US Regulators Approve Bitcoin ETFs: A New Era for Cryptocurrency Investments

In a groundbreaking move, US regulators have approved the launch of Bitcoin exchange-traded funds (ETFs), marking a pivotal moment for the $1.7 trillion digital-asset sector. This decision paves the way for broader access to Bitcoin on Wall Street and beyond, signaling a major shift in cryptocurrency investment.

Some Background if you are living under a Rock

The journey towards this historic approval began in 2013 with the Winklevoss twins' proposal for a Bitcoin ETF, a vision that faced more than a decade of resistance from the Securities and Exchange Commission (SEC). The opposition was rooted in investor protection concerns. However, the scenario began to shift with applications from industry heavyweights like BlackRock Inc., triggering speculation and a rally in the cryptocurrency market. This shift in the SEC's stance was a response to both market dynamics and legal pressures, marking a pivotal point in the integration of cryptocurrencies into mainstream financial services.

SEC's Approval and Rationale

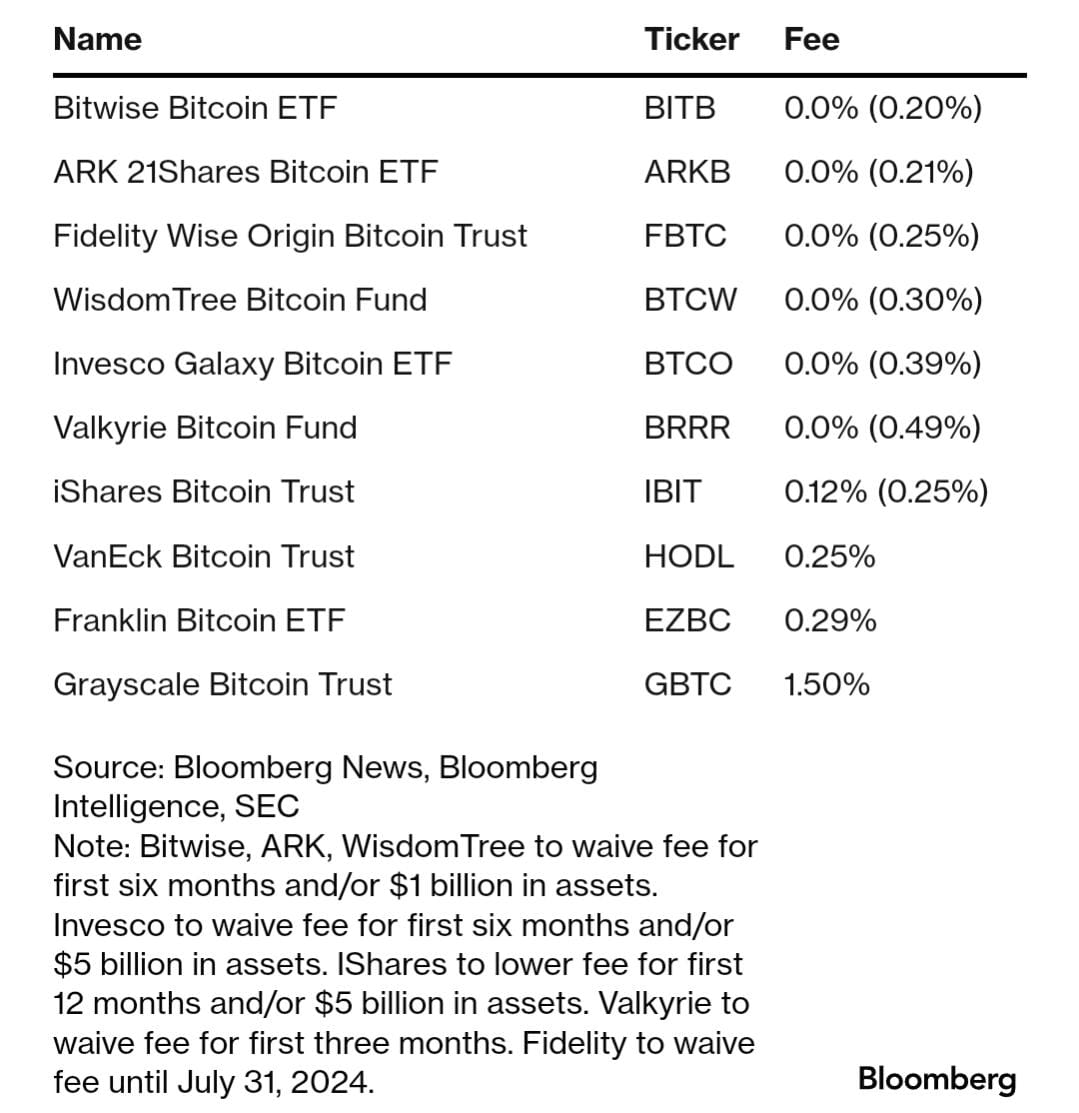

The SEC's approval, embracing firms ranging from BlackRock, Invesco, and Fidelity to smaller competitors like Valkyrie, demonstrates a significant change in the regulator's approach. SEC Chair Gary Gensler clarified that the approval for listing and trading of certain spot Bitcoin ETP shares was not an endorsement of Bitcoin, but a recognition of the evolving market dynamics. This decision came after the SEC addressed its concerns about the monitoring of Bitcoin trading and the potential for market manipulation.

Market Reaction

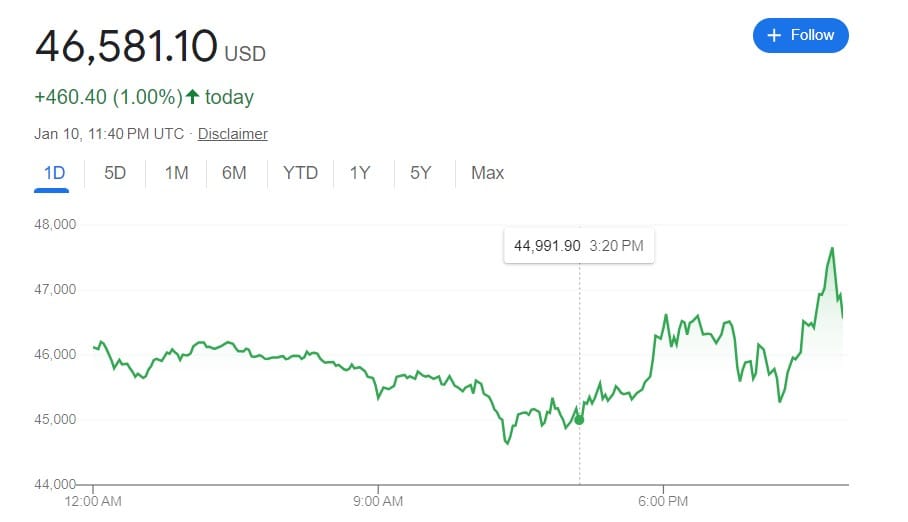

