Understanding Bank Credit: Predicting Economic Trends and Bitcoin's Fate

Welcome to the Issue V of Bitconometrics. In this issue, I'll be demystifying

Bank credit

A typically under-the-radar economic indicator. Serving as an early signal for potential recessions, understanding the shifts in bank credit can be key to anticipating economic trends, thereby Bitcoin price trend. Given its complexity, you might want to grab a coffee as we navigate this intricate subject.

Understanding Bank Credit

"Bank credit" in the context of the Federal Reserve's H.8 data refers to the total value of assets that commercial banks in the United States have loaned out. This includes various forms of credit, such as loans to consumers (for example, credit cards, auto loans, student loans, and mortgages) and loans to businesses (both commercial and industrial loans and commercial real estate loans), among others.

Bank Credit and Recession Precursor

When bank credit is growing, it can indicate that banks are willing to take on more risk and that borrowers are in a good financial position to take on debt. This often corresponds with periods of economic expansion, when businesses are investing in growing, and consumers are making large purchases.

Conversely, when bank credit is contracting, it can suggest that banks are becoming more risk-averse, tightening their lending standards, and/or that borrowers are less willing or able to take on debt. This often corresponds with periods of economic contraction or recession, when businesses invest less and consumers reduce spending.

For instance, leading up to the financial crisis of 2007-2008, bank credit had a significant expansion, largely due to risky mortgage lending. However, in the aftermath of the crisis, bank credit contracted sharply as financial institutions became significantly more conservative in their lending practices.

Bank Credit and Bitcoin Price Trend

The relationship between bank credit and Bitcoin prices is less direct and more complex. As a speculative asset, Bitcoin does not have a straightforward link to traditional monetary variables such as bank credit. However, if we consider bank credit as a reflection of economic conditions and investor sentiment, periods of economic stability and easy credit conditions could foster risk-taking and speculative investments, potentially leading to increases in Bitcoin prices. Conversely, in periods of tight credit, Bitcoin might lose some appeal as a risky, speculative asset. Nonetheless, Bitcoin is influenced by a wide variety of factors, and its price can behave unpredictably even in response to known information. Therefore, while there might be periods where trends in bank credit and Bitcoin prices coincide, these should not be interpreted as a consistent or predictive relationship.

