FED Up? Decoding the Rate Riddle

Alright economic enthusiasts! Brace yourselves for an adventure into the heart of the U.S. financial system: the Federal Reserve, or the "FED", and its crucial instrument, the FED Funds Rate.

Think of the FED as the maestro conducting the symphony of our economy. Its tool of choice isn't a baton, but the powerful FED Funds Rate. This rate, ever so subtly, guides the lending and borrowing that occurs between banks, much like a GPS system, steering the flow of money in our economy.

Welcome to the FED's House

Established back in 1913, the FED's primary role is to be the United States' central bank. Think of it as the ultimate financial quarterback, making strategic calls to guide the entire economic team down the field. Its objectives? To maintain price stability, moderate long-term interest rates, and strive towards maximum employment. Quite a laundry list, right?

So, how does the FED do it all? Before we dive into that detail, it's important to understand the structure of the FED. Let's look at some key components :

Board of Governors

This is the main governing body of the FED, consisting of seven members appointed by the President of the United States and confirmed by the Senate.

Federal Reserve Banks

There are twelve regional Reserve Banks across the U.S., each serving its particular geographic area.

Federal Open Market Committee (FOMC)

The FOMC is crucial in the FED's economic influence as it oversees the open market operations (the buying and selling of U.S. Treasury securities). It includes the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis.

FOMC Meeting Schedule

The FOMC typically meets eight times per year. Here is a basic table of the FOMC meetings for a given year:

| Month | FOMC Meeting |

|---|---|

| January | Yes |

| February | No |

| March | Yes |

| April | No |

| May | Yes |

| June | Yes |

| July | No |

| August | Yes |

| September | Yes |

| October | No |

| November | Yes |

| December | Yes |

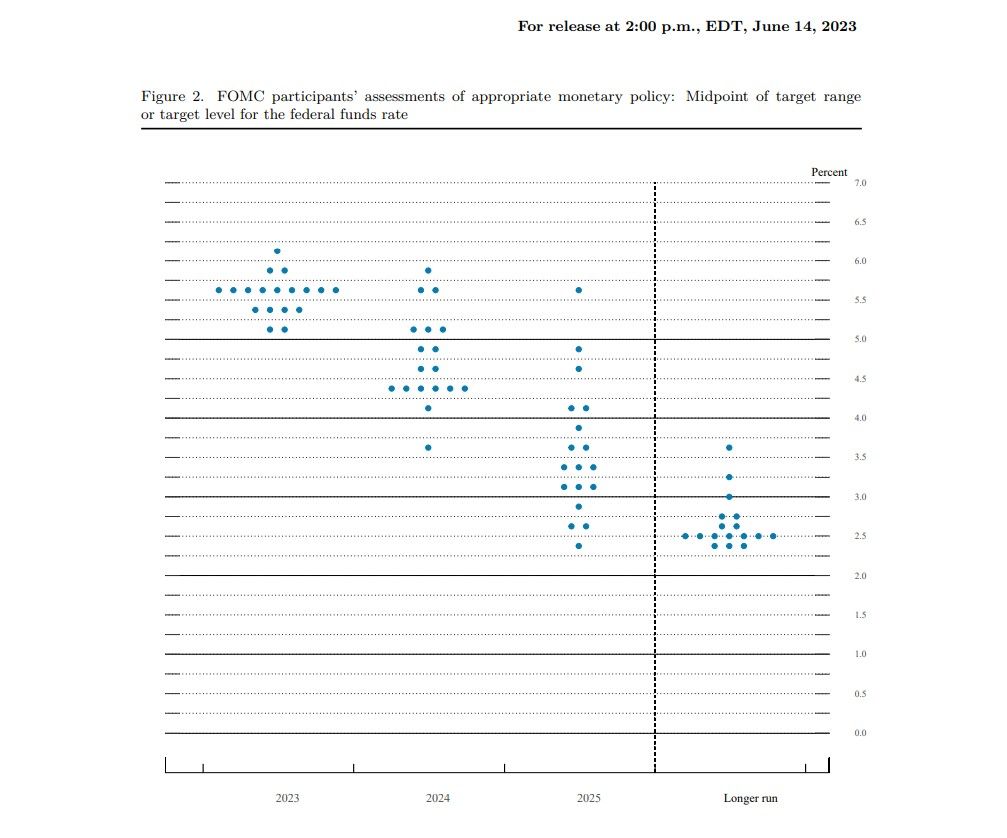

The FOMC's Dot Plot

The Dot Plot is a graph published after every other FOMC meeting, providing anonymous individual FOMC members' predictions about the future course of the FED Funds Rate. Each dot on the plot represents one FOMC member's view.

