Is Regulation the Key to Bitcoin's Success?

The regulation of Bitcoin is a topic of considerable debate in the global financial community. In the context of Bitcoin, regulation means setting certain rules and norms for its issuance, transaction, and use. While some purists believe that the unregulated nature of Bitcoin is its unique selling point, there are compelling reasons why Bitcoin needs to be regulated. One of the prime reasons for regulating Bitcoin is its potential to become a legitimate inflation hedge and its possible role in portfolio diversification.

Why is Bitcoin not Functioning as an Inflation Hedge?

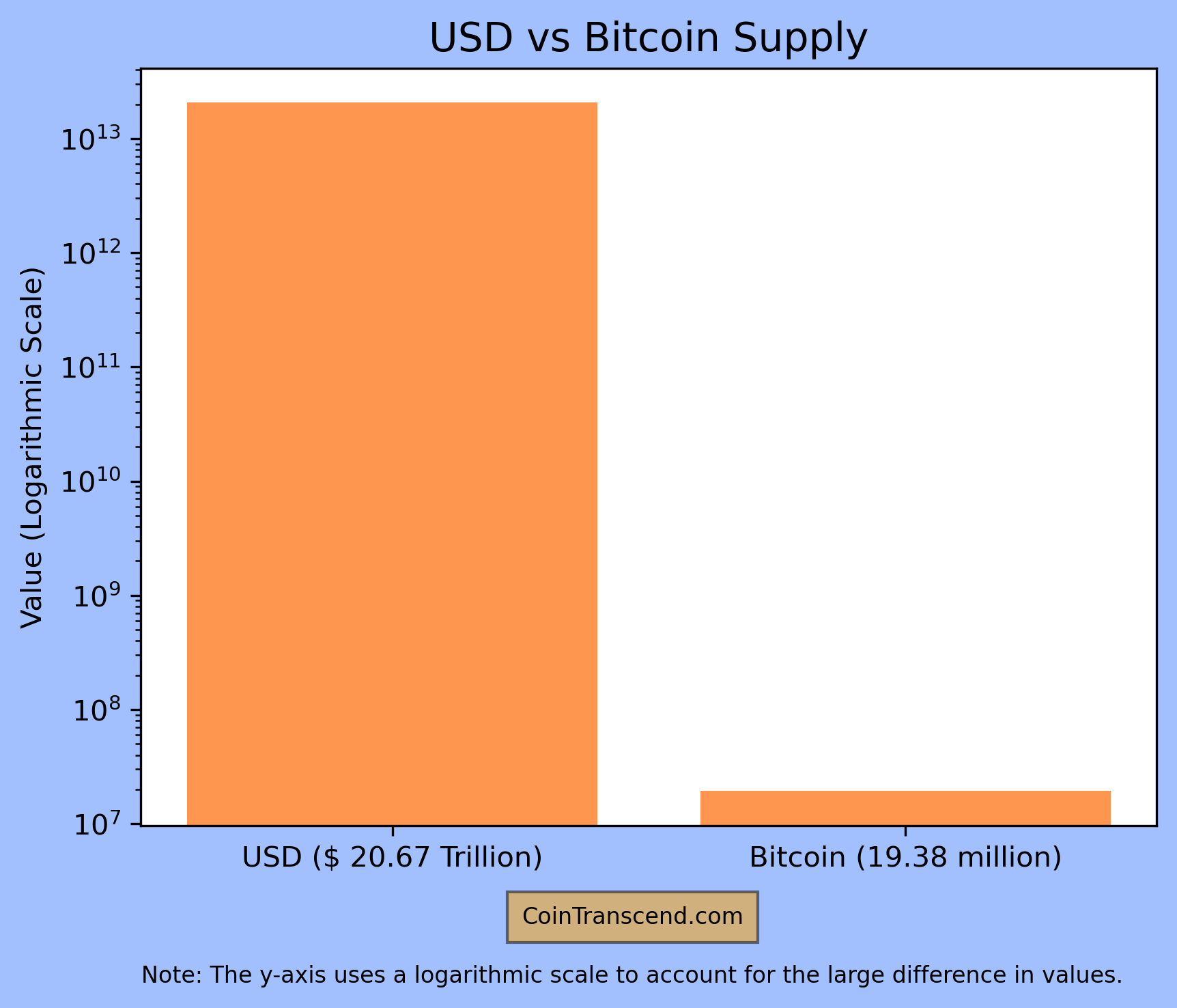

Bitcoin has been promoted as a hedge against inflation. The fundamental premise of Bitcoin, as defined by its pseudonymous creator, Satoshi Nakamoto, was to create a digital currency that is immune to government manipulation, with a finite supply, to prevent devaluation. Bitcoin's capped supply of 21 million introduces an inherent deflationary bias, differentiating it from fiat currencies, which central banks can inflate. It was designed with a finite supply to act as a store of value, immune to inflationary pressures. However, despite these assertions, Bitcoin's performance has sometimes been contrary to expectations during periods of inflation. Here's why.

- Speculative Nature: Bitcoin has often been subject to extreme price volatility, with rapid price increases followed by severe crashes. This instability has frequently been linked to speculative trading, where investors buy assets with the hope that their prices will rise quickly, allowing them to sell at a profit. Such speculative behavior can result in sudden, unpredictable shifts in value, undermining Bitcoin's usefulness as a stable store of value or hedge against inflation.

- Investor Confidence: Bitcoin's lack of regulation has led to a lack of confidence among some investors. Without clear regulations in place, investors may fear potential legal or financial repercussions of investing in Bitcoin. Furthermore, the absence of a central authority to govern Bitcoin also contributes to its unpredictability. Investors prefer predictability and security, and until Bitcoin can offer both, it may struggle to act as an effective hedge against inflation.

