Bitcoin's Response to Initial Jobless Claims: An In-Depth Review

Welcome to the Issue III of Bitconometrics. In this issue, we will look at another leading economic indicator -

Initial jobless claims

Historically, periods of low-interest rates, known as easy money policies, have led to increased investment in riskier assets like cryptocurrencies. However, we are currently in a tightening phase, with the Federal Reserve raising interest rates since March 2022. This shift makes traditional investments more appealing and could potentially lead to a downturn in cryptocurrency markets. To forecast a rally in Bitcoin and similar assets, investors should watch for signs of a shift back to a rate-cutting environment. So a FED pause or even a rate cut would be favorable.

Based on the trends observed in Issue I & Issue II, we have concluded :

| Economic Indicator | Type | Comments |

| Employment Situation | B | it's a leading indicator |

| CPI | A | A inverse relationship with Bitcoin's price has been seen |

Understanding Initial Jobless Claims

Initial Jobless Claims serve as a critical economic indicator, providing insights into the health of the job market and, by extension, the broader economy. They represent the number of people filing for unemployment benefits for the first time, serving as a measure of job loss nationwide. A surge in these figures typically indicates a downturn in the labor market and could signal an economic recession. Conversely, a decrease in initial jobless claims suggests an improving job market.

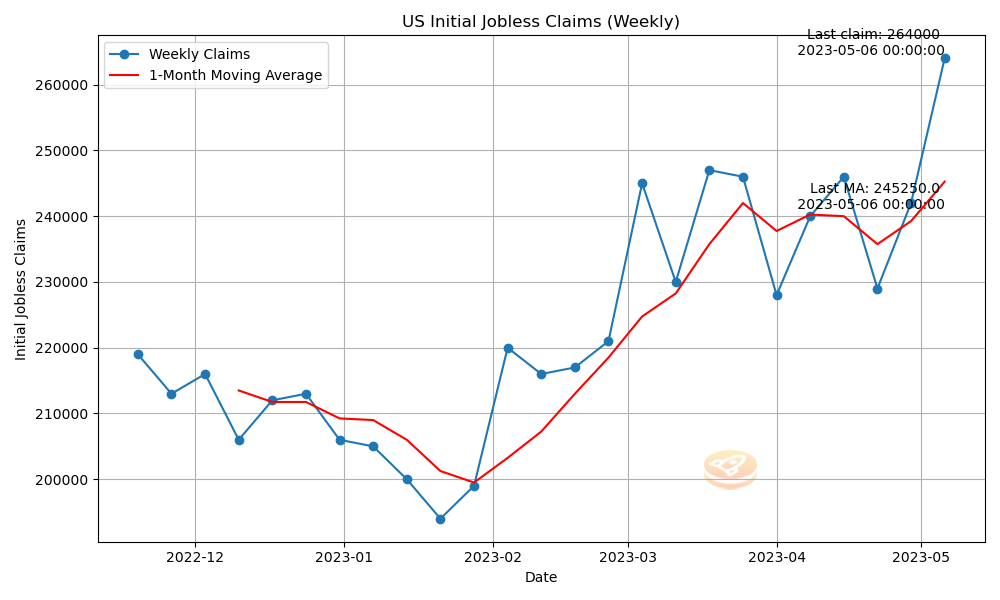

Weekly data on initial jobless claims are released by the U.S. Department of Labor. This frequency allows for near real-time tracking of labor market conditions, making it one of the most timely economic indicators available. However, this data can be volatile from week to week due to seasonal factors or irregular events. A four-week moving average is often used to smooth out these fluctuations and give a clearer picture of underlying trends.

The Interplay Between Initial Jobless Claims and Federal Reserve Interest Rate Policy

Initial jobless claims serve as a key barometer of labor market health, signaling the number of individuals filing for unemployment benefits for the first time. In turn, the job market's health is a significant factor in the Federal Reserve's decision-making regarding interest rates.

When initial jobless claims are high, it indicates that the labor market is under stress, with more people losing their jobs. If this trend persists, it can suggest a slowing or even contracting economy. In response to such conditions, the Federal Reserve may opt to lower interest rates as part of an "easy money" policy, designed to stimulate economic activity. Lower interest rates reduce borrowing costs for businesses and consumers, encouraging spending and investment, which can help to stimulate job growth.

Conversely, when initial jobless claims are low and decreasing, it signifies a robust labor market and possibly a thriving economy. In these circumstances, the Federal Reserve may choose to raise interest rates to prevent the economy from overheating, leading to excessive inflation. Higher interest rates increase the cost of borrowing, thus moderating spending and investment.

However, it's crucial to note that the Federal Reserve's decisions are based on a wide array of economic indicators, not solely on initial jobless claims. The Fed's goal is to balance low unemployment and stable inflation, often described as the dual mandate. Therefore, while initial jobless claims are an important piece of the puzzle, they are part of a broader economic picture that the Federal Reserve considers when setting interest rate policy.

