ETH to the Moon? SEC Greenlights Ether ETFs, Crypto Summer Heats Up!

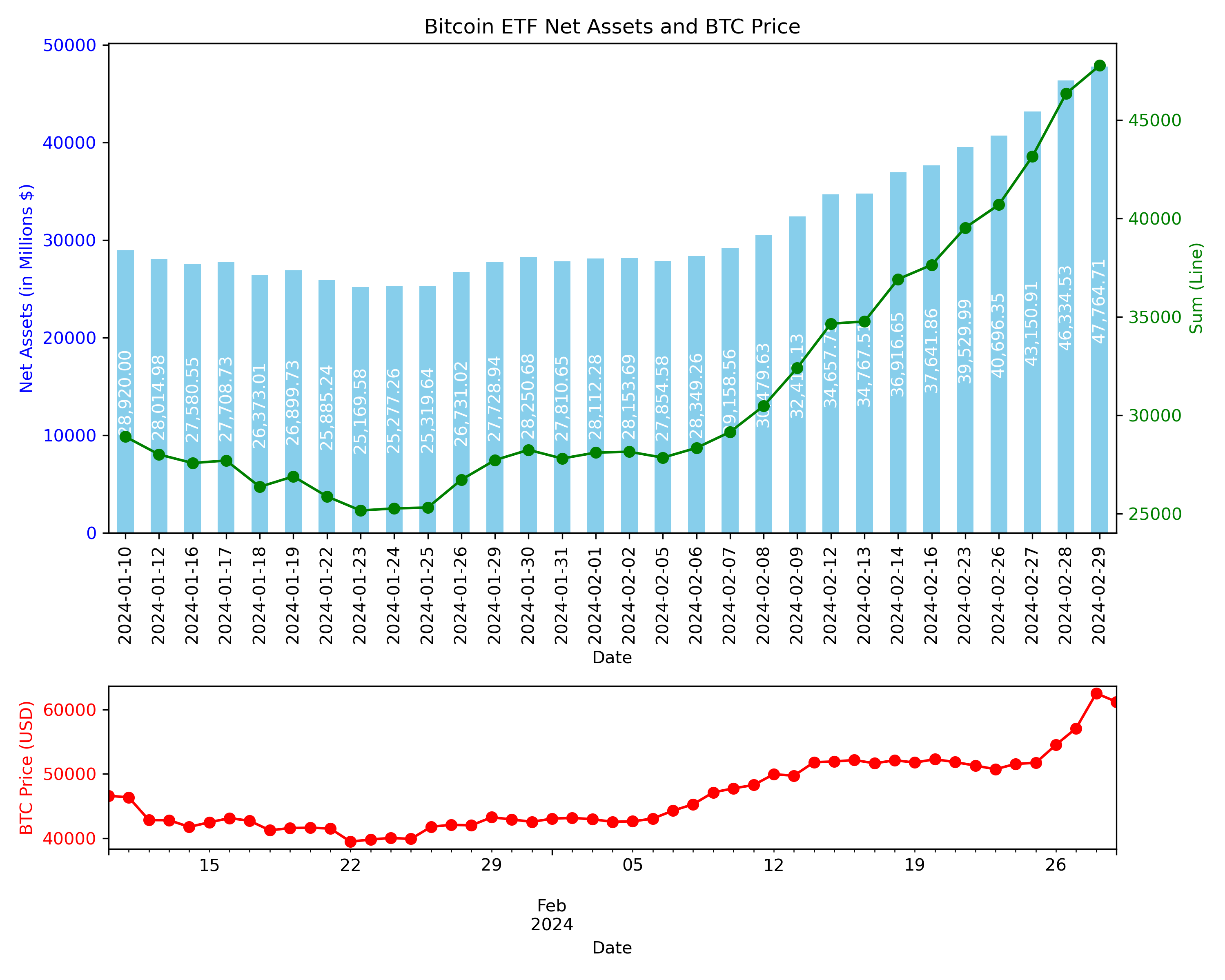

The SEC just dropped a bombshell: Ether ETFs are getting the green light in the US! 🤯 This is HUGE news, signaling a major shift in the mainstream acceptance of crypto. Remember when Bitcoin ETFs finally got approved? Bitcoin ETF assets went from under $30 Billion to over $45 Billion in just TWO MONTHS and hit a whopping $60+ Billion last month! Now, all eyes are on Ether.

But hold your horses, it ain't a done deal yet. The big players like VanEck, ARK Invest, BlackRock, and Fidelity still need the final nod from the SEC. They're all racing to be the first to launch, hoping to snag a piece of that sweet, sweet ETF pie. 🥧

Experts are already predicting a massive influx of cash, maybe even $15 to $45 billion in a flash! But hey, this is crypto, anything could happen! We're keeping our eyes peeled for the SEC's next move and will keep you updated every step of the way.

Beyond the Hype: What Ether ETFs Could Mean for the Average Investor

Alright, fam, let's break this down for the everyday investor. What's the big deal with Ether ETFs? Well, it's all about accessibility. ETFs are like crypto starter packs, letting you invest in Ether without needing a fancy wallet or dealing with complex exchanges.

This means more folks can dip their toes into the crypto waters, which is a win for the whole community! 🙌 Plus, ETFs are traded on traditional stock exchanges, so you can buy and sell them just like your regular stocks. Easy peasy!

Not Just ETFs: This Could Be a Game-Changer for Ether's Future

This ain't just about ETFs. The SEC's move could have ripple effects across the whole crypto world! For starters, it kinda hints that the SEC might be leaning towards seeing Ether as a commodity, not a security. That's a BIG deal because it could spare Ethereum from getting tangled up in the SEC's strict rules.

And get this: even though the CFTC (those derivatives folks) have been chill with Ether futures for a while, this SEC decision adds another layer of legitimacy. It's like a stamp of approval from the big boss, saying, "Hey, Ether is legit!"

So, yeah, this could open the floodgates for more institutions to dive into Ether. And who knows, maybe we'll see even more innovation on the Ethereum blockchain as a result. This is a major step forward for crypto, fam! 🚀

Hong Kong's ETH ETF Power Play: Staking to Outshine the US?

Hong Kong might be about to drop a staking bombshell on the ETH ETF scene! While the US is still figuring out its stance on staking, Hong Kong is already in talks to allow it for their Ether ETFs.

This could be a game-changer, fam! Staking offers passive income, like earning interest on your crypto. It's a way to get even more bang for your buck with your Ether investments. This could make Hong Kong's ETFs way more attractive than the US options, which might not even include staking.

It's all part of Hong Kong's grand plan to become the next big crypto hub. They're pushing hard with their crypto regulations, and this staking move could be a major power play.

Of course, nothing's set in stone yet. But if this goes through, it could be a huge win for Hong Kong's crypto scene and a major shakeup for the global ETH ETF landscape. Stay tuned, fam, this could get spicy! 🌶️

So, what do you think? Will Ether ETFs be the next big thing? Could they even surpass Bitcoin's ETF success? Drop your thoughts in the comments below! ⬇️

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*