Exploring the Sui Blockchain: A Comprehensive Guide to Its Innovative Tokenomics and Ecosystem

The Sui Economy is a groundbreaking blockchain platform that revolutionizes the way digital assets are created, managed, and exchanged. Powered by smart contracts, interoperability, and composability, this innovative system is designed around three key entities: users, SUI owners, and validators. The platform features a unique proof-of-stake mechanism that capitalizes on the causal ordering approach, ensuring efficient and fair reward distribution among validators.

An essential component of the Sui Economy is its gas pricing mechanism, which strikes a balance between low, predictable transaction fees for users and incentives for validators to optimize their operations. The platform also includes a sustainable storage fund that addresses the challenges of on-chain data handling and storage costs, providing a long-term economic solution.

One crucial aspect that underpins its success is the tokenomics behind the platform. In this article, we will delve into the details of Sui Blockchain's tokenomics by examining its various components and the dynamics that shape the ecosystem.

Before digging in the SUI Economy , lets look at some important terms :

The Sui economy consists of three main entities:

- Users: These are individuals who interact with the Sui platform by submitting transactions. They can create, modify, and transfer digital assets or engage with more complex applications enabled by smart contracts, interoperability, and composability.

- SUI Owners: People who hold SUI, the native asset of the Sui platform, have the option to delegate their holdings to validators and participate in the proof-of-stake mechanism. SUI owners also have the right to take part in Sui's governance.

- Validators: These entities manage transaction processing and execution on the Sui platform. They play a crucial role in maintaining the system's integrity and functionality.

The Sui economy is built on four key components

- The SUI token, the native asset that ensures on-chain liquidity.

- Gas fees, which are used for rewarding proof-of-stake participants and maintaining network security.

- Storage Fund - The storage fund is a sustainable mechanism in Sui's economic model that finances data storage by redistributing fees from past transactions to future validators and incentivizing efficient data management.

- The proof-of-stake mechanism, which promotes honest behavior among validators and SUI delegators.

- On-chain governance, which allows for continuous protocol improvement and adaptation.

Let's dig deeper -

The SUI token

The Sui platform features a native asset called SUI, which serves four key purposes:

- Participating in the proof-of-stake mechanism

- Paying gas fees

- Functioning as a versatile and liquid asset in various applications

- Enabling governance through on-chain voting.

