Regulation Impact on Bitcoin: Navigating the Crypto Regulatory Waves

Happy Weekend and Welcome to Issue VII of Bitcoinometrics. This edition focuses on a topic that's become increasingly vital to the Bitcoin community.

Regulation

It's undeniable that the crypto-sphere has recently been rife with regulatory news. From the United States Securities and Exchange Commission's (SEC) lawsuits against leading cryptocurrency exchanges like Binance and Coinbase, to the tightening grip of regulatory frameworks in numerous countries, these developments have sent shockwaves through the market, deeply impacting Bitcoin and other cryptocurrency prices.

These occurrences underline the fact that we no longer exist in the Wild West era of cryptocurrencies. As digital currencies inch closer to mainstream adoption, they attract more scrutiny from regulators worldwide. But what does this mean for Bitcoin's prices? How do we quantify and understand the effects of regulation on our digital assets?

In this issue, we explore the various aspects of regulation, laying out a comprehensive analysis of the factors that need to be assessed to estimate regulatory effects on Bitcoin prices.

Unraveling the Impact: Key Factors to Assess Crypto Price Reaction to Regulation

Predicting the precise impact of a particular regulation on cryptocurrency prices is a complex endeavor. It requires understanding the new law or rule and evaluating a set of interconnected factors. Here are the vital elements you should consider:

Nature of the Regulation: Consider whether the regulation is restrictive or enabling. Restrictive regulations, such as bans or tight controls on crypto operations, can potentially lower prices. Conversely, regulations that provide legitimacy and security to crypto operations might bolster the market, increasing prices. Some examples are - Recent SEC action against Coinbase & Binance, May 2021 China's ban on financial institutions and payment companies from providing services related to cryptocurrency transactions, the Indian government's Nov 2021 announcement regarding Cryptocurrencies classification, etc.

Jurisdiction Impact: The region where the regulation is implemented matters. If a major economic power ( just a name a few - United States, China, Japan, European Union, India, etc. ) introduces new crypto regulations, it's likely to cause more significant price fluctuations than regulations introduced by smaller economies.

Market Sentiment: Public sentiment, driven by investor perception of regulation, can influence price volatility. Regulatory news can cause fear or enthusiasm, leading to sell-offs or buying sprees.

Implementation Timeline: The time frame for the regulation to come into effect can impact how the market reacts. Immediate enforcement could lead to drastic short-term price changes, while a longer timeline might result in a more gradual shift. For example, In 2020, the United States Securities and Exchange Commission (SEC) filed charges against Ripple Labs, the company behind the XRP cryptocurrency. This led to a sharp sell-off in XRP prices.

Industry Preparedness: The ability of crypto businesses to adapt to the regulation can impact price reaction. If businesses are ill-prepared, it might lead to operational disruptions, negatively impacting prices like proactively preparing for SEC compliance in the United States.

Precedent: Previous market reactions to similar regulatory actions can give an indication of potential price effects. However, this should be used cautiously as past performance doesn't guarantee future results.

Scope of the Regulation: Does the regulation target a specific type of crypto activity (like Initial Coin Offerings), or is it more broadly applicable? Narrow regulations may have a less significant impact on overall crypto prices compared to broad-sweeping rules. In 2018, South Korea passed a regulation that required cryptocurrency exchanges to register with the government. This led to a sharp sell-off in the cryptocurrency market, with Bitcoin prices falling by more than 20%. However, the market recovered after the government clarified that the regulation would not ban cryptocurrency trading.

The reaction to regulatory actions highlights the interconnectedness of these factors and the complexity of predicting the precise impact of specific regulatory moves on cryptocurrency prices.