The market's reaction to this approval was mixed. Bitcoin's price oscillated around $45,500, failing to receive a major boost from the news. This subdued response might be attributed to the cryptocurrency's already significant rally of 160% in anticipation of the ETFs. Some analysts posited that the market had already priced in the approval, leading to a 'buy the rumor, sell the news' scenario. Other major cryptocurrencies like Ether, however, experienced more noticeable gains.

Impact on Investors and the Industry

The approval of Bitcoin ETFs is a game-changer for investors. It simplifies the process of adding crypto exposure to portfolios, particularly for those wary of the complexities and risks of direct cryptocurrency ownership. However, initial inflows into Bitcoin ETFs are likely to be from reallocating existing BTC holdings rather than new investments. The ETFs could eventually attract new money into Bitcoin, further integrating the cryptocurrency into the broader financial ecosystem. And now it paves a way for ETH ETF 🤞

Future Outlook and Challenges

This decision may pave the way for more cryptocurrency-based financial products and influence global regulatory perspectives. However, it also brings challenges, including potential market volatility and the need for continued regulatory vigilance. The SEC's move is seen as a balancing act between fostering innovation and protecting investors, highlighting the evolving nature of cryptocurrency regulation.

Conclusion

The SEC's approval of Bitcoin ETFs is a watershed moment, reflecting the growing maturity and acceptance of cryptocurrencies in the financial world. While it opens new opportunities for investor participation in the crypto market, it also underscores the need for cautious optimism and a balanced approach in navigating the dynamic and evolving landscape of cryptocurrency investments.

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*