The Ultimate Guide to Decentralized Finance (DeFi) for Beginners

Decentralized finance, or DeFi, is revolutionizing the way people interact with financial services by leveraging blockchain technology to create a more accessible, transparent, and secure ecosystem. As DeFi continues to gain momentum, it's crucial for newcomers to understand the fundamentals and navigate this rapidly evolving landscape with confidence. In this article, we aim to provide a comprehensive guide to DeFi for beginners, covering everything from its core principles to the popular platforms and services available in the market.

The importance of DeFi cannot be overstated, as it has the potential to reshape traditional finance, break down barriers to entry, and foster financial inclusion for millions of people worldwide. DeFi applications are already changing how we lend, borrow, trade, and manage assets, all without the need for intermediaries like banks or financial institutions. Moreover, the DeFi ecosystem promotes innovation and encourages the development of new financial products and services tailored to the needs of a diverse user base.

Our ultimate goal is to equip you with the knowledge and insights necessary to explore and participate in the DeFi ecosystem, ultimately helping you make informed decisions and harness the power of decentralized finance. We will delve into the key components of DeFi, highlight popular platforms and use cases, discuss governance and tokenomics, and address the challenges and future outlook of this transformative movement. By the end of this guide, you will have a solid understanding of DeFi and be ready to take your first steps into this exciting world of decentralized financial services.

Definition and key features

Decentralized finance, or DeFi, refers to a financial ecosystem built on blockchain technology, particularly Ethereum, that allows users to access and engage in various financial services without the need for traditional intermediaries like banks or financial institutions. The key features of DeFi include decentralization, permissionless access, transparency, and programmability.

- Decentralization: DeFi services are governed by smart contracts – self-executing agreements with the terms directly written into code – which automate transactions and remove the need for central authorities. This decentralization eliminates single points of failure and reduces the risk of fraud or manipulation.

- Permissionless access: DeFi platforms are accessible to anyone with an internet connection and a cryptocurrency wallet, regardless of their location or financial status. This enables greater financial inclusion, as users can access a wide range of services without the constraints of traditional banking systems.

- Transparency: DeFi platforms are built on public blockchains, which means that all transactions and interactions are recorded on a transparent ledger. This transparency fosters trust, as users can independently verify the legitimacy and solvency of a platform or service.

- Programmability: DeFi applications are built using smart contracts, allowing for the creation of complex financial instruments and products. This programmability enables rapid innovation, as developers can build new services and iterate on existing ones to meet the evolving needs of the market.

Comparison with traditional finance

In contrast to traditional finance, which relies on centralized institutions and intermediaries to facilitate transactions and manage assets, DeFi operates on a decentralized and trustless model. This decentralization eliminates the need for intermediaries and reduces the associated fees and inefficiencies. Moreover, DeFi platforms provide users with greater control over their assets and enable them to earn passive income through various mechanisms, such as lending, staking, or yield farming.

Main components of DeFi

The DeFi ecosystem is comprised of various components, which can be grouped into the following categories:

- Lending and borrowing platforms: Services like Aave and Compound allow users to lend and borrow cryptocurrencies, earning interest on their deposits or accessing liquidity without selling their assets.

- Decentralized exchanges (DEXs): Platforms such as Uniswap and SushiSwap enable users to trade cryptocurrencies directly from their wallets, without the need for a centralized exchange.

- Yield farming and liquidity provision: Users can earn passive income by providing liquidity to decentralized exchanges or participating in yield farming strategies, which involve optimizing returns by staking and lending assets on multiple platforms.

- Asset management and aggregation: Platforms like Yearn Finance and DeFi Saver help users optimize their investments by automating strategies and aggregating yields from various DeFi platforms.

- Insurance and risk management: Services like Nexus Mutual and Cover Protocol provide decentralized insurance solutions to protect users against smart contract vulnerabilities and other risks associated with DeFi.