Decoding Bank Credit: Its Implications for Bitcoin Price Movements

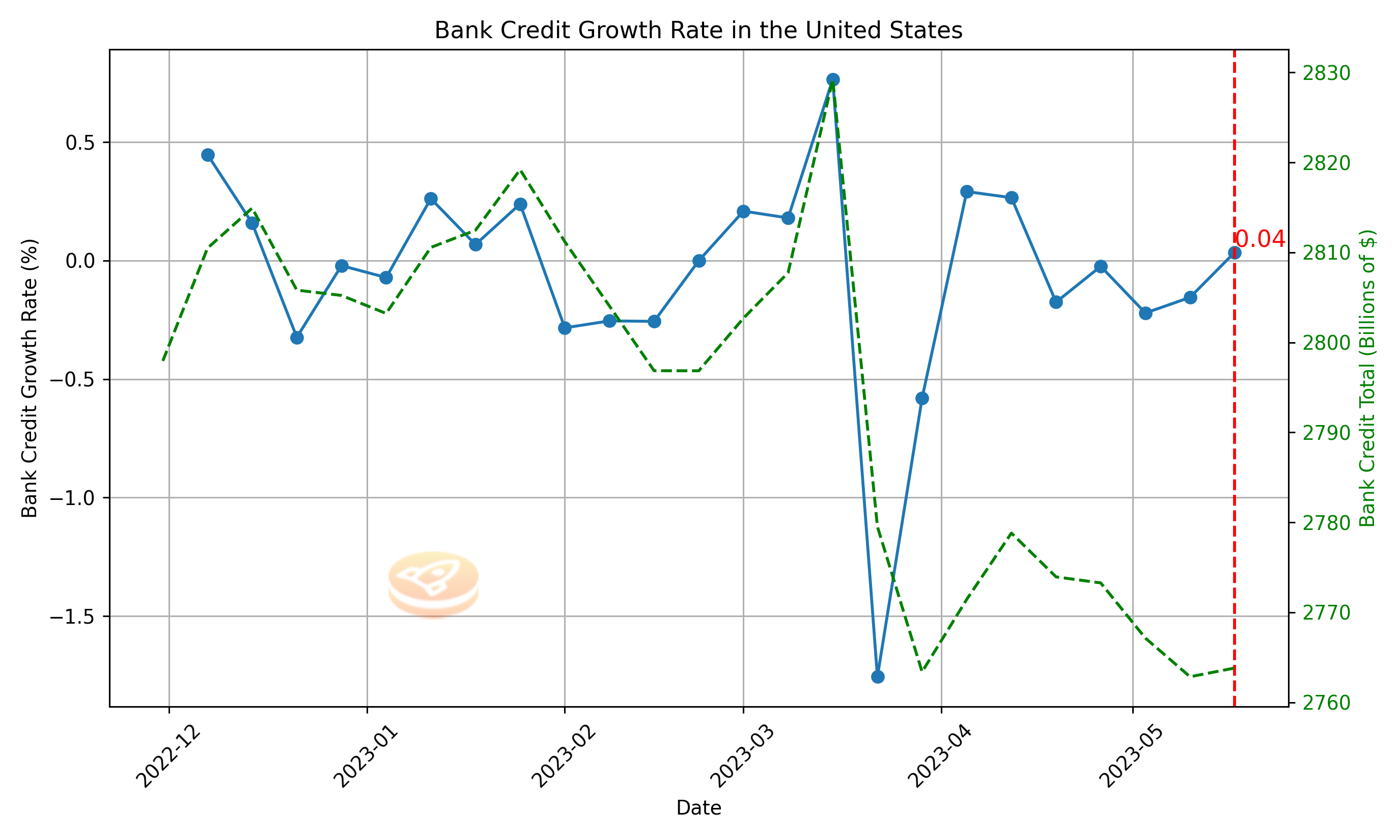

Let's throw some numbers and analyze the "Bank Credit" with Bitcoin price trend. Bank Credit is released weekly by FED.

From the end of March 2023 to mid-May 2023, bank credit has shown some significant fluctuations, with a general declining trend punctuated by intermittent recoveries. This is because of the recent bank crisis. If the Fed hadn't acted in time, we might have experienced a recession.

