Bitcoin Blasts Past $60K: Is $100K Next or a Crash Back to Reality?

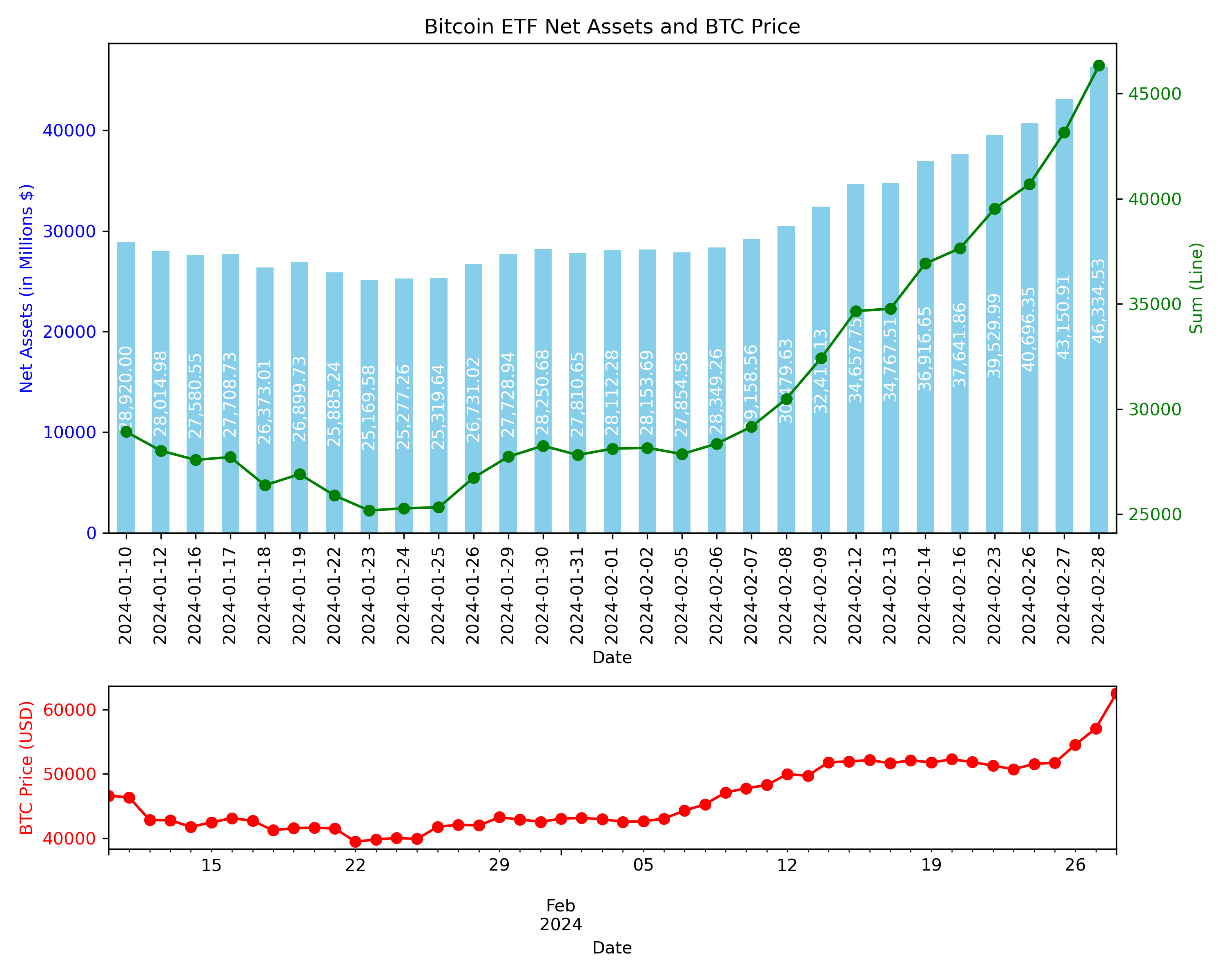

Crypto's high-risk game is back on. After years of cautious play, leverage is flooding the market, fueling Bitcoin's dramatic surge past $60,000. This frenzy, amplified by the launch of Bitcoin ETFs, has experts calling it a full-blown "rush to the upside."

