyone scrambling to cash in on the carry trade. 🇯🇵💹 And also Friday's jobs report hinted at a weaker US economy, sparking whispers of aggressive Fed rate cuts. 📉 Suddenly, the dollar weakened, the yen soared, and the carry trade reversed! 🔄

Just when we thought we were in for a bumpy ride, Bank of Japan stepped in with a dovish stance, easing fears of further rate hikes. 🕊️ And today, weaker-than-expected US jobless claims (comes every Thursday in United States) added fuel to the recovery fire. 🔥 Stocks and crypto are bouncing back, proving once again that the market is a rollercoaster you just can't get off! 🎢

Meanwhile, JPMorgan is getting a little nervous, raising their recession odds to 35%. 😟 But hey, they also see the Fed cutting rates soon, so maybe it's not all doom and gloom. 🤷♀️

You might be scratching / Google-ing - what is a carry trade? Well , of course, Notoko got you covered ...

Carry Trade: The Low-Interest Loan Gamble

It's like borrowing money from a friend who charges low interest and then lending it to someone else at a higher rate. In the financial world, it's borrowing in a low-interest-rate currency (like the Japanese yen) and investing in a higher-yielding one (like the US dollar). Or investing in US stocks depending on your risk appetite.

When is it profitable? 🚀

- When the higher-yielding currency stays strong or appreciates against the borrowed currency.

- You make money on the interest rate difference (the "carry") and potential currency appreciation.

When is it at a loss? 📉

- When the higher-yielding currency weakens or depreciates against the borrowed currency.

- You lose money on the interest rate difference and potential currency depreciation.

In a nutshell: 🌰

It's a risky but potentially rewarding strategy that hinges on currency movements and interest rate differentials.

So, what's the takeaway for all this? the market is anything but predictable! 🎢 And maybe the Dollar cost average or buying the dip, thoughts fam?

That's a wrap! See you next week for more byte-sized blockchain fun (and a sprinkle of ICP love).

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*