Analyzing Real-World Data in Relation to Bitcoin Price-performance

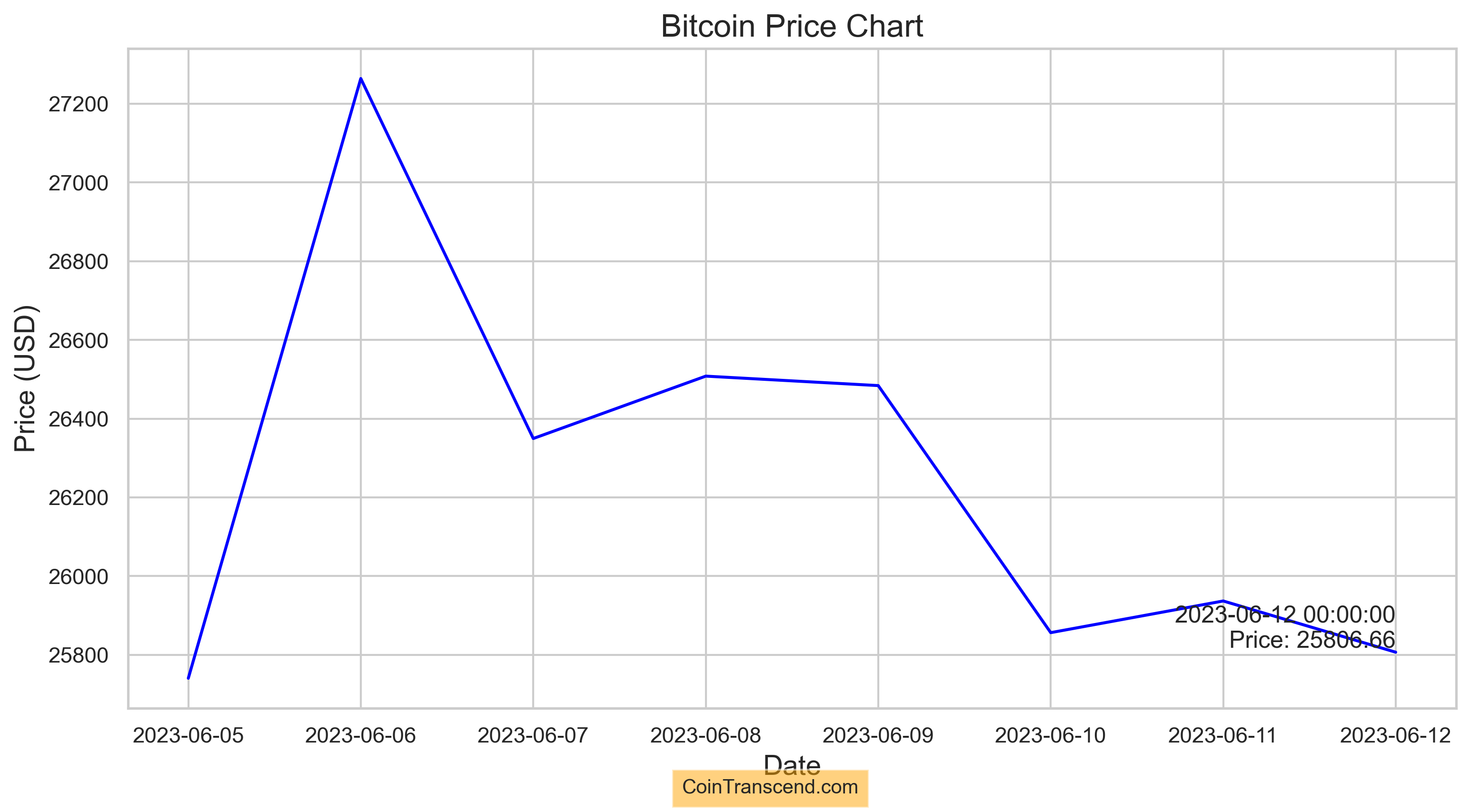

Let's take the example of the recent Regulatory Action by the SEC, The news broke on June 6th, and since then, Bitcoin has fallen close to 6% even though SEC didn't include Bitcoin in the lawsuit, with most Altcoins falling in a double-digit percentage.

Notice the sudden drop on June 6th after the SEC announcement. It's quite possible that a particular regulation falls under multiple categories. For example, Above SEC's action against Binance and Coinbase for offering unregistered securities would fall under :

Nature of the Regulation: The action is restrictive as it puts a limitation on the services these platforms can provide, which could have a dampening effect on crypto prices, particularly the assets deemed as unregistered securities.

Jurisdiction Impact: The United States, being a significant player in the global financial and crypto markets, often sets a precedent for other jurisdictions. Enforcement actions taken by the SEC could lead to considerable price volatility.

Market Sentiment: News of such lawsuits can generate fear, uncertainty, and doubt (FUD) among investors, potentially leading to sell-offs and lowering prices.