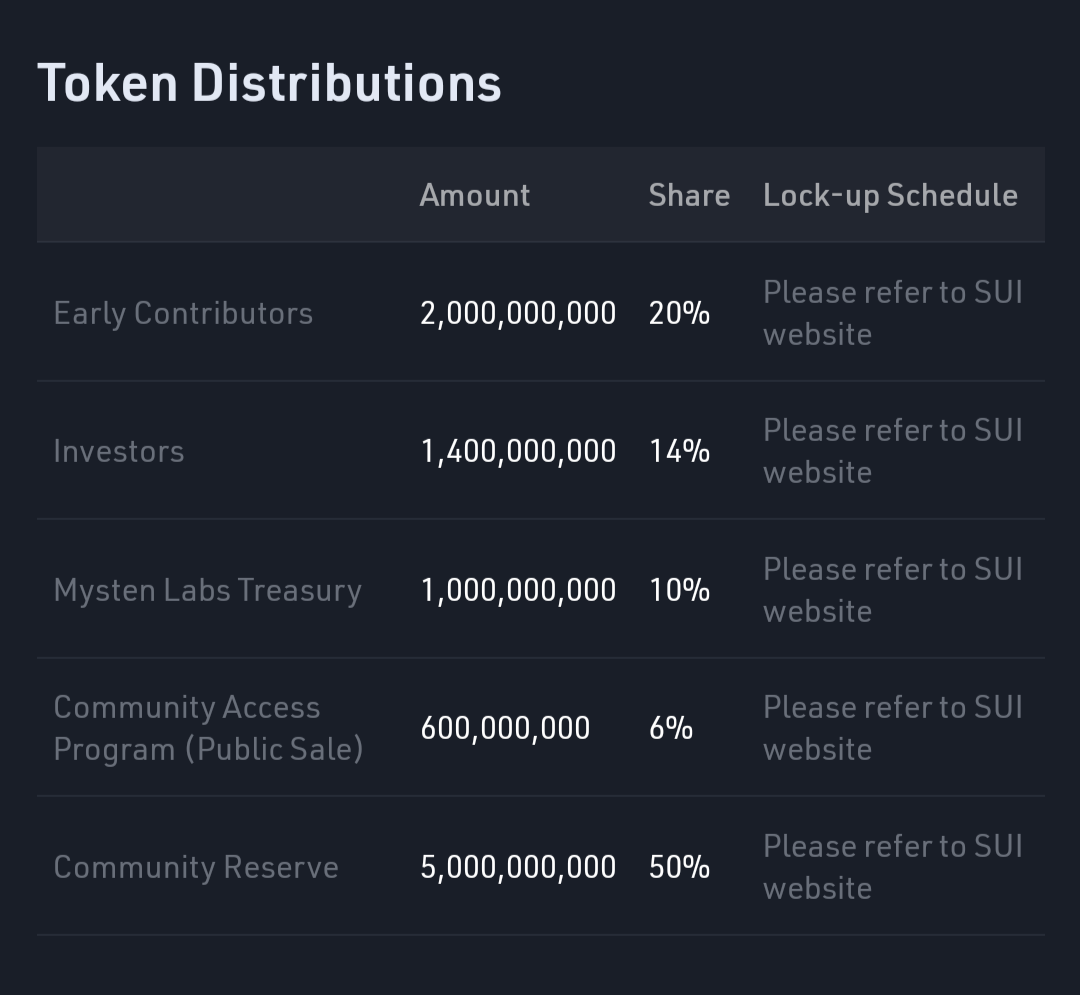

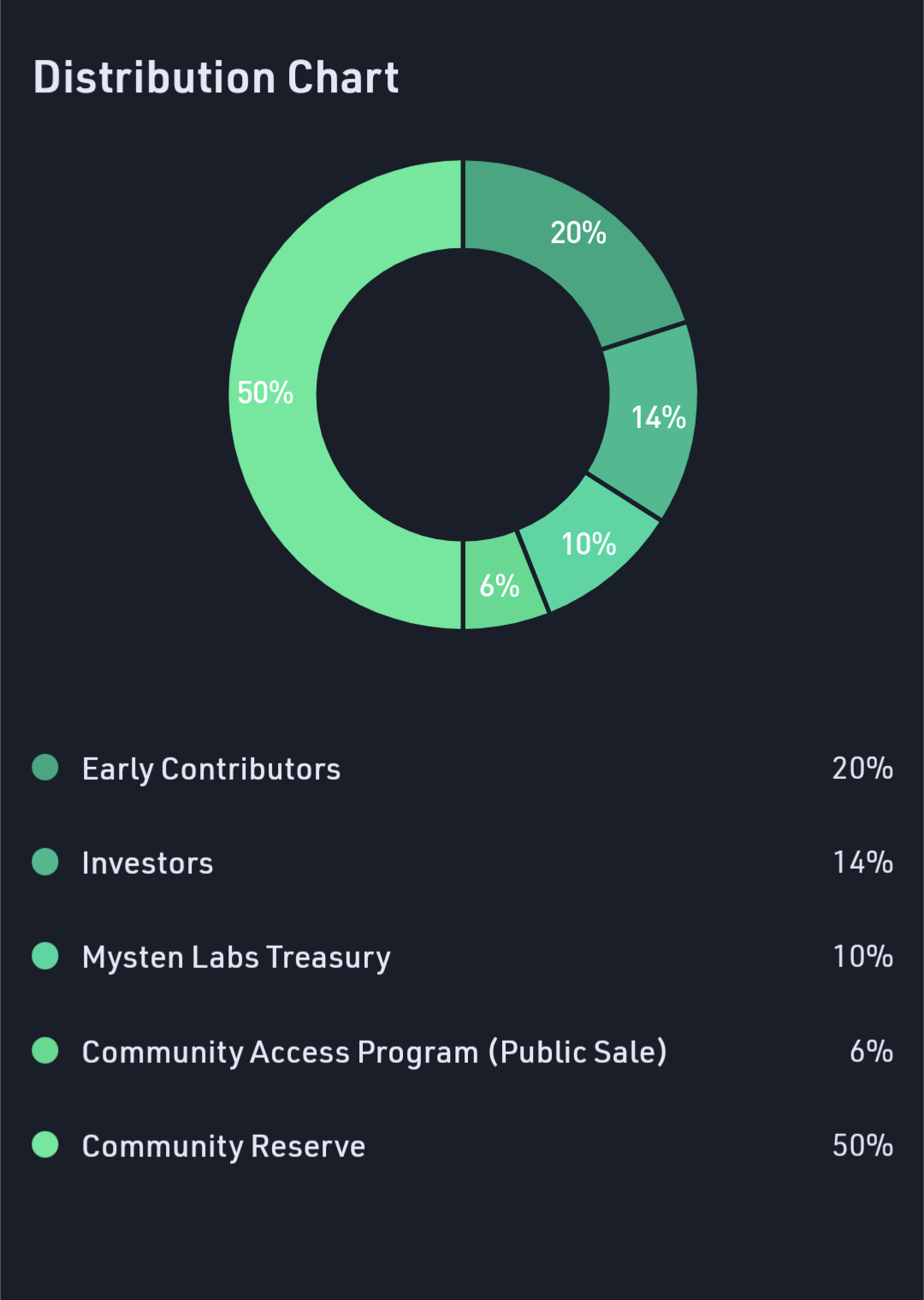

With a capped supply of 10 billion tokens, SUI's value is expected to increase as the platform expands and attracts more users.

Gas Fees

Sui's gas-pricing mechanism offers low, predictable transaction fees while incentivizing validators to optimize transaction processing and preventing denial of service attacks. A unique feature of this mechanism is the separation of fees for transaction execution and data storage. Users pay computation gas prices at the transaction level, while storage gas prices, determined through governance proposals, cover the cost of on-chain data storage in perpetuity. Validators set a network-wide reference price at the beginning of each epoch, aligning incentives between token holders, validators, and users. This approach provides a reliable user experience, encourages healthy competition among validators, and promotes continuous innovation for improved network efficiency, all while ensuring users pay fairly for their use of on-chain storage.

Storage Fund

Sui's platform is designed to deliver high throughput and low latency while handling large amounts of on-chain data. To address the economic challenge of paying for data storage, Sui has implemented a storage fund that ensures a sustainable and viable mechanism for compensating validators for storage costs.

The storage fund has three key features:

- Funded by past transactions: This ensures that future validators are compensated for storage costs by the past users who generated those storage requirements, effectively shifting stake rewards across different epochs.

- Indirect distribution of tokens: The storage fund only pays out returns on its capital without distributing its principal, guaranteeing its indefinite survival. Validators receive a share of stake rewards to compensate them for data storage costs, and a portion of these rewards is reinvested into the fund.

- Deletion option and fee rebate: Users can delete previously stored on-chain data and obtain a partial refund of the original storage fees. This market-based mechanism incentivizes users to free up storage when it becomes uneconomical to keep the data on-chain.

Overall, Sui's storage fund provides an efficient and sustainable economic mechanism that addresses the challenge of financing data storage in a fair and balanced manner. It creates a healthy incentive structure that benefits users, validators, and the Sui economy.

