Understanding the Federal Funds Rate and Its Impact on Bitcoin Prices

Welcome to the special issue of Bitcoinometrics, where we will cover

Federal Funds Rate (FFR)

In this issue, we will cover the Federal Funds Rate, why it is essential, and explore its relationship with Bitcoin prices.

What is the Federal Funds Rate?

The Federal Funds Rate (FFR) is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions' reserve requirements. The FFR is an essential benchmark rate and is the primary tool the Federal Reserve uses to influence monetary and financial conditions.

In simple terms - It's a bit like the rate of interest your friend might charge you if you borrow money from them.

If the economy is overheating (growing too fast, leading to high inflation), the Fed might raise the FFR, making it more expensive for banks to borrow money. This generally leads to banks lending less money to businesses and consumers, slowing economic activity down a bit.

On the other hand, if the economy is sluggish, the Fed might lower the FFR, making it cheaper for banks to borrow money. This generally encourages more lending to businesses and consumers, stimulating economic activity.

So in simple terms, the Federal Funds Rate is like the cost of borrowing money for banks, and it's one of the ways the Fed tries to keep the U.S. economy on a steady path.

Why is the Federal Funds Rate Important?

The FFR plays a vital role in the U.S. economy. When the Federal Reserve alters the FFR, it indirectly affects other interest rates, including those for mortgages, credit cards, and loans. Changes in the FFR can also influence investment trends and consumer spending.

A lower FFR typically promotes borrowing and spending, stimulating economic growth. Conversely, a higher FFR can make borrowing more expensive, curbing inflation by slowing down economic activity.

Relationship Between the Federal Funds Rate and Bitcoin Prices

Traditionally, Bitcoin and other cryptocurrencies have been viewed as alternative investments, somewhat immune to conventional economic factors. However, as the crypto market matures, the relationship between the FFR and Bitcoin prices becomes increasingly significant.

When the FFR is low, there is a surplus of cheap money in the economy, leading investors to search for alternative investment options offering potentially higher returns. This search for 'yield' often leads investors to riskier asset classes, including cryptocurrencies like Bitcoin.

However, when the Federal Reserve hikes the FFR, as in a tightening monetary policy, traditional investments such as bonds become more attractive due to higher yields. This shift can lead to a reduced demand for riskier assets like Bitcoin, resulting in potential price drops.

