Decoding the Relationship: Bitcoin Price & Personal Consumption Expenditures (PCE)

Welcome to the Issue IV of Bitconometrics. In this issue, we will look at an economic indicator that is extremely crucial for FED for the Interest rate Policy

Personal Consumption Expenditures (PCE)

The relationship between Bitcoin price and Federal Reserve (Fed) interest rate policy is complex. Various factors influence it, including technological advancements, regulatory developments, and broader economic conditions.

However, the relationship with the Fed's interest rate policy can be considered from several perspectives.

- Risk Appetite: Interest rates set by the Fed impact the overall risk appetite in the market. Lower interest rates often encourage risk-taking as borrowing costs decrease, potentially increasing demand for higher-risk assets like Bitcoin. On the other hand, higher interest rates increase borrowing costs and can deter risk-taking, which might negatively impact Bitcoin prices.

- Macro-Economic Factors: Changes in Fed interest rates can also indirectly influence Bitcoin prices through their impact on the broader economy. For instance, an increase in interest rates can lead to a stronger U.S. dollar, which could decrease the price of Bitcoin in dollar terms.

What is PCE & Core PCE?

Personal Consumption Expenditures (PCE) and the PCE price index excluding Food and Energy, more commonly known as Core PCE, are critical indicators used by the Federal Reserve (Fed) to assess inflation trends and make monetary policy decisions, including setting interest rates.

Personal Consumption Expenditures (PCE) refers to the value of goods and services purchased by, or on the behalf of, "households" and includes actual expenditures and imputed expenditures. These expenditures are categorized into goods (both durable and non-durable) and services. The PCE is a significant component of the Gross Domestic Product (GDP) and gives insights into consumers' spending habits, a crucial determinant of overall economic activity.

The Core PCE price index, on the other hand, excludes the volatile components of Food and Energy. It provides a more stable measure of inflation, enabling policymakers to gauge the underlying inflation trend more effectively. The prices of food and energy commodities can fluctuate significantly due to various factors, including geopolitical events and natural disasters, which may not reflect the long-term inflation trend.

What's the relationship between Fed Interest Policy & PCE?

The Fed pays close attention to these indicators because they reflect inflation trends, one of the main factors considered in setting monetary policy. The Fed has a dual mandate: to maximize employment and stabilize prices. Regarding price stability, the Fed targets an average inflation rate of 2% over the long run, as measured by the annual change in the PCE price index.

If the PCE and Core PCE show that inflation is consistently running above or below the 2% target, the Fed may adjust the federal funds rate, which is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight, to influence economic activity and bring inflation closer to the target. When inflation is high, the Fed may raise interest rates to slow down economic activity, thus reducing inflationary pressures. Conversely, if inflation is too low, the Fed may lower interest rates to stimulate economic activity and push inflation toward the target.

In conclusion, PCE and Core PCE are crucial tools for the Fed to monitor inflation trends. By understanding these indicators, the Fed can make informed decisions about interest rate adjustments, fulfilling its mandate to promote maximum employment and price stability.