Recent Reading, and its influence on the Bitcoin Price

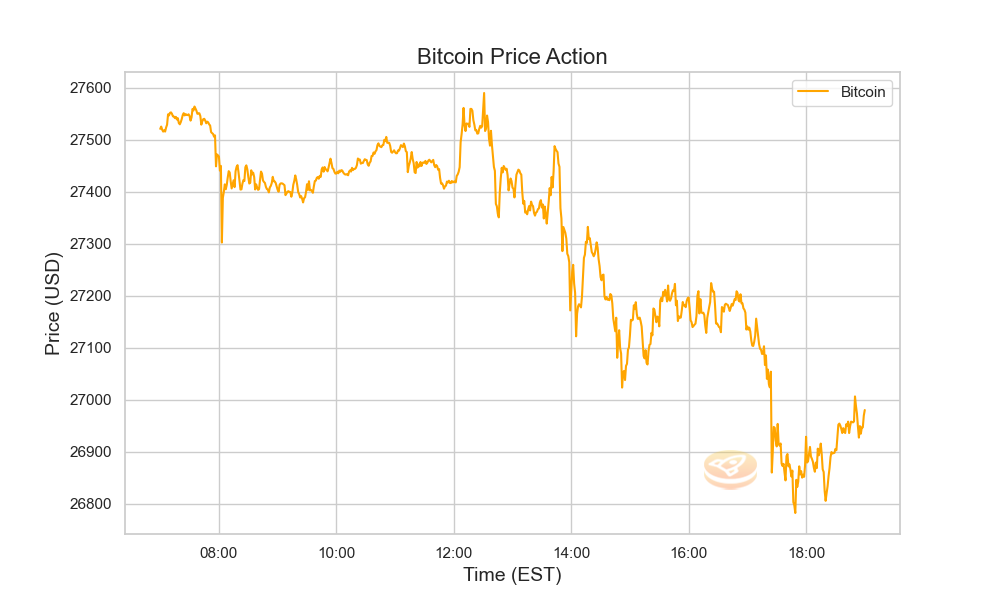

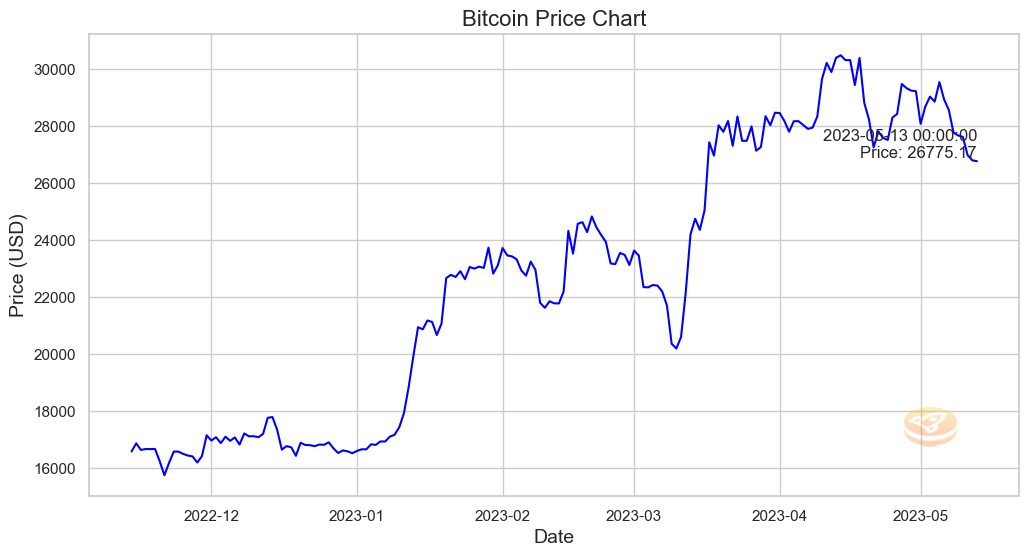

On Thursday, May 11, 2023, U.S. DEPARTMENT OF LABOR released the initial Jobless claims at 08:30 AM EST. Bitcoin Price chart shows no significant price drop / Pump after the release, it somewhat dropped even with a favorable report.

Let's analyze the broader trend :

The price chart illustrates a somewhat direct correlation, yet the recent data release doesn't reflect any significant alterations in Bitcoin's price.

Takeaways and Conclusion

- The Bitcoin market didn't experience any significant pump or drop following the release of the initial jobless claims report.

- Upon examining the price chart & Moving average of initial jobless claims, one can discern a loose correlation between Bitcoin's price trend and the initial jobless claims data over the past six months.

- Despite the observed correlation not being as robust as one might expect, it remains a noteworthy aspect of Bitcoin's price dynamics. Given this consistent pattern over the past six months, we are designating this trend as a 'B component' of our Bitcoin index.

In conclusion, here is the updated table for Bitcoin price forecast Index

| Indicator | Rank |

|---|---|

| Employment Situation Report | B |

| CPI | A |

| Initial Jobless Claims | B |

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The content provided in the Bitconometrics: Decrypting Crypto Correlations section is intended for informational and educational purposes only. It should not be construed as financial, investment, or trading advice. The opinions, analysis, and forecasts expressed in this section are those of the authors and do not necessarily reflect the views of the entire Bitconometrics team or any associated entities.

The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies

Cryptocurrency markets, including Bitcoin, are highly volatile and can fluctuate significantly in a short period. The information presented in this section is based on historical data, current market conditions, and the authors' interpretation of various economic indicators. Although we make every effort to provide accurate and up-to-date information, there is no guarantee that any analysis, prediction, or projection will materialize or prove accurate.

Before making any financial or investment decision, we strongly recommend that you consult with a qualified financial advisor, conduct your own research, and assess your personal risk tolerance. Bitconometrics, its authors, and affiliates will not be held liable for any direct, indirect, or consequential loss or damage incurred as a result of the use or reliance on the information presented in this section.

By accessing and using the content in the Bitconometrics: Decrypting Crypto Correlations section, you agree to assume full responsibility for any investment or trading decisions you make based on the information provided herein.*