The horizontal axis represents the year or time period, while the vertical axis represents the FED Funds Rate. The position of each dot indicates the rate that each FOMC participant believes will be most appropriate for that year or over the longer run. So FED gives enough evidence of what their future direction is. Still, Traders predict and bet on rates' futures. Why? Well, we are all degen at heart🙂.

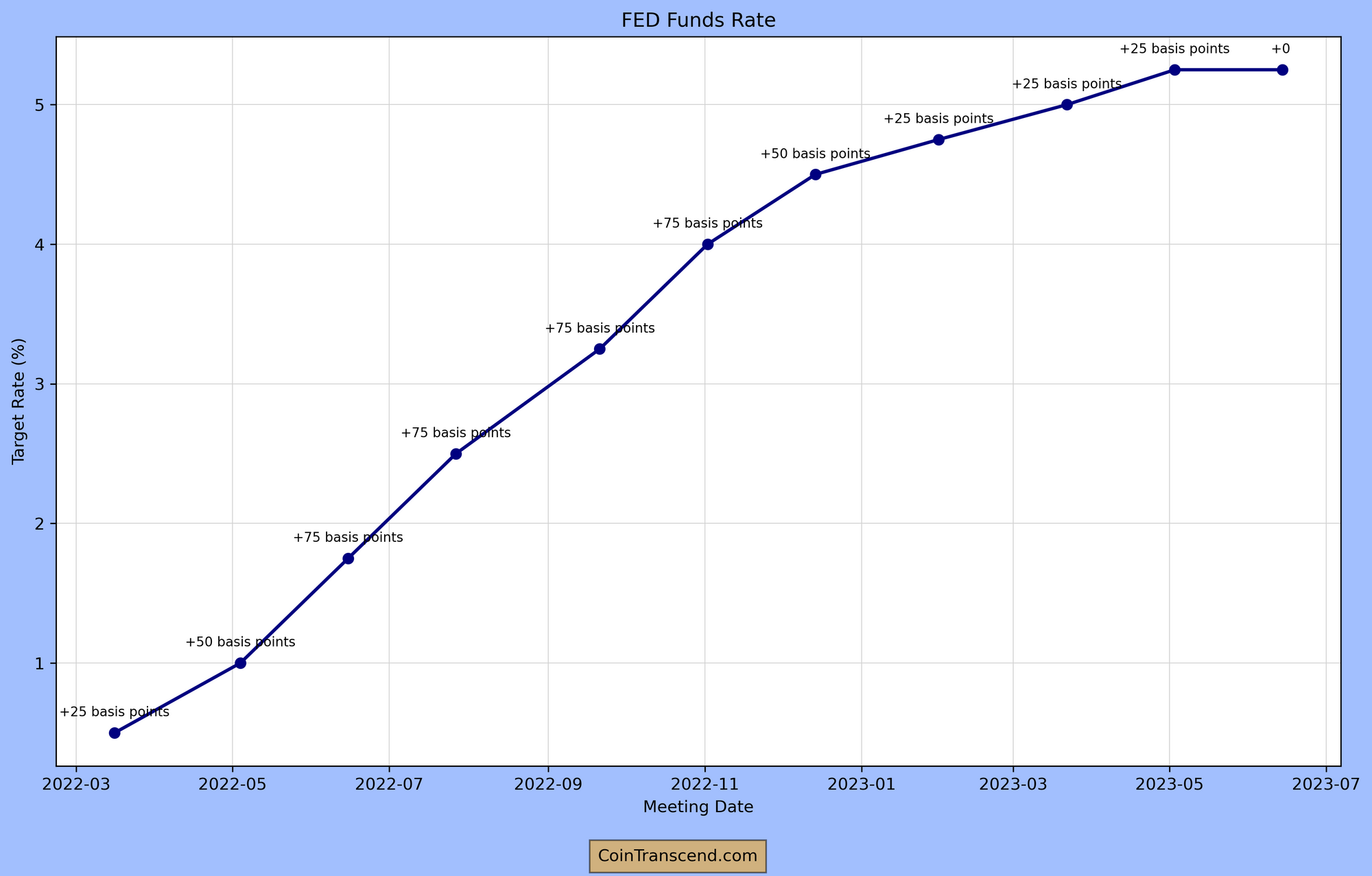

Diving into the Funds Rate

Now that we've gotten acquainted with the FED, let's dive deeper into our main attraction - the FED Funds Rate. In the simplest terms, it's the interest rate that banks charge each other for overnight loans.

Now, why would banks need to borrow from each other, you ask? Well, banks are required to maintain a certain amount of reserves by the end of each day. Think of it as a curfew, but for money. Sometimes, a bank may find itself short and needs a quick 'loan lift' to meet the curfew.

The FED steps in here, setting the rate or 'fare' for these lifts. In doing so, it influences how much banks are willing to borrow and lend, which in turn affects the entire economy. It's like adjusting the speed limit on a highway, impacting the flow of all the traffic.

Why FED Funds Rate Important?

Inflation and Unemployment – two critical economic indicators that the FED monitors closely while setting the FED Funds Rate. The FED's aim is to strike a delicate balance between the two.

Inflation represents the overall rise in prices over time, eroding the purchasing power of money. Unemployment, on the other hand, represents the percentage of the total labor force that is jobless and actively seeking employment.

When the FED Funds Rate increases, borrowing becomes more expensive. Banks are less likely to take out loans, reducing the money supply in the economy. It's like the see-saw going up on one side. This can slow down economic activity but also help to keep inflation in check.

On the other hand, when the FED Funds Rate decreases, borrowing is cheaper, and banks are more likely to take out loans, increasing the money supply. This is the see-saw tipping down on the other side. It can boost economic activity but may also lead to inflation if not carefully managed.

The balancing act between inflation and unemployment is a core responsibility of the FED, and it is the essence of monetary policy.