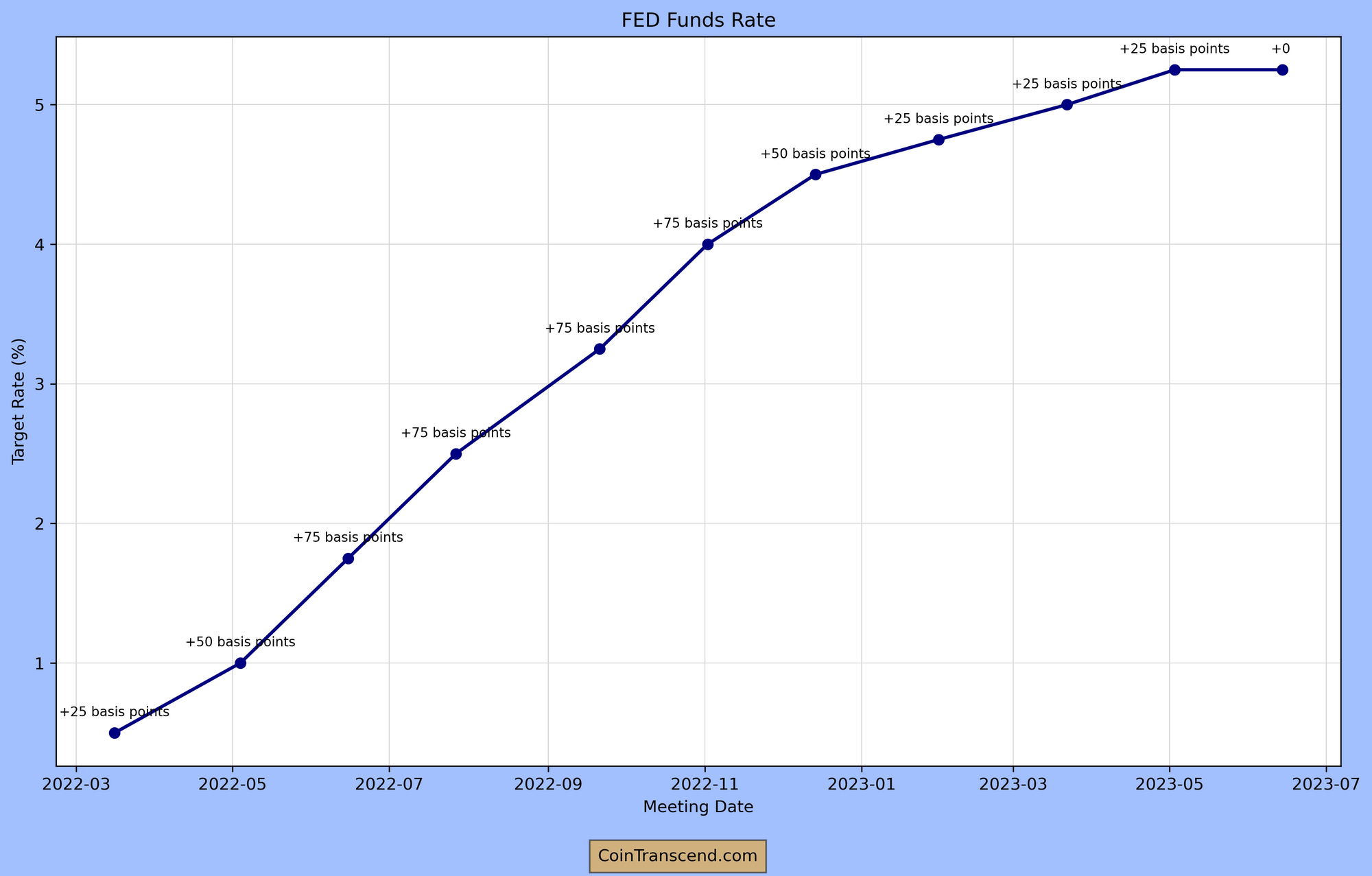

Examining the Current Federal Funds Rate Tightening Cycle

Because of the high inflation, the Fed is on a tightening path; FFR has risen from 0.25 % to above 5%.

