The Federal Reserve's Policies: A Double-Edged Sword for Banks

The Federal Reserve's monetary policies have always been a significant influence on the banking sector. However, with the advent of cryptocurrencies, these policies are now shaping a new digital frontier, creating a unique interplay of opportunities and challenges for both banks and cryptocurrency markets.

The Interest Rate Dilemma

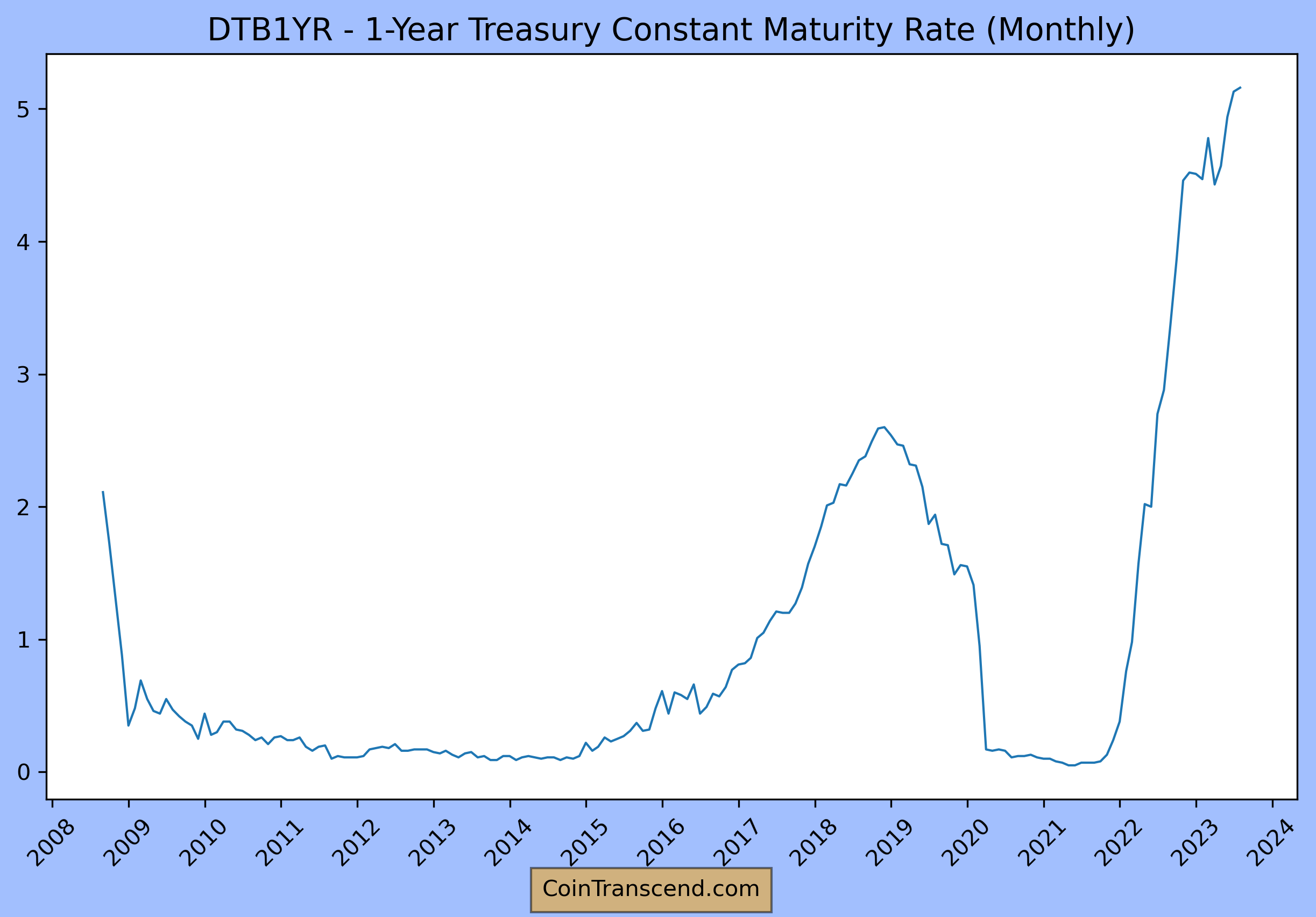

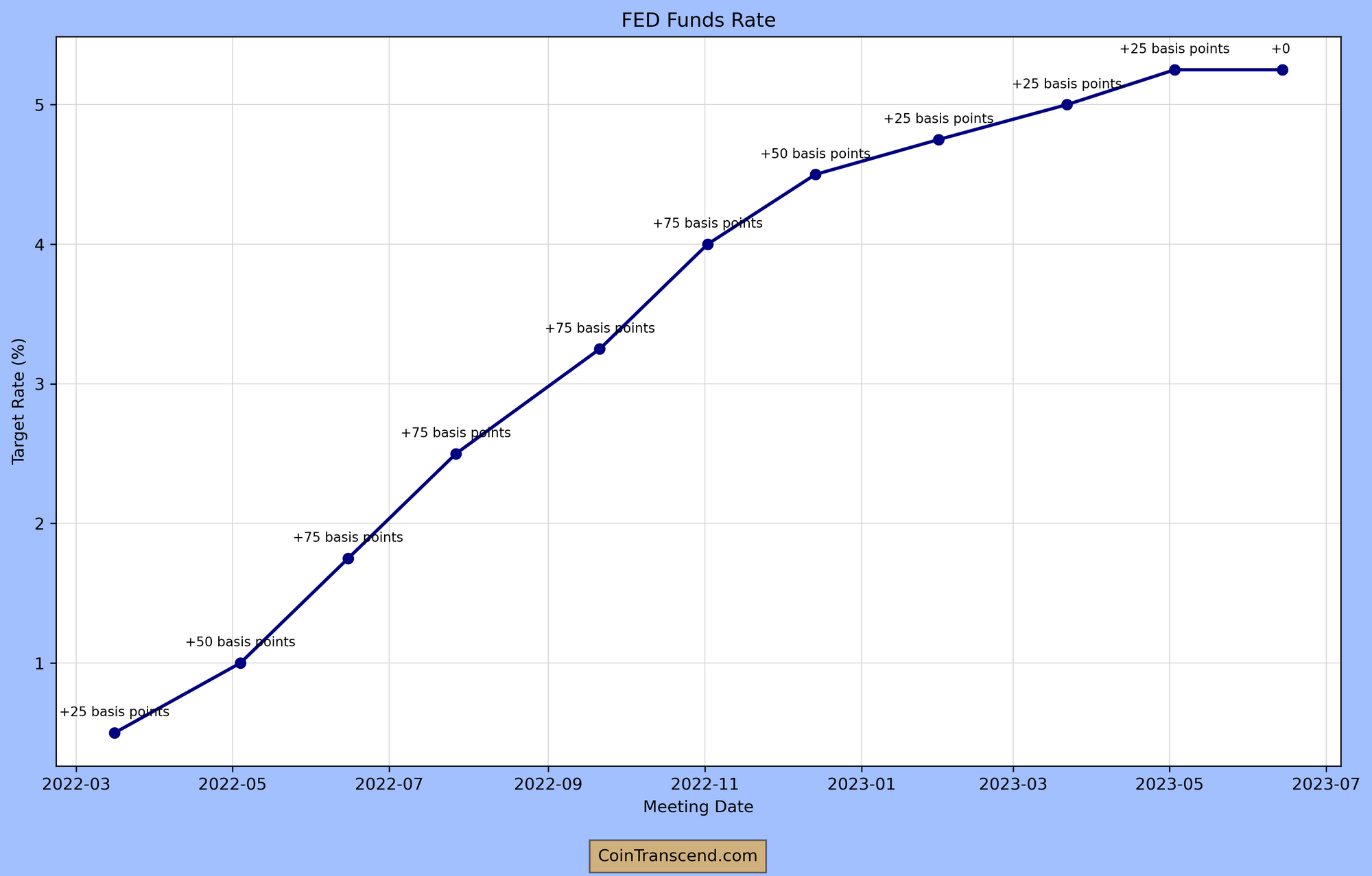

The Fed has the power to adjust the federal funds rate, which is the interest rate at which banks lend to each other overnight. Changes in this rate can have a ripple effect throughout the economy, influencing everything from the interest rates on savings accounts to the cost of mortgages.

When the Fed raises the federal funds rate, it can lead to higher interest rates on Treasury bonds. These bonds are considered one of the safest investments, as they are backed by the full faith and credit of the U.S. government. As the yield on these bonds increases, they can become more attractive to investors compared to the interest rates offered by banks on deposits.

For example, if the Fed raises the federal funds rate from 0.5% to 1.5%, the yield on a 10-year Treasury bond might increase from 2% to 3%. Meanwhile, a bank might only offer a 1% interest rate on a savings account. In this scenario, an investor might choose to buy Treasury bonds instead of depositing their money in a bank, as the bonds offer a higher return.