Industry Preparedness: If the exchanges were not prepared for this kind of regulatory action, it could disrupt their operations, affecting the prices of the cryptocurrencies they host.

Precedent: There is a precedent for this in the form of the SEC's action against Ripple Labs for selling XRP, which it deemed as an unregistered security. Following the lawsuit, many exchanges delisted XRP, leading to a substantial drop in its price.

Historical Parallels: Gold Regulation and Its Lessons for Crypto

Here's a table outlining some key historical events where regulations significantly impacted gold prices:

| Year | Regulation/Event | Impact on Gold Prices |

|---|---|---|

| 1933 | Executive Order 6102 | U.S. citizens were required to sell their gold to the Federal Reserve, effectively increasing the government's gold reserves and altering the supply-demand dynamics. |

| 1934 | Gold Reserve Act | The price of gold was revalued from $20.67 per troy ounce to $35, essentially devaluing the U.S. dollar against gold by nearly 70% and causing an immediate increase in gold prices. |

| 1971 | End of Bretton Woods System | President Richard Nixon ended the convertibility of U.S. dollars to gold, leading to the free-floating of gold prices and eventual significant price increases. |

| 1974 | Legalization of Private Gold Ownership | The lifting of the gold ownership ban in the U.S. opened up the market to private investors once again, contributing to a sharp rise in gold prices amid the economic uncertainty of the 1970s. |

| 1999 | Central Bank Gold Agreement | European central banks agreed to limit their gold sales to stabilize the gold market, leading to a gradual increase in gold prices in the years that followed. |

Ultimately, a regulatory adaptation paved the way for gold's broader institutional adoption, effectively stabilizing its market and bolstering prices. This transformation, however, spanned nearly half a century, underscoring the gradual nature of change within traditional asset classes.

In stark contrast, the world of cryptocurrencies moves at lightning speed. What took gold decades to accomplish could potentially transpire in a fraction of the time in the dynamic and fast-paced crypto realm!

Conclusion: The Implications of Regulation on Bitcoin's Developing Asset Class

In the constantly evolving world of cryptocurrencies, Bitcoin's status as a maturing asset class accentuates the influence of regulatory measures on its market dynamics. As we've explored, everything from the nature of the regulation to its severity, speed of implementation, market sentiment, and jurisdictional impact play pivotal roles in shaping Bitcoin's price trajectory.

Regulatory actions can send ripples or shockwaves through the cryptocurrency market, underscoring the importance of staying abreast with legal developments. However, the complexity lies in understanding the multifaceted aspects of regulations and predicting the market's response to these rules.

This complexity is precisely why we have included 'Regulation Impact' as a category in our Bitcoinometrics Index. This index aims to monitor the long-term price and health of Bitcoin by giving due consideration to a range of influential factors.

Not all factors, however, are created equal. Therefore, we assign more weight to those with a historically more significant impact on Bitcoin prices. For instance, the jurisdiction impact and market sentiment could carry more weight, given their potential to trigger immediate and substantial price fluctuations.

Components table so far :

| Indicator | Rank |

|---|---|

| Crypto Regulation | A |

| BitCoin Technicals | A |

| Bank Credit | C |

| PCE | B |

| Employment Situation Report | B |

| CPI | A |

| Initial Jobless Claims | B |

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The content provided in the Bitconometrics section is intended for informational and educational purposes only. It should not be construed as financial, investment, or trading advice. The opinions, analysis, and forecasts expressed in this section are those of the authors and do not necessarily reflect the views of the entire Bitconometrics team or any associated entities.

The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies

Cryptocurrency markets, including Bitcoin, are highly volatile and can fluctuate significantly in a short period. The information presented in this section is based on historical data, current market conditions, and the authors' interpretation of various economic indicators. Although we make every effort to provide accurate and up-to-date information, there is no guarantee that any analysis, prediction, or projection will materialize or prove accurate.

Before making any financial or investment decision, we strongly recommend that you consult with a qualified financial advisor, conduct your own research, and assess your personal risk tolerance. Bitconometrics, its authors, and affiliates will not be held liable for any direct, indirect, or consequential loss or damage incurred as a result of the use or reliance on the information presented in this section.

By accessing and using the content in the Bitconometrics: Decrypting Crypto Correlations section, you agree to assume full responsibility for any investment or trading decisions you make based on the information provided herein.*