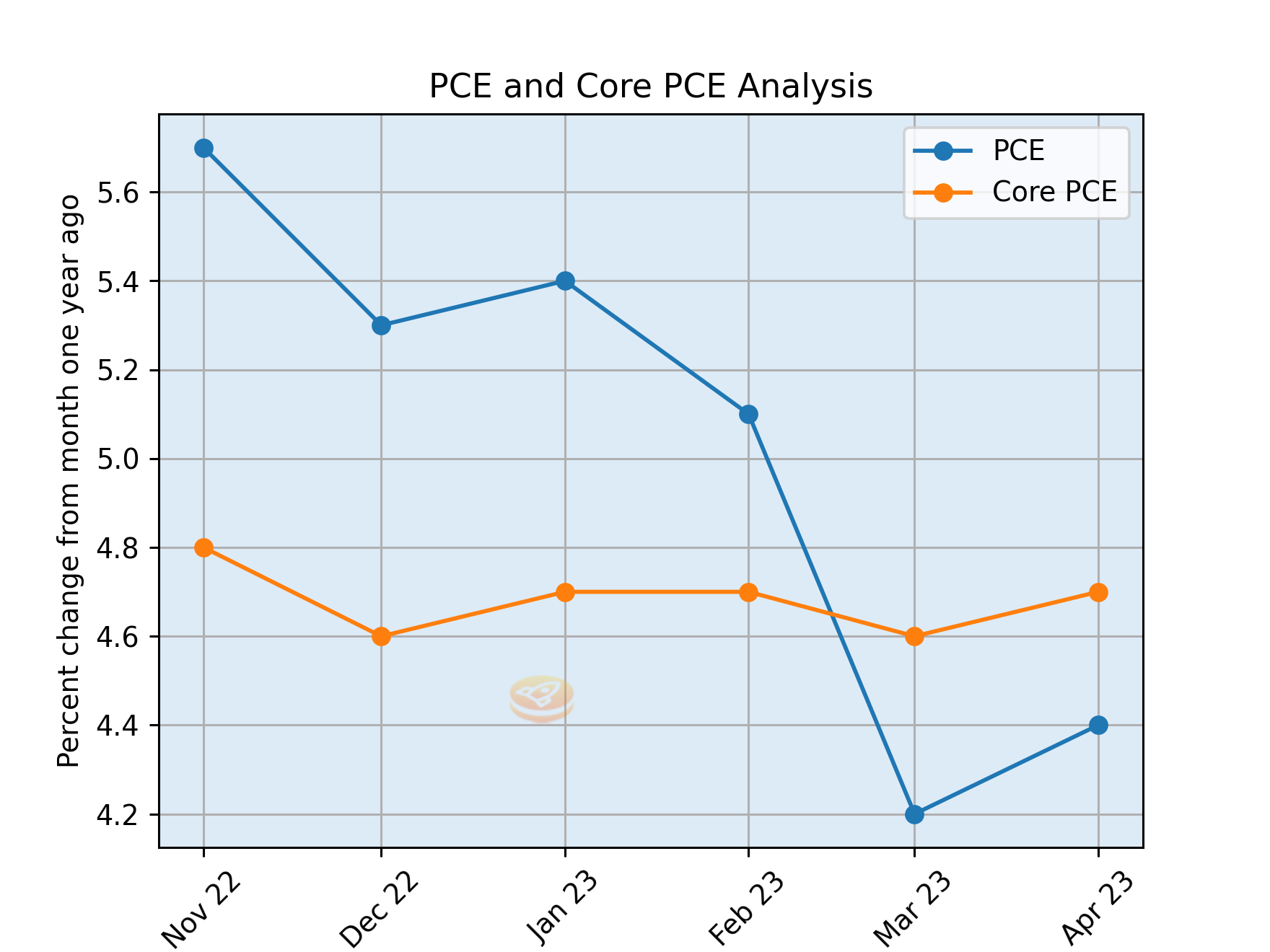

Analyzing the Correlation Between Bitcoin Price Trends & PCE

On May 26th, 8:30 am, BLS released PCE numbers for April, and it is a strong inflation report

The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index (Core PCE) increased by 0.4 percent