The Treasury's Balancing Act

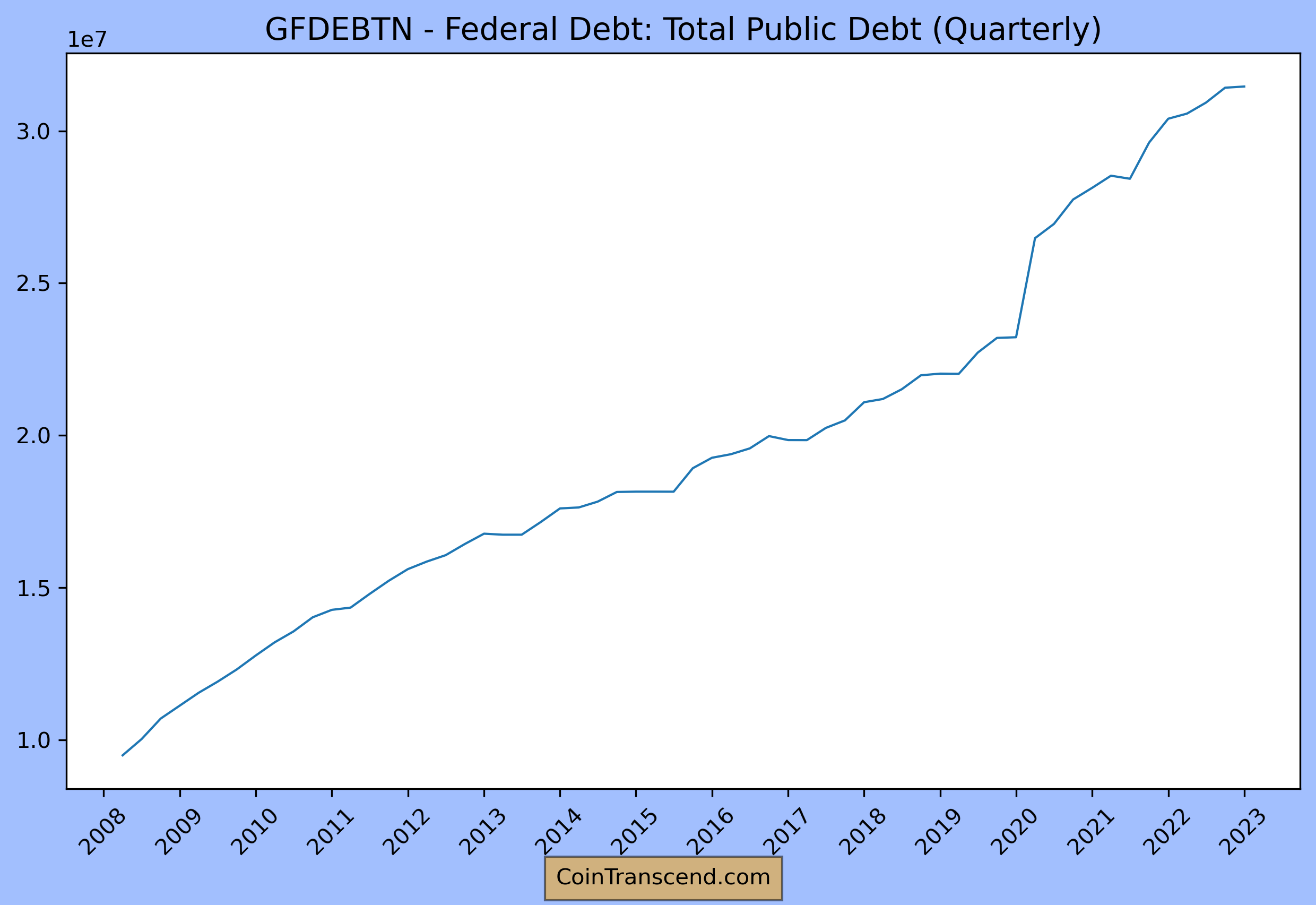

The U.S. Treasury regularly issues new debt in the form of Treasury bonds to finance government spending, including social security, healthcare, and other programs. When the Fed raises interest rates, the Treasury must offer higher yields on its bonds to attract investors. This can lead to an increase in the government's borrowing costs.

However, the Treasury has little choice but to continue issuing new debt in large amounts. The U.S. government runs a deficit, meaning it spends more than it collects in revenue. To finance this deficit, the Treasury must issue new debt. This is especially true in times of increased spending, such as during a recession or in response to a crisis.

The Impact on Banks

The combination of higher yields on Treasury bonds and the continuous issuance of new debt can create a challenging environment for banks. They may struggle to attract deposits if they cannot offer competitive interest rates. This can lead to a decrease in their lending capacity, as banks use deposits to fund loans.