Delegated Proof-of-Stake System

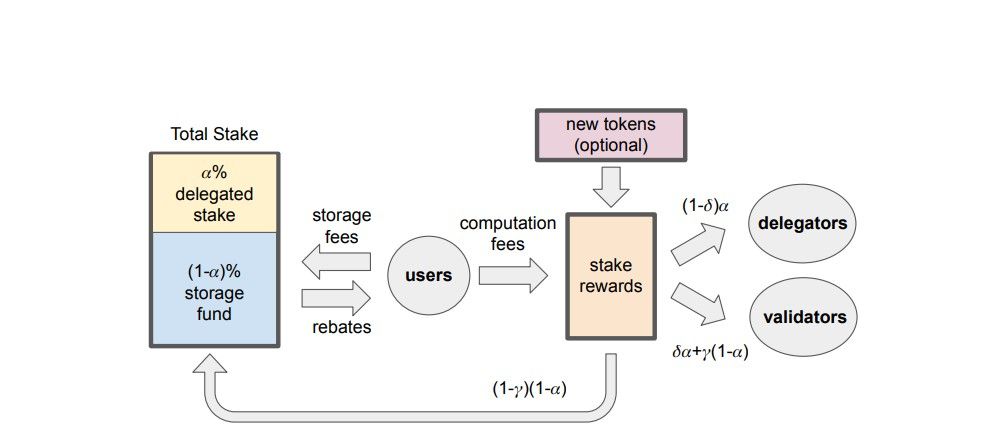

Sui's Delegated Proof-of-Stake system determines the validators who process transactions by computing the total stake as the sum of staked SUI and the storage fund. During each epoch, users submit transactions and validators process them, with users paying associated gas fees. At the end of each epoch, stake rewards are distributed to participants through computation fees accrued and epoch's stake reward subsidies.

Validators with more stake earn more stake rewards, and the joint term incentivizes them to increase their share of stake while operating the network performantly. The storage fund rewards accrue to all validators equally, and a small amount of stake rewards that is not distributed gets reinvested in the storage fund. Sui's economic model encourages healthy competition for fair prices, where validators set low gas fees while operating with viable business models, with users and SUI token stakers monitoring the process.

Now let's use these concepts and look at the Economic Model

Sui's Economic Model

The Sui economic model is designed to create a sustainable and fair ecosystem for participants in the proof-of-stake network. It is based on the following components and processes:

- Epochs: The model operates in discrete time periods called epochs. Each epoch has a beginning, during which a validator committee is formed, reference gas prices are set, and the size of the storage fund is updated. Epochs also have an end, during which validators vote to commit a checkpoint and rewards are distributed.

- Validators and delegators: SUI token holders delegate their tokens to validators who process transactions on the network. Validators play a passive role, allowing for a smoother reward system.

- Transactions: Users submit transactions to the Sui platform during an epoch, and validators process them. Transaction fees are paid by users, and rewards are given for deleting data associated with past transactions.

- Stake rewards: Computation fees and new token issuance generate stake rewards during an epoch. These rewards are distributed to delegators and validators based on their stake.

- Storage fund: A key feature of the Sui economic model, the storage fund enables validators to receive additional rewards to cover storage overhead costs. This ensures that validators can maintain a viable business model, regardless of their delegated stake size.

- Reward distribution: At the end of each epoch, stake rewards are calculated and distributed among delegators, validators, and the storage fund. Validators receive a portion of the rewards from the storage fund based on a parameter γ, which is adjusted depending on the fund's health.

- Incentives: The Sui economic model is designed to preserve incentives from the proof-of-stake mechanism while accommodating the additional incentives arising from the storage fund. This balance promotes a sustainable and fair ecosystem for all participants.

Overall, the Sui economic model aims to create a stable, fair, and sustainable proof-of-stake network by offering smooth reward distribution, incorporating a storage fund for validators' overhead costs, and carefully balancing incentives for all participants.

Deflation aspect of SUI token

SUI Deflation in the Sui economy arises due to its capped supply at ten billion tokens and the presence of the Sui storage fund. As more use cases are unlocked and users join the platform, the dollar price of SUI may increase, leading to falling on-chain SUI prices, including gas prices, and ultimately a deflationary economy.

The Sui storage fund introduces two deflationary forces: one temporary and the other quasi-permanent. The temporary force occurs when tokens in the storage fund are locked up, reducing the amount of SUI available for activities like staking and paying gas fees. This effect is temporary, as users can release SUI tokens by deleting on-chain data. However, it is likely to be significant in the long run as storage increases with network activity.

