Crypto-Economics: A Deep Dive into the Interplay of CPI and Bitcoin Value

Welcome to the Issue II of Bitconometrics. To recap the relationship of Bitcoin price with Interest Rate from Issue 1

Bitcoin's price has often been seen to have an inverse relationship with interest rates. Traditional investment vehicles like bonds and savings accounts offer lower returns when interest rates are low. This pushes investors to look for alternative spectulative investment opportunities, like Bitcoin, causing its price to increase.

Conversely, when interest rates rise, traditional investments become more attractive due to the higher returns they offer, potentially causing a decrease in Bitcoin's price as investors move their funds back into these traditional assets.

What are the Interest Rates here?

Interest rates are set by central banks, such as the Federal Reserve in the U.S., as a tool to manage economic growth and inflation. When interest rates are high, borrowing costs increase, which can slow down economic activity. Conversely, when interest rates are low, borrowing becomes cheaper, which can stimulate economic growth.

In this Issue, we will analyze another crucial economic indicator

CPI (Consumer Price Index)

What is CPI, and what it has to do with Interest Rate?

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change in prices paid by consumers for a basket of goods and services over time. It's used by economists and policymakers worldwide to gauge inflation levels, which directly influence monetary policy decisions, including interest rates. A rising CPI signifies increasing inflation, indicating the cost of living is getting steeper, which can impact everything from your grocery bill to the cost of housing. Conversely, a falling CPI indicates deflation, which can lead to decreased consumer spending and economic stagnation.

We will focus ONLY on Core Consumer Price Index (Core CPI) and the Supercore CPI components here.

The Core CPI is a variant of the standard Consumer Price Index (CPI), excluding food and energy prices. It's used as a measure of long-term inflation because it omits these two categories that tend to be volatile and can distort the overall inflation trend.

The Supercore CPI, on the other hand, is a more refined measure. It excludes not only food and energy prices but also other volatile elements such as housing. This index gives a clearer view of the underlying, persistent inflationary trends, making it a valuable tool for economic forecasting.

The Federal Reserve closely monitors these indicators to inform its interest rate policy. If Core CPI or Supercore CPI shows sustained increases, this may indicate rising inflation. The Fed might respond by raising interest rates to cool down the economy and prevent inflation from spiraling out of control. Conversely, if these indices show a consistent downtrend, the Fed might lower interest rates to stimulate economic activity. Thus, these two indices play a pivotal role in the Fed's strategy to maintain economic stability.

Now it's time to look at the Real-time data to look at the relationship between core and super core CPI & Bitcoin price ...