Popular DeFi Platforms and Services

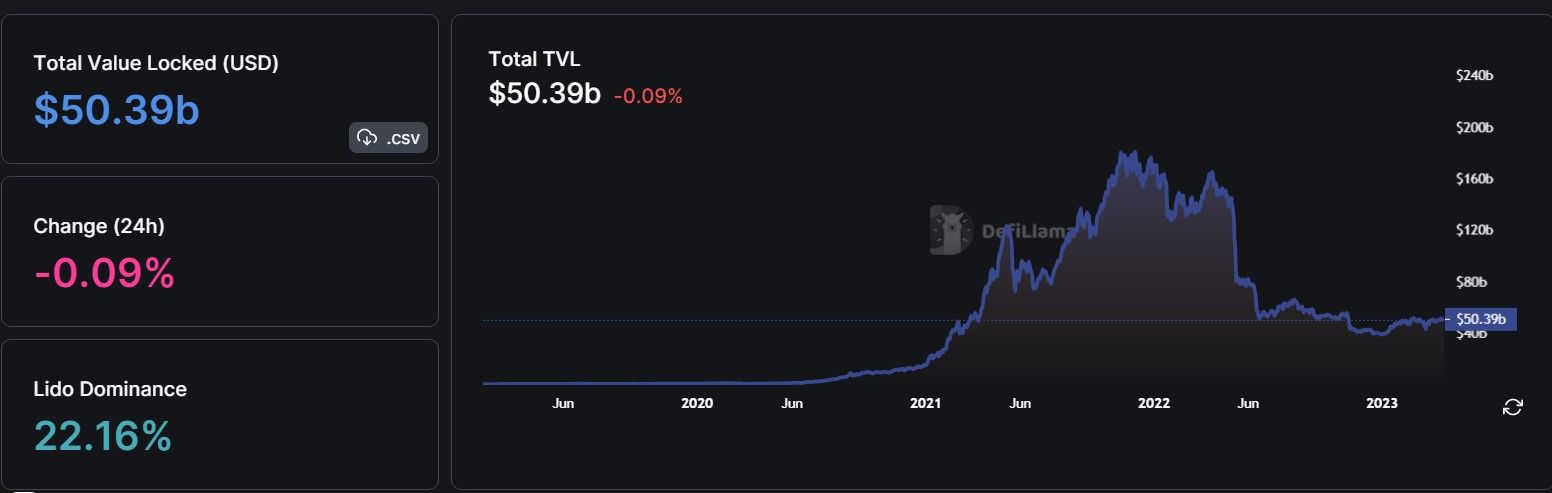

A. Overview of top DeFi platforms ( as of April 10 2023)

- Lido : Lido is a groundbreaking decentralized finance (DeFi) protocol that simplifies the process of staking on Ethereum 2.0 by offering a liquid staking solution. Lido allows users to stake their Ether (ETH) tokens without needing to run their own validator node or lock up their assets for an extended period. When users stake their ETH through Lido, they receive stETH, a token that represents their staked Ether and the accrued staking rewards. The stETH token can be freely traded or used in various DeFi applications, enabling users to maintain liquidity and access to their staked assets. Lido's innovative approach addresses the limitations of traditional Ethereum 2.0 staking, such as illiquidity and technical barriers, making it more accessible and appealing to a broader range of users. By integrating Lido's liquid staking solution with other DeFi platforms, including lending and borrowing services, decentralized exchanges, and yield farming protocols, Lido unlocks new possibilities for users and strengthens the overall DeFi ecosystem. Total value locked (TVL) - $ 11.17 Billion (as of April 10 2023)d

- MakerDAO : MakerDAO is a pioneering decentralized finance (DeFi) protocol that enables the creation of the DAI stablecoin, a decentralized, crypto-collateralized stablecoin pegged to the US dollar. By leveraging smart contracts and a system of collateralized debt positions (CDPs), users can generate DAI by depositing collateral, primarily Ethereum, into the MakerDAO platform. The protocol's governance is managed by the community through the Maker (MKR) token, which allows token holders to vote on proposals and changes to the system. MakerDAO's innovative approach to stablecoin creation addresses issues of centralization and trust associated with fiat-collateralized stablecoins, offering users a decentralized alternative for stability within the DeFi ecosystem. Its integration with various DeFi platforms, such as lending and borrowing services, decentralized exchanges, and yield farming protocols, demonstrates the versatility and potential of MakerDAO's DAI stablecoin in revolutionizing the DeFi landscape. Total value locked (TVL) - $ 7.7 Billion (as of April 10 2023)

- Aave: Aave is a decentralized lending and borrowing platform that allows users to earn interest on their cryptocurrency deposits or borrow against their holdings. Aave offers a wide range of assets, variable and stable interest rates, and innovative features like flash loans, which enable users to borrow funds without collateral for a single transaction. Aave is popular for its user-friendly interface and diverse lending options. Total value locked (TVL) - $ 5.67 Billion (as of April 10 2023)

- Uniswap: Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain that enables users to trade cryptocurrencies directly from their wallets without the need for a centralized intermediary. It employs an automated market maker (AMM) model, where liquidity providers deposit equal amounts of two tokens to create a liquidity pool, which facilitates token swaps. Uniswap is known for its ease of use, permissionless listing of tokens, and low trading fees. Total value locked (TVL) - $ 4.01 Billion (as of April 10 2023)