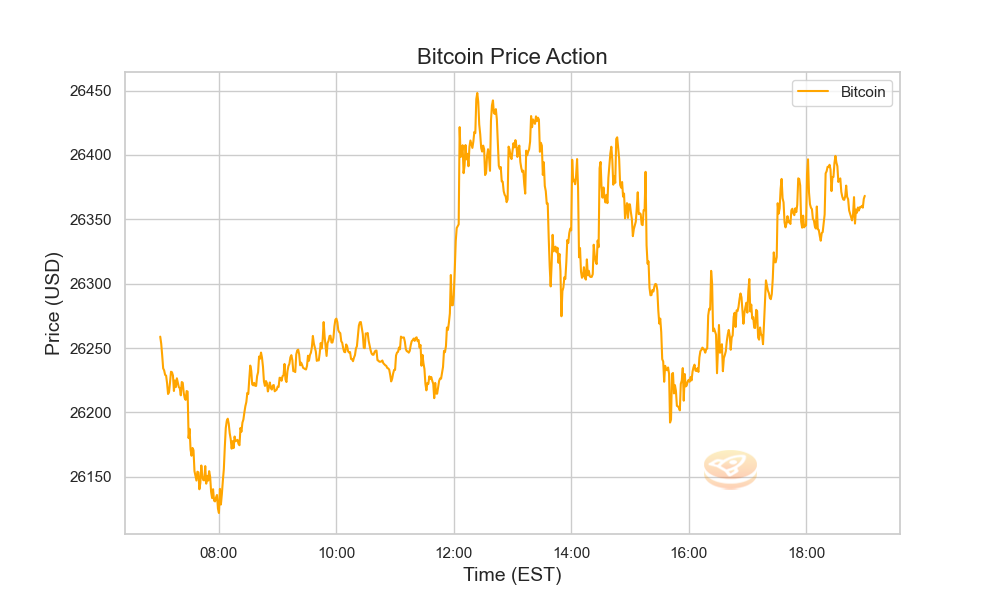

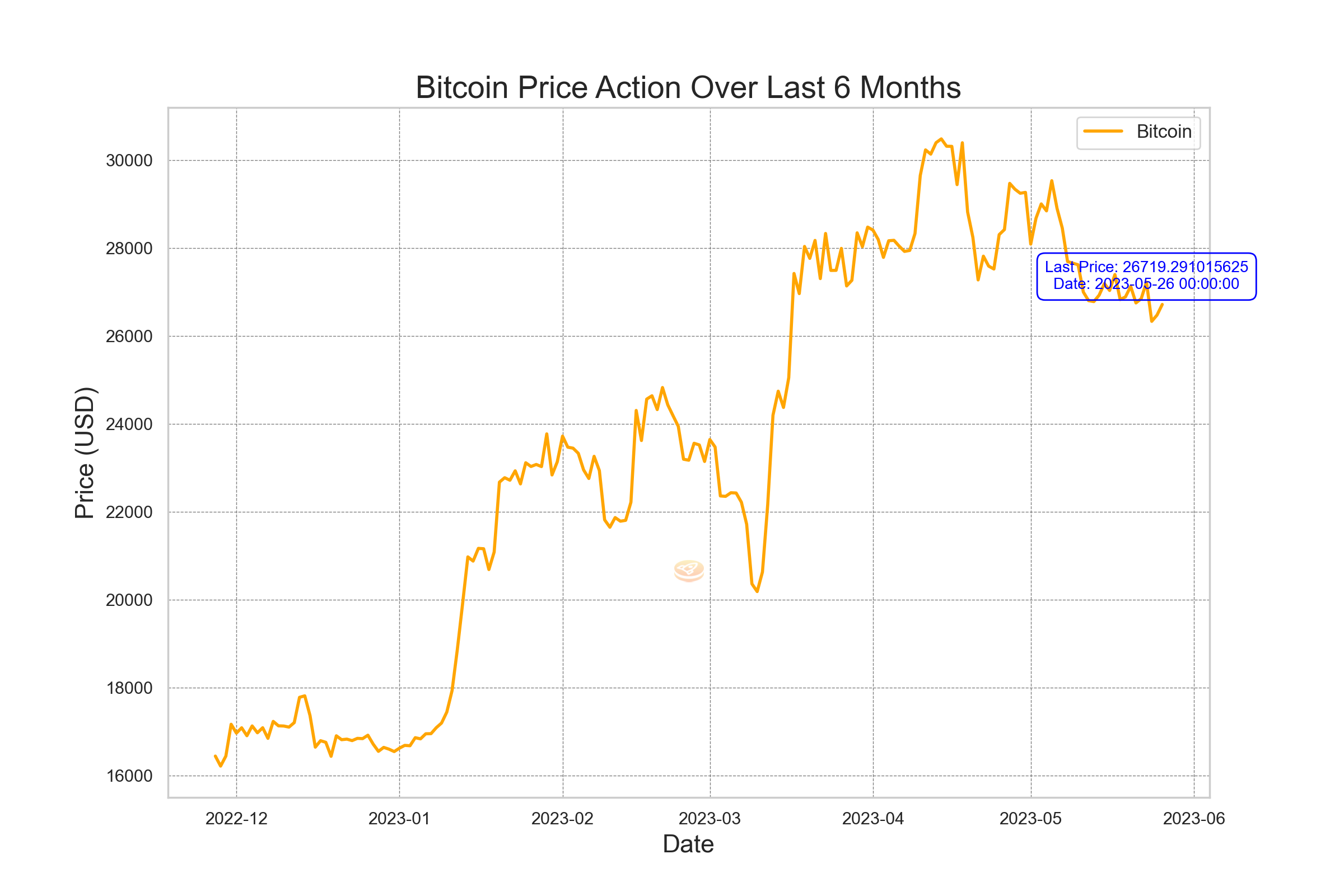

Let's look at the Bitcoin Price trend for 26th May around 08:30 am EST...

Also past 6-month price trend

Besides the sudden drop in March, the Price trend doesn't align significantly.

Conclusion

At times, certain market developments outshine fundamental economic indicators. Currently, we're witnessing this in the midst of the ongoing debt ceiling discussions. These discussions have temporarily overshadowed strong inflation numbers, particularly the Personal Consumption Expenditures (PCE) index, a primary measure of consumer inflation. If these inflationary conditions persist, it may necessitate the Federal Reserve to raise interest rates by another 25 basis points (0.25%). Remarkably, these inflationary trends are yet to reflect on the performance of Bitcoin and the broader equities market.

The debt ceiling situation reached a critical point ahead of the June 5th deadline, when the U.S. Treasury would have been unable to meet its debt obligations, risking a default. However, a principle agreement has been reached in Congress, averting the immediate threat of default.

Parallelly, we're experiencing an AI boom cycle, aptly termed as the "Chat GPT boom." This surge has significantly benefited companies like Nvidia, a leading chip manufacturer. Nvidia reported blowout earnings on May 24th, primarily driven by the AI sector, propelling its stock price up by an impressive 25%. Historically, tech booms have positively influenced speculative assets like Bitcoin, injecting them with a surge of risk-tolerant capital.

However, the relationship between recent PCE data and Bitcoin's price doesn't align with this historical 6-month border trend. Given these observations, we are marking the PCE and core PCE as the 'B' component of our index, indicating a need to monitor these indicators for future correlations and market insight.