Unraveling the Relationship between CPI and Bitcoin Price Using Real-time Data

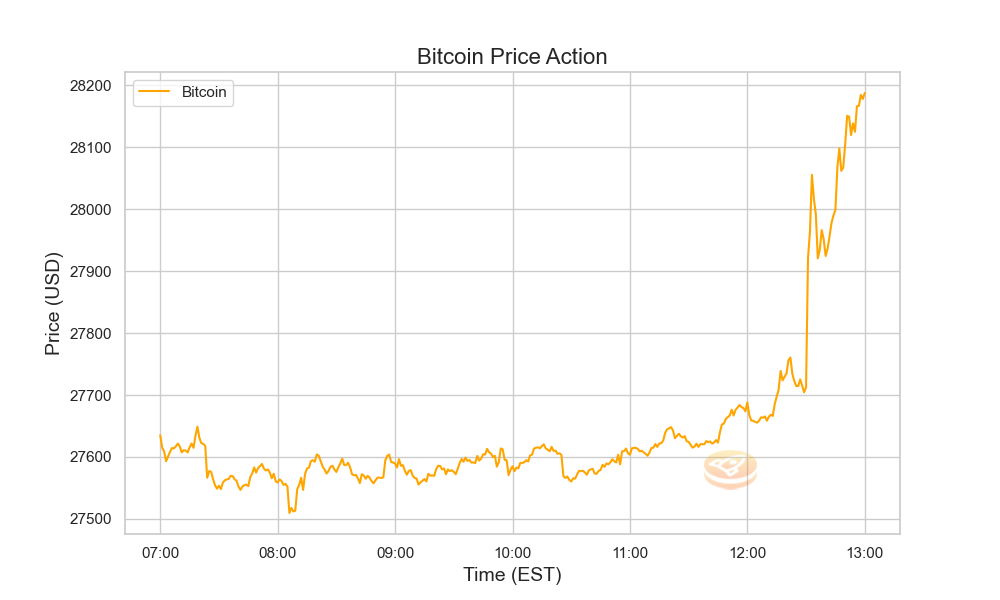

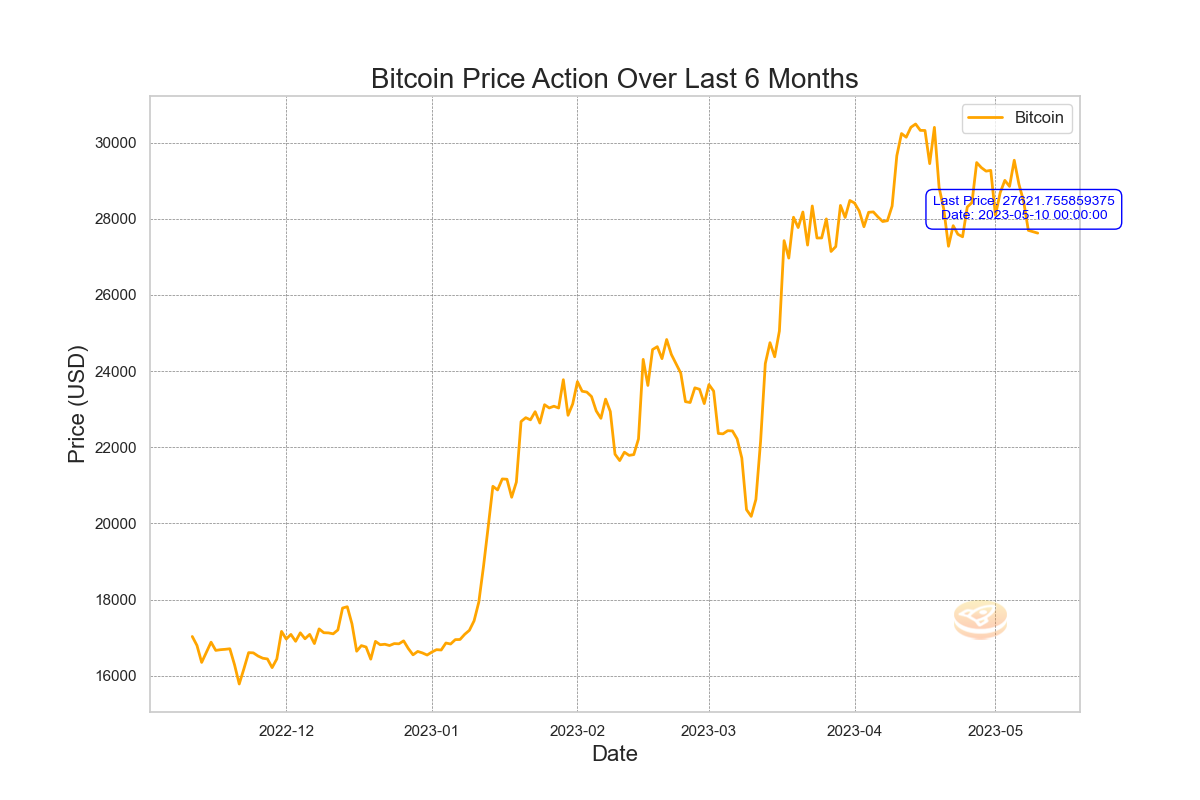

On May 10, the latest Consumer Price Index (CPI) numbers were unveiled at 8:30 AM EST, offering fresh insights into the state of the U.S. economy. The data revealed a slightly cooler inflation rate than expected, signaling that the Federal Reserve may pause its interest rate hiking cycle. Interestingly, this CPI announcement coincided with a noticeable jump in Bitcoin prices. Although this jump eventually cooled down, prices now hovering below the initial jump.