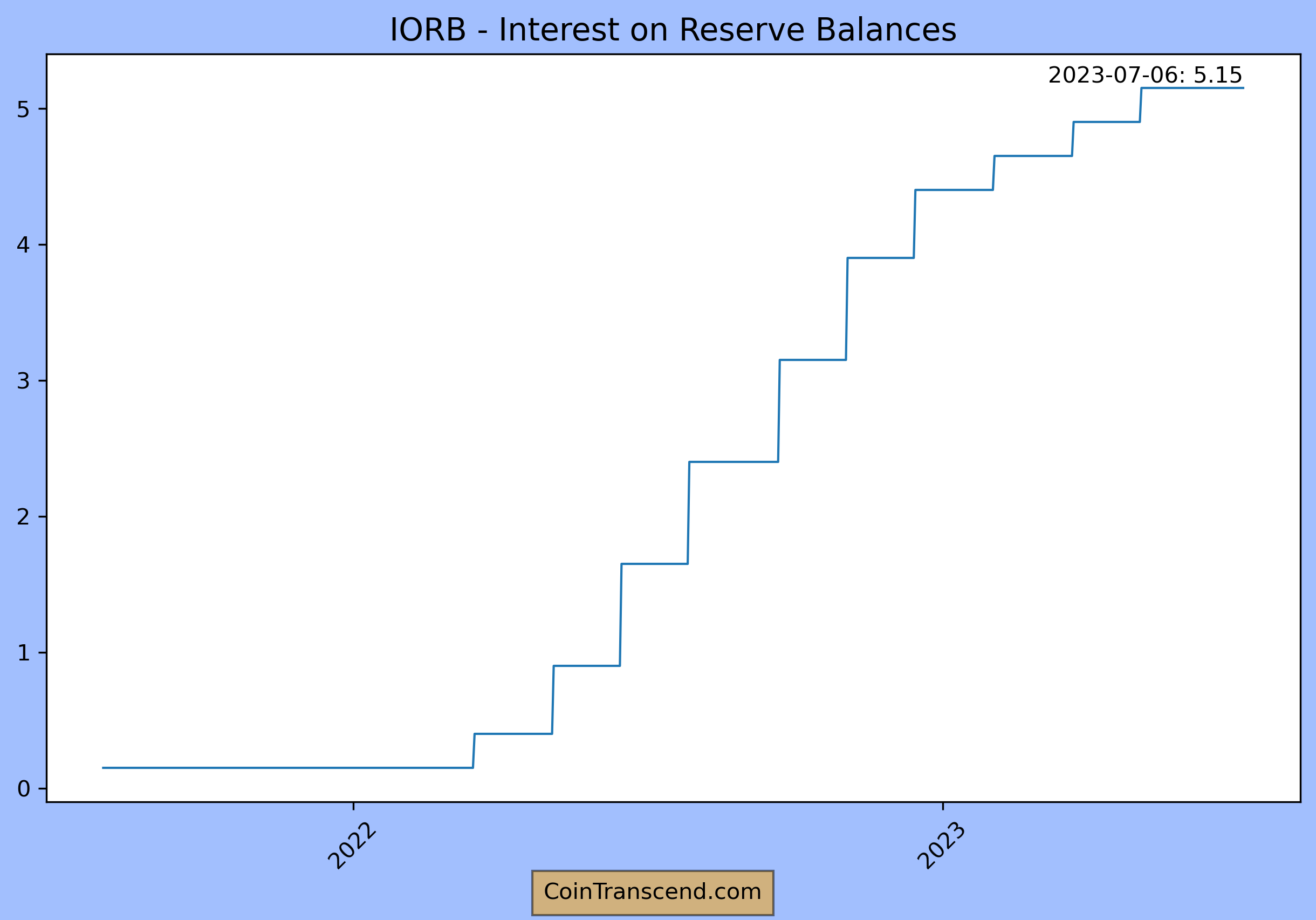

Moreover, banks also face competition from the Fed itself. The central bank offers interest on reserves (IOR), which are the funds that commercial banks hold at the Fed. When the Fed raises the IOR rate, banks might prefer to keep their money at the Fed rather than lending it out, further reducing their lending capacity.

The New Frontier: Cryptocurrencies

In the world of cryptocurrencies, the impact of the Federal Reserve's policies can be more complex and unpredictable. Cryptocurrencies, like Bitcoin and Ethereum, operate on decentralized networks and are not directly tied to traditional banking systems. This means they can, to some extent, operate independently of central bank policies. However, they are not entirely immune to the effects of these policies.

When the Federal Reserve lowers interest rates, traditional investments like savings accounts and bonds become less attractive, as they yield lower returns. This can drive investors to seek higher returns elsewhere, and cryptocurrencies, with their potential for high returns, can become an attractive alternative. This increased demand can drive up the price of cryptocurrencies.

On the other hand, when the Federal Reserve raises interest rates, cryptocurrencies can become less attractive compared to traditional investments. Higher interest rates can lead to higher yields from savings accounts and bonds, potentially drawing investors away from the volatile cryptocurrency market.

However, it's important to note that a multitude of factors influences the cryptocurrency market, and the Federal Reserve's policies are just one piece of the puzzle. Other factors, such as technological advancements, regulatory changes, and market sentiment, also play significant roles in shaping the cryptocurrency landscape.

Conclusion: Navigating the Double-Edged Sword

In conclusion, the Federal Reserve's policies can act as a double-edged sword for banks and the cryptocurrency market. While the Fed's policies are designed to maintain economic stability, they can sometimes create challenges for commercial banks & Cryptocurrencies. The interplay between the Fed's control over interest rates, the Treasury's need to issue new debt, and the banks' need to attract deposits creates a complex dynamic that banks must navigate.

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*