In conclusion, while Bitcoin has the potential to serve as an inflation hedge due to its finite supply and decentralized nature, its current state of high volatility and regulatory uncertainty are major obstacles. It is currently more of a speculative asset than a reliable value store.

Interest Rate & Bitcoin

Because Bitcoin is considered a speculative asset class, it's prone to high-interest rates. Higher interest rates generally increase the cost of borrowing, which in turn can impact investments across various asset classes, including Bitcoin. In an environment of high-interest rates, the opportunity cost of holding non-interest-bearing assets like Bitcoin increases. That means investors might opt for assets where they can earn interest, like treasuries which yield almost 5% these days.

Another way we can look at Interest Rate Parity (IRP) concept for the relationship between Internet rate & Bitcoin. Basically, IRP describes the relationship between interest rates and the exchange rate of two countries. The theory provides a critical framework for understanding how markets should operate under perfect capital mobility and arbitrage conditions.

The IRP theory rests on the idea that the difference in interest rates between two countries equals the expected change in exchange rates between the countries currencies. If this parity does not hold, there is an opportunity for arbitrage.

In simpler terms, consider two countries, A and B, with currencies $ and €, respectively. Suppose the interest rate in country A is lower than in country B. According to the IRP theory, the currency of country A ($), where the interest rate is lower, should trade at a forward premium to currency B (€). This means that the future value of the $ is expected to be higher compared to the €. The forward premium compensates for the lower interest rates in country A.

Now, how does this apply to Bitcoin or cryptocurrencies? Cryptocurrencies like Bitcoin exist outside traditional financial systems and hence, in theory, are not directly linked to any country's interest rate. However, Bitcoin and other cryptocurrencies do interact with the traditional financial system at various levels. For instance, people buy cryptocurrencies using fiat currencies, and interest rates can affect the appeal of holding fiat currencies versus holding cryptocurrencies.