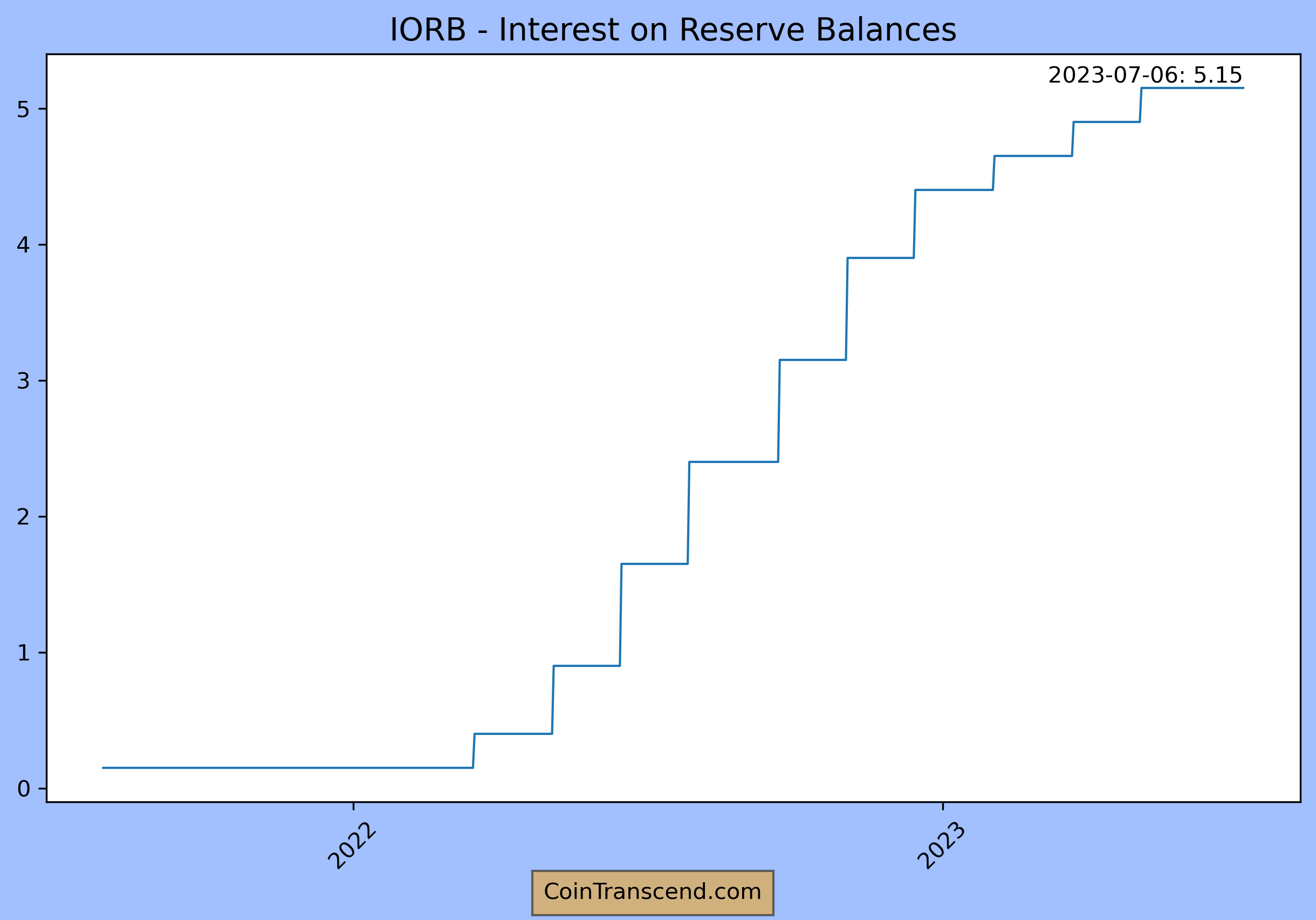

The Inside Story: Interest on Reserves (IOR)

In simple terms, the Federal Reserve pays interest to banks on the reserves they hold at the FED, a practice they began in 2008. Why does this matter? Well, by paying interest on these reserves, the FED provides banks with a baseline for profitability. After all, why would a bank lend to others at a lower rate than it can earn risk-free at the FED?

But there's more to it. This IOR also plays a role in implementing monetary policy. If the FED wants to discourage banks from making too many loans (to curb inflation, for example), it can raise the IOR, making it more profitable for banks to hold reserves than to lend. Conversely, if the FED wants to stimulate the economy, it can lower the IOR, encouraging banks to lend more.

The Plot Thickens: Interest on Excess Reserves (IOER)

As we go further down the rabbit hole, let's talk about the Interest on Excess Reserves (IOER). Banks are required to hold a certain amount of reserves, but anything above that is considered 'excess.' The FED also pays interest on these excess reserves.

The IOER serves as a sort of guardrail for the FED Funds Rate. Banks are unlikely to lend to each other at rates significantly lower than what they can earn from the FED. By adjusting the IOER, the FED can influence the FED Funds Rate and, by extension, control monetary conditions.

The Ripple Effect: Impact on Individuals and Businesses

The FED Funds Rate may seem like a concept confined to the world of banks and financial institutions, but its effects ripple out to touch businesses and individuals alike.

When the FED Funds Rate changes, the interest rates on various forms of borrowing, like mortgages, student loans, or business loans, often move in sync. A higher rate means borrowing is more expensive, potentially slowing spending and investment. Conversely, a lower rate makes borrowing cheaper, encouraging spending and investment.

The Global Echo: Impact on the World Economy

The FED Funds Rate doesn't just influence the U.S. economy; its impact echoes around the globe. Given the prominence of the U.S. dollar in global trade and finance, changes in the FED Funds Rate can affect exchange rates, foreign investment, and overall global economic health.

When the FED Funds Rate increases, foreign investors might flock to the U.S., attracted by higher returns. This can lead to an appreciation of the U.S. dollar, impacting international trade. A decrease in the rate can have the opposite effect.

Conclusion - Mastering the Tune of the FED Funds Rate

As we conclude our journey, it's clear that the FED Funds Rate is a vital part of the economic ecosystem. It's a tool, a guide, a balancing act, and even a global influencer. Whether you're a bank, a business owner, or just an individual trying to understand the economy, the tune of the FED Funds Rate plays a role in your financial narrative.

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*