Let's do a deep dive into the trends. First, here are the key takeaways from May 10th CPI data :

- CPI-U rose 0.4% in April on a seasonally adjusted basis, with a 4.9% increase over the last 12 months

- Shelter index was the largest contributor to the monthly all items increase, followed by used cars and trucks, and gasoline

- Food index remained unchanged; food at home fell 0.2%, while food away from home rose 0.4%

- Energy index increased 0.6% in April, driven by a 3.0% increase in the gasoline index

- All items less food and energy index rose 0.4% in April, with notable increases in shelter, used cars and trucks, and motor vehicle insurance

- Over the past 12 months, the all items less food and energy index increased 5.5%, with the shelter index accounting for over 60% of the total increase.

The rate of monthly increase is slightly cooler - core CPI rising 0.4 %, with super-core CPI (core CPI excluding housing) rising only 0.1 % from last month.

What does it all mean for the BTC price and CPI relationship?

- Bitcoin value, characterized by its volatility, has shown some interesting trends vis-à-vis CPI. We noticed a particular surge in Bitcoin's price corresponding with the latest CPI reading, but this spike eventually cooled down, with prices retracting below the initial bump.

- The role of interest rates in this interplay cannot be understated. Higher interest rates typically result in an increased cost of borrowing. This tends to make riskier investments, such as Bitcoin, less appealing as investors lean towards safer, less volatile options. Conversely, when interest rates are low, traditional investments might not yield expected returns, pushing investors to seek alternatives like Bitcoin.

- Furthermore, if the CPI shows a downtrend, it could signal to the Federal Reserve to maintain or even cut interest rates. Such a scenario could potentially boost Bitcoin's attractiveness among investors looking for higher yields.

However, it is crucial to remember that the crypto market, including Bitcoin, is influenced by a myriad of factors, with CPI and interest rates being just two of them.

Conclusion

Please note that this conclusion is based on observations and trends and should not be considered investment advice. Bitcoin investment carries risk, and investors should consider consulting with a financial advisor.

In the world of digital currency, the interplay between key economic indicators like the Consumer Price Index (CPI) and the value of Bitcoin can provide insightful trends for investors. Our observations indicate a somewhat inverse relationship between CPI and Bitcoin price, highlighted by an initial price spike. As a result, we have assigned CPI an 'A' status in our Economic Indicator Index, underscoring its potential influence on Bitcoin's value.

The upcoming CPI reading scheduled for June 13th, 2023, at 08:30 AM EST, which reflects May's data, will provide further insight into whether this inverse relation holds. Stay tuned as we continue to monitor these market indicators to bring you the latest insights on Bitcoin's price dynamics in relation to key economic trends.

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The content provided in the Bitconometrics: Decrypting Crypto Correlations section is intended for informational and educational purposes only. It should not be construed as financial, investment, or trading advice. The opinions, analysis, and forecasts expressed in this section are those of the authors and do not necessarily reflect the views of the entire Bitconometrics team or any associated entities.

The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies

Cryptocurrency markets, including Bitcoin, are highly volatile and can fluctuate significantly in a short period. The information presented in this section is based on historical data, current market conditions, and the authors' interpretation of various economic indicators. Although we make every effort to provide accurate and up-to-date information, there is no guarantee that any analysis, prediction, or projection will materialize or prove accurate.

Before making any financial or investment decision, we strongly recommend that you consult with a qualified financial advisor, conduct your own research, and assess your personal risk tolerance. Bitconometrics, its authors, and affiliates will not be held liable for any direct, indirect, or consequential loss or damage incurred as a result of the use or reliance on the information presented in this section.

By accessing and using the content in the Bitconometrics: Decrypting Crypto Correlations section, you agree to assume full responsibility for any investment or trading decisions you make based on the information provided herein.*