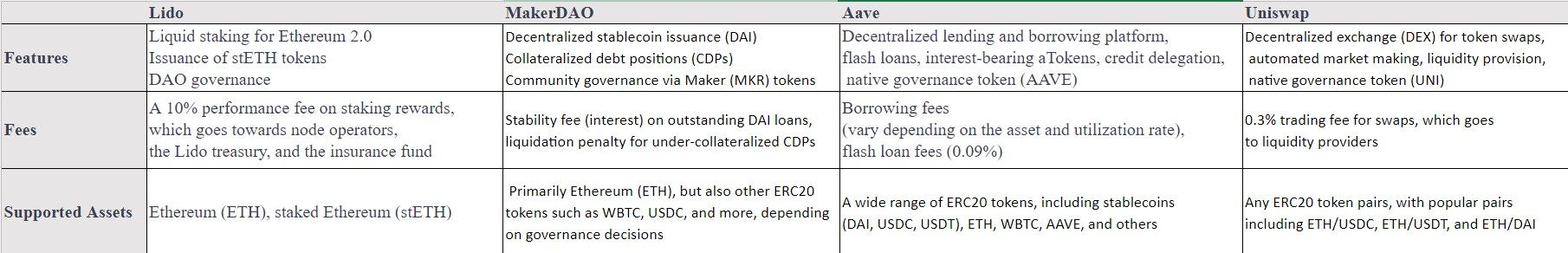

B. Comparison of the platforms' features, fees, and supported assets

Here is a comparison of features, fees, and supported assets for Lido, MakerDAO, Aave, and Uniswap:

Each of these DeFi protocols serves a unique purpose and caters to different use cases within the ecosystem. Lido focuses on liquid staking for Ethereum 2.0, MakerDAO enables decentralized stablecoin creation, Aave offers a decentralized lending and borrowing platform, and Uniswap is a decentralized exchange for token trading.

How to Get Started with DeFi

A. Creating a cryptocurrency wallet

To get started with DeFi, you will need a cryptocurrency wallet that supports the blockchain on which the DeFi platform is built (usually Ethereum). Some popular wallets compatible with DeFi platforms include:

- Metamask: A browser extension available for Chrome, Firefox, and Brave browsers that allows you to manage your Ethereum-based assets and interact with DeFi platforms directly from your browser.

- Trust Wallet: A mobile wallet for iOS and Android devices that supports Ethereum and other blockchains, enabling you to manage a wide range of assets and interact with DeFi applications.

B. Acquiring cryptocurrencies for DeFi

Once you have set up a wallet, you will need to acquire the cryptocurrencies you want to use on DeFi platforms. You can do this through:

- Centralized exchanges: Platforms like Coinbase, Binance, and Kraken allow you to purchase cryptocurrencies using your local currency. Once purchased, you can transfer your assets to your DeFi-compatible wallet.

- Decentralized exchanges (DEXs): If you already own some cryptocurrency, you can use DEXs like Uniswap or SushiSwap to swap your existing assets for the ones you need to use on DeFi platforms.

C. Connecting your wallet to DeFi platforms

After acquiring the necessary cryptocurrencies and storing them in your wallet, you can connect your wallet to the DeFi platform of your choice by:

- Visiting the platform's website.

- Clicking on the "Connect Wallet" button, usually located in the top right corner.

- Selecting your wallet from the list of supported options and granting the necessary permissions.

Once connected, you can start using the DeFi platform's services, such as lending, borrowing, or trading.

D. Understanding risks and potential rewards

While DeFi offers numerous opportunities, it is essential to be aware of the risks involved:

- Smart contract vulnerabilities: DeFi platforms rely on smart contracts, which can have undiscovered bugs or security flaws that could lead to loss of funds.

- Impermanent loss: When providing liquidity to AMM-based DEXs, you may experience impermanent loss, which occurs when the value of your deposited assets changes relative to each other due to market fluctuations.

- Regulation and compliance: The regulatory landscape for DeFi is still uncertain, and changes in regulations could impact the platforms and services you use.

It is crucial to conduct thorough research, evaluate risks, and only invest what you can afford to lose when participating in DeFi activities.

Use Cases of DeFi

A. Lending and borrowing

DeFi platforms like Aave and Compound allow users to lend their cryptocurrencies to earn interest or borrow against their assets. Lenders deposit their tokens into smart-contract-based liquidity pools, which borrowers can access by providing collateral. Interest rates are determined by supply and demand, ensuring fair and competitive rates for both parties.

B. Decentralized exchanges (DEXs)

Decentralized exchanges like Uniswap and SushiSwap enable users to trade cryptocurrencies directly from their wallets without relying on centralized intermediaries. DEXs employ an automated market maker (AMM) model, which uses liquidity pools instead of order books to facilitate token swaps. This model allows for seamless trading, reduced fees, and permissionless listing of tokens.