If we loosely apply the concept of IRP to Bitcoin, it would suggest that when real-world interest rates increase, holding traditional currency becomes more attractive as it now yields higher returns. As a result, the demand for Bitcoin might decrease, leading to a potential decrease in Bitcoin's price. This is a simplified representation, and real-world outcomes can be more complex, given the multitude of other factors influencing Bitcoin's price.

Are High-Interest Rates Here to Stay?

The short answer is yes. Why? Because of Inflation. The stickiness of inflation, particularly in the context of the current economic climate, can be traced back to a variety of interconnecting factors, many of which were set in motion or amplified by the COVID-19 pandemic. Here's a walkthrough of why inflation is proving difficult to contain under the prevailing conditions:

Low-Interest Environment: Prior to the pandemic, we lived in an era of low-interest rates. During this period, companies preferred to generate revenue through volume sales rather than focusing on profit margins. This led to a competitive landscape with a strong emphasis on cost control.

Pandemic Stimulus: The onset of the pandemic and the subsequent economic fallout led to the deployment of massive fiscal stimulus packages globally. These measures injected substantial liquidity into the economy, bolstering consumer financial health.

Consumer Spending Behavior: Post-pandemic pent-up demand was released as consumers who had been financially insulated during the pandemic were eager to spend. Despite not being financially robust, some consumers were influenced by a desire to regain some normalcy, further stoking spending.

Supply Chain Disruptions: The pandemic also caused unprecedented disruptions to global supply chains, leading to shortages and increased costs across many sectors. This scenario provided companies with a rationale to raise prices to cover increased operational costs.

Inflationary Expectations: As consumers started to accept the higher prices, an inflationary mindset took hold. The economic narrative of shortages and inflation made higher prices seem inevitable, and consumers were prepared to pay more due to their perceived increase in wealth, reduced unemployment, and wage increases.

Shift in Corporate Strategy: Companies, seeing consumers were willing to absorb higher prices, began prioritizing profit margins over volume. This marked a significant strategic shift from the pre-pandemic era.

Persistent Price Increases: As long as consumers continue to accept higher prices, companies will maintain their elevated pricing. Even as supply chain issues begin to resolve, firms face increased wage pressures, another justification for keeping prices high.

So Inflation's stickiness in the current climate is the result of a unique mix of unprecedented global events, policy responses, and shifts in consumer and corporate behavior. These factors have created an environment where inflation, once set in motion, is stubbornly resistant to easing.

How Can Bitcoin Transition to an Inflation Hedge?

The current perception of Bitcoin as a speculative asset is mainly due to its volatility. Wild price swings, driven by speculation, deter many institutional investors and traditional hedge funds from including Bitcoin in their portfolios. Also, Despite Bitcoin's potential as an inflation hedge, there are several steps that it needs to undergo to realize this role fully.

- Increased Regulation: Increased oversight can lead to a reduction in the speculative nature of Bitcoin and increase investor confidence. Regulatory measures can ensure investor protection, limit fraudulent activities, and provide a legal framework within which Bitcoin can operate. Regulation can be complex and controversial within the decentralized ethos of cryptocurrencies, but it can contribute to stability and encourage broader acceptance.The key is to strike a balance where the decentralized nature of Bitcoin is preserved while ensuring it operates within a trusted framework.

By instating regulations, Bitcoin's credibility could be enhanced, thereby attracting a broader investor base.

- Integration with Traditional Financial Systems: For Bitcoin to function as an effective inflation hedge, it must be easily converted into other assets and currencies. This may require closer integration with traditional financial institutions and systems, which may also require regulatory adjustments.

Conclusion

In conclusion, while regulation could potentially diminish some of the unique characteristics of Bitcoin, such as its decentralization and anonymity, it is a crucial step in legitimizing Bitcoin as a stable financial asset and an inflation Hedge. The implementation of such regulation requires a nuanced approach, ensuring the preservation of the fundamental ethos of cryptocurrencies - decentralization and financial inclusion.

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*