In conclusion, here is the updated table for Bitcoin price forecast Index

| Indicator | Rank |

|---|---|

| PCE | B |

| Employment Situation Report | B |

| CPI | A |

| Initial Jobless Claims | B |

Last issue

You might like past issues here

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The content provided in the Bitconometrics: Decrypting Crypto Correlations section is intended for informational and educational purposes only. It should not be construed as financial, investment, or trading advice. The opinions, analysis, and forecasts expressed in this section are those of the authors and do not necessarily reflect the views of the entire Bitconometrics team or any associated entities.

The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies

Cryptocurrency markets, including Bitcoin, are highly volatile and can fluctuate significantly in a short period. The information presented in this section is based on historical data, current market conditions, and the authors' interpretation of various economic indicators. Although we make every effort to provide accurate and up-to-date information, there is no guarantee that any analysis, prediction, or projection will materialize or prove accurate.

Before making any financial or investment decision, we strongly recommend that you consult with a qualified financial advisor, conduct your own research, and assess your personal risk tolerance. Bitconometrics, its authors, and affiliates will not be held liable for any direct, indirect, or consequential loss or damage incurred as a result of the use or reliance on the information presented in this section.

By accessing and using the content in the Bitconometrics: Decrypting Crypto Correlations section, you agree to assume full responsibility for any investment or trading decisions you make based on the information provided herein.*