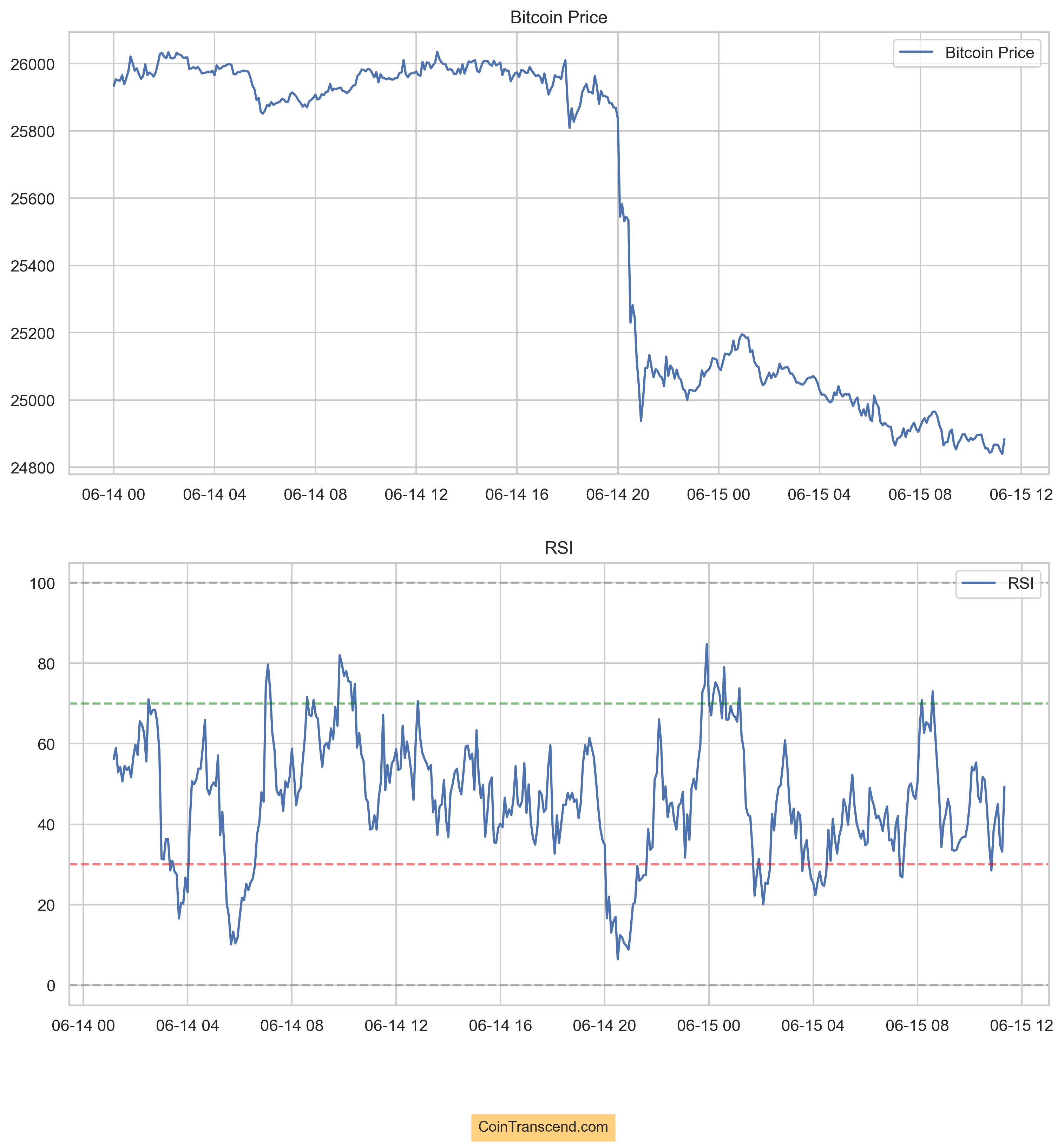

In yesterday's Federal Reserve meeting held on June 14th, it was decided to keep the rates steady. However, in an interesting turn, it was signaled that two more rate hikes are expected to take place by the end of the year. Even though the decision to maintain the current rates might initially seem beneficial for Bitcoin, the proposed 0.25% rate hikes (two times) could potentially pose challenges for Bitcoin's market dynamics. As a result, we saw a downward price trend.

If all this economics text hasn't put you to sleep yet, buckle up! We've got more fascinating insights coming your way!

- The Federal Reserve has decided to keep interest rates steady following a series of ten consecutive increases. However, out of 18 policymakers, 12 have indicated that there might be two more hikes of 25 basis points (0.25 %) each in the future.

- The possibility of a rate hike as soon as July is not off the table. The primary objective is to bring inflation down, which has proven to be persistent. Policymakers have been taken aback by the stubbornness of inflation and the robustness of the labor market, which is partly contributing to continued inflation.

- Fed Chair Jerome Powell has indicated that decisions about rates will be made on a meeting-by-meeting basis, hinting at the volatility and unpredictability of the current economic environment. The next meeting, which will have the potential for significant policy decisions, will be broadcasted live.

Conclusion

The FFR is more than just a financial term; it's a cog in the vast economic machine that impacts everyone, including crypto investors. So obviously this is an "A" Component for the Index.

| Indicator | Rank |

|---|---|

| FFR | A |

| BitCoin Technicals | A |

| Bank Credit | C |

| PCE | B |

| Employment Situation Report | B |

| CPI | A |

| Initial Jobless Claims | B |

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The content provided in the Bitconometrics: Decrypting Crypto Correlations section is intended for informational and educational purposes only. It should not be construed as financial, investment, or trading advice. The opinions, analysis, and forecasts expressed in this section are those of the authors and do not necessarily reflect the views of the entire Bitconometrics team or any associated entities.

The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies

Cryptocurrency markets, including Bitcoin, are highly volatile and can fluctuate significantly in a short period. The information presented in this section is based on historical data, current market conditions, and the authors' interpretation of various economic indicators. Although we make every effort to provide accurate and up-to-date information, there is no guarantee that any analysis, prediction, or projection will materialize or prove accurate.

Before making any financial or investment decision, we strongly recommend that you consult with a qualified financial advisor, conduct your own research, and assess your personal risk tolerance. Bitconometrics, its authors, and affiliates will not be held liable for any direct, indirect, or consequential loss or damage incurred as a result of the use or reliance on the information presented in this section.

By accessing and using the content in the Bitconometrics: Decrypting Crypto Correlations section, you agree to assume full responsibility for any investment or trading decisions you make based on the information provided herein.*