C. Yield farming and liquidity provision

Yield farming is a DeFi strategy where users deposit or stake their assets on multiple platforms to maximize returns. Users can provide liquidity to DEXs, participate in lending and borrowing platforms, or stake their tokens in various DeFi protocols to earn interest, trading fees, or governance tokens. Liquidity provision on DEXs like Uniswap involves depositing equal amounts of two tokens to create a liquidity pool, which facilitates token swaps and generates trading fees for liquidity providers.

D. Insurance and risk management

DeFi platforms like Nexus Mutual and Cover Protocol offer decentralized insurance solutions to protect users against smart contract vulnerabilities, hacks, and other risks associated with DeFi. Users can purchase coverage for specific platforms or smart contracts, and in the event of a covered incident, receive compensation from the insurance pool. This helps mitigate some of the risks inherent in the DeFi ecosystem.

These use cases demonstrate the versatility and potential of DeFi, as it continues to disrupt traditional financial services and offer innovative solutions for lending, trading, and asset management. By understanding these use cases and assessing the risks involved, you can explore the DeFi ecosystem with confidence and make informed decisions about which platforms and services best align with your financial goals.

Challenges and Future Outlook of DeFi

A. Challenges facing DeFi

- Scalability: As DeFi platforms are mostly built on Ethereum, they are subject to the network's limitations in terms of transaction throughput and scalability. High network congestion can result in slow transactions and increased gas fees, which may deter potential users.

- Security: DeFi platforms rely on smart contracts, which can contain vulnerabilities or bugs that may lead to hacks or loss of funds. Ensuring the security and reliability of these contracts is crucial for the growth and mainstream adoption of DeFi.

- Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and simplifying the onboarding process is essential for attracting new users and promoting widespread adoption.

- Regulation: The regulatory landscape for DeFi remains uncertain, and changes in regulations could impact the platforms and services available to users. Establishing clear and supportive regulatory frameworks will be crucial for the long-term success of DeFi.

Future outlook of DeFi

- Layer 2 solutions and alternative blockchains: The adoption of Layer 2 scaling solutions like Optimism and Arbitrum, as well as the emergence of alternative blockchains like Binance Smart Chain and Solana, could help address scalability concerns and reduce transaction fees, thus enabling DeFi to accommodate more users and use cases.

- Cross-chain interoperability: The development of cross-chain bridges and interoperable protocols will facilitate seamless integration of DeFi platforms and assets across different blockchains, expanding the ecosystem and fostering innovation.

- Integration with traditional finance: As DeFi gains mainstream recognition, we may see increased collaboration between DeFi platforms and traditional financial institutions, leading to new products, services, and hybrid solutions that combine the best of both worlds.

- Decentralized identity and privacy: The development of decentralized identity solutions and privacy-preserving technologies could help address privacy concerns and regulatory compliance issues, making DeFi more accessible and trustworthy for a broader audience.

While challenges persist, the potential of DeFi to reshape the financial landscape remains immense. As technology continues to evolve and mature, we can expect DeFi to play an increasingly prominent role in the global financial ecosystem.

Conclusion

As we've explored throughout this guide, decentralized finance (DeFi) is revolutionizing the financial landscape by offering a more accessible, transparent, and secure alternative to traditional financial services. By leveraging blockchain technology, DeFi allows users to engage in lending, borrowing, trading, yield farming, and more without relying on centralized intermediaries like banks or financial institutions.

Despite the challenges of scalability, security, usability, and regulation, the future outlook for DeFi remains promising. With ongoing developments in Layer 2 scaling solutions, cross-chain interoperability, and integration with traditional finance, we can expect DeFi to continue expanding and evolving to meet the needs of a diverse user base. The potential for DeFi to foster financial inclusion, promote innovation, and reshape the global financial ecosystem is immense.

In conclusion, understanding the fundamentals of DeFi is crucial for anyone looking to explore this rapidly growing space. By familiarizing yourself with the key components, popular platforms, and use cases, you can navigate the DeFi ecosystem with confidence and make informed decisions about which services and platforms best align with your financial goals. As DeFi continues to gain momentum, the opportunities for both newcomers and seasoned users alike will only continue to grow.

Please share your thoughts on the article by clicking below Emoji ...

Disclosure

*The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies.

The content on this blog is based on the authors' personal opinions, experiences, and research, and should not be considered as professional financial guidance. While we strive to provide accurate, up-to-date, and reliable information, we cannot guarantee the accuracy or completeness of the information presented. Cryptocurrency markets are highly volatile, and investments in cryptocurrencies and related assets carry a substantial risk of loss.

Before making any financial decisions or investments, you should consult with a qualified financial advisor or perform your own research and analysis. Any actions taken based on the information provided on this blog are at your own risk, and the authors, contributors, and administrators of this blog cannot be held liable for any losses or damages resulting from the use of the information found herein.

By using this blog, you acknowledge that you have read and understood this disclosure and agree to assume full responsibility for any decisions or actions you take based on the information provided.*