Traders are piling into leveraged positions, betting everything on a new Bitcoin record. Open interest on derivatives exchanges is skyrocketing, mirroring the peak of the 2021 bull run. Could history repeat, or will this leveraged gamble trigger a spectacular crash? Some are already predicting a sharp pullback, recalling Wednesday's brief roller coaster plunge on Coinbase. One thing's for sure: the next chapter of Bitcoin's story is going to be a wild one.

Absolutely! Here's a revamped "Road to $60K" section, infused with the energy and insights from the new source material:

The $60K Surge: Why Bitcoin's Blazing a Trail

The crypto market, fueled by Bitcoin's rise, has roared back to a $2 trillion valuation, a level we haven't witnessed in almost two years. Several catalysts ignited this fire:

- ETF Mania: The wave of Bitcoin ETFs has unleashed a torrent of fresh capital. Inflows are breaking records (over $46 Billion), signaling mainstream acceptance and driving up demand.

- Short Squeeze Frenzy: The surge likely forced many short-sellers (those betting on a drop) to abandon their positions, throwing fuel on the upward momentum.

- Tech Titan Backing: MicroStrategy's continued massive Bitcoin purchases, now at $10 billion, add legitimacy and reinforce investor confidence.

- Defying Expectations: Bitcoin's surge even amidst rising interest rates is a testament to its growing allure as a hedge against inflation and traditional markets.

You may like

Crystal Ball Gazing: Is $100K Within Reach?

The $100,000 price target may seem ambitious, but it's not out of the realm of possibility. Here's why:

- Stock-to-Flow Model: Analytical models like the stock-to-flow ratio, which measures scarcity, have long predicted that Bitcoin could surpass $100,000 within this market cycle.

- Rising Demand, Limited Supply: With a finite supply of 21 million coins, Bitcoin is inherently scarce. Demand continues to outpace supply, which could propel prices even higher.

- The Halving Effect: Bitcoin's upcoming "halving" event, where rewards for miners get cut, is creating anticipation of a supply squeeze. Less Bitcoin + more buyers = potential price explosion. It is anticipated around April 2024. This built-in event slashes miner rewards in half, dramatically reducing the supply of new Bitcoin entering the market. While the exact date is unpredictable, history has shown a potential connection between halvings and significant price increases.

The Bearish Case: Is a Correction Coming?

- Profit-Taking: Investors who bought in at lower prices may be tempted to cash out, fueling a temporary drop in value.

- The Leverage Trap: Extreme leverage makes the market more vulnerable to sharp corrections, as we saw with the flash crash on Wednesday afternoon.

- Regulatory Headwinds: Increased regulatory scrutiny could dampen enthusiasm and raise questions about the long-term trajectory of Bitcoin.

- The Unknown Factor: Unforeseen events—anything from a security breach to negative headlines—can trigger sell-offs and derail bull runs.

What Should Investors Do?

Bitcoin's future path is uncertain, but there are a few key things to remember:

- DYOR (Do Your Own Research): Don't just follow the hype. Thoroughly research Bitcoin, its underlying technology, and competing crypto projects before investing.

- Long-Term Perspective: Focus on Bitcoin's potential as a long-term investment. Expect volatility along the way, and don't be swayed by short-term price fluctuations.

- Risk Management: Invest only what you can afford to lose, and never invest money you need for essential expenses in the near future.

The Bottom Line

Bitcoin's latest achievement is exciting, but it's only a chapter in a longer story. The road to $100,000 won't be a smooth ride. Embrace caution, monitor market dynamics, and make informed decisions.

Also Leverage is a powerful tool that can magnify both gains and losses. Bitcoin's latest rally is a reminder that the crypto world is a high-risk, high-reward arena. While the potential for massive returns is undeniable, so are the dangers of extreme volatility and sudden downturns. Buckle up; the crypto rollercoaster is about to get even wilder.

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*