The quasi-permanent deflationary force involves the maximum number of SUI tokens that can be in circulation, which is affected by new SUI issuance, tokens reinvested to capitalize the storage fund, and the residual of new storage rebates. Both the capitalization term and the rebate residual represent coins deposited in the storage fund in perpetuity, limiting the number of SUI tokens in circulation.

However, this quasi-permanent effect is not entirely permanent. The Sui economy has a safeguard to prevent the storage fund from becoming too large. If the share of delegated stake becomes too small, an outflow of the storage fund principal is triggered. This outflow is limited to the portion endowed through capitalizations or rebate residuals, ensuring the fund's long-term viability and manageable size. The lower bound may be updated through on-chain governance, and outflow funds can be used as future stake reward subsidies.

In conclusion, the Sui storage fund introduces two deflationary forces on the SUI token, each with varying strength and duration. The temporary effect is more potent but potentially short-lived, while the quasi-permanent effect has a weaker impact but may last indefinitely, depending on the platform's storage history.

How Sui's proof-of-stake model is different

A common critique of proof-of-stake systems is the "rich-get-richer" effect, where the stake distribution across validators converges to a degenerate distribution in the long run. This effect is driven by randomness and arises even if all validators act honestly. Traditional proof-of-stake systems enable compounding when validators reinvest their rewards, causing validators with high stakes to accumulate the majority of the stake over time.

However, Sui's proof-of-stake model does not exhibit the "rich-get-richer" effect, as all honest validators receive their share of staking rewards at the end of each epoch with full certainty. The stake distribution remains fixed over time, and this can be formally proven in a special case where all validators submit the same price quote during the gas survey, process all transactions in a reasonable time, and reinvest their stake rewards in the same validators across time.

The fact that the staking distribution remains constant over time is crucial for Sui's network security, as it significantly reduces the concern of some validators gaining a disproportionate amount of voting power. Although the proof corresponds to a stylized setting, it highlights a valuable force present in Sui's proof-of-stake implementation.

Conclusion

In conclusion, the Sui Economy is a groundbreaking blockchain platform that offers a novel approach to creating, managing, and exchanging digital assets. Through the introduction of smart contracts, interoperability, and composability, the platform provides a unique user experience supported by a well-designed tokenomics structure. The proof-of-stake mechanism, storage fund, and gas pricing mechanism all contribute to the creation of a fair and sustainable ecosystem for users, SUI owners, and validators.

Sui's economic model ensures that rewards are distributed equitably, and validators' storage costs are met, while balancing the incentives for all participants. Furthermore, the platform addresses the common "rich-get-richer" critique of traditional proof-of-stake systems by maintaining a constant stake distribution over time. This innovative approach ensures the network's security and mitigates concerns about a disproportionate concentration of voting power.

The deflationary forces introduced by the Sui storage fund, coupled with the capped supply of SUI tokens, make the platform an attractive investment opportunity for users and SUI owners alike. As the platform continues to grow and unlock new use cases, it is poised to revolutionize the blockchain landscape and establish itself as a leader in the industry.

Please share your thoughts on the article by clicking below Emoji ...

References of this articles

Disclosure

*The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies.

The content on this blog is based on the authors' personal opinions, experiences, and research, and should not be considered as professional financial guidance. While we strive to provide accurate, up-to-date, and reliable information, we cannot guarantee the accuracy or completeness of the information presented. Cryptocurrency markets are highly volatile, and investments in cryptocurrencies and related assets carry a substantial risk of loss.

Before making any financial decisions or investments, you should consult with a qualified financial advisor or perform your own research and analysis. Any actions taken based on the information provided on this blog are at your own risk, and the authors, contributors, and administrators of this blog cannot be held liable for any losses or damages resulting from the use of the information found herein.

By using this blog, you acknowledge that you have read and understood this disclosure and agree to assume full responsibility for any decisions or actions you take based on the information provided.*