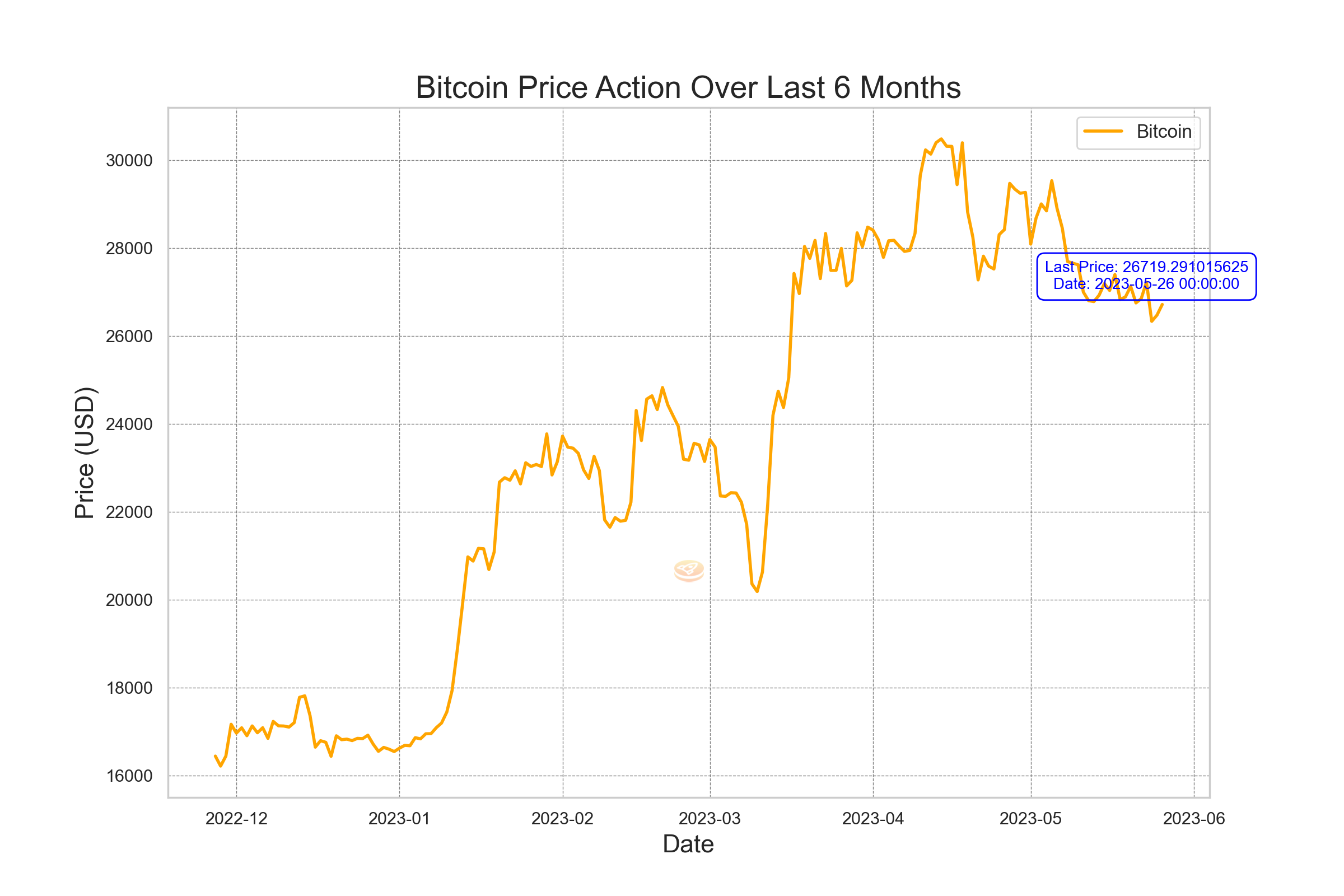

The same March dip can be seen in the above Bitcoin price chart.

Conclusion

In conclusion, our analysis reveals that short-term variations in bank credit do not necessarily reflect in Bitcoin's price movement. This could be due to the cryptocurrency's volatile nature, which is influenced by numerous factors beyond traditional financial indicators. However, substantial shifts in bank credit, indicative of broader macroeconomic changes such as a potential recession, do seem to have an impact on Bitcoin.

As witnessed in March 2023, the significant dip in bank credit coincided with looming recessionary fears, a factor that was likely reflected in Bitcoin's price action. Such significant changes in credit growth, representing systemic shifts in lending behavior and risk appetite, can signal larger economic trends that influence speculative assets like Bitcoin.

Therefore, while bank credit might not be a direct day-to-day price driver for Bitcoin, its value lies in signaling broader economic shifts. For this reason, we will assign Bank Credit as the 'C' component in our index, reflecting its utility as a macroeconomic indicator in assessing potential trends and shifts in Bitcoin's performance.

| Indicator | Rank |

|---|---|

| Bank Credit | C |

| PCE | B |

| Employment Situation Report | B |

| CPI | A |

| Initial Jobless Claims | B |

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The content provided in the Bitconometrics: Decrypting Crypto Correlations section is intended for informational and educational purposes only. It should not be construed as financial, investment, or trading advice. The opinions, analysis, and forecasts expressed in this section are those of the authors and do not necessarily reflect the views of the entire Bitconometrics team or any associated entities.

The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies

Cryptocurrency markets, including Bitcoin, are highly volatile and can fluctuate significantly in a short period. The information presented in this section is based on historical data, current market conditions, and the authors' interpretation of various economic indicators. Although we make every effort to provide accurate and up-to-date information, there is no guarantee that any analysis, prediction, or projection will materialize or prove accurate.

Before making any financial or investment decision, we strongly recommend that you consult with a qualified financial advisor, conduct your own research, and assess your personal risk tolerance. Bitconometrics, its authors, and affiliates will not be held liable for any direct, indirect, or consequential loss or damage incurred as a result of the use or reliance on the information presented in this section.

By accessing and using the content in the Bitconometrics: Decrypting Crypto Correlations section, you agree to assume full responsibility for any investment or trading decisions you make based on the information provided herein.*