Tokenomics Simplified: Introducing The Blockchain Explorer Tokenomics Index

Happy Weekend and Welcome to the fifth edition of "The Blockchain Explorer." This issue is all about Tokenomics. So grab your coffee, and let's dive into the world of digital money! Remember, the only thing more volatile than cryptocurrencies is the weather, but at least we can understand Tokenomics! Keep smiling and keep exploring.

What is Tokenomics?

Tokenomics, a portmanteau of 'token' and 'economics,' refers to the economic ecosystem surrounding a cryptocurrency token. It's a crucial aspect of cryptocurrencies and blockchain projects that can largely influence a project's long-term success or failure. Tokenomics involves understanding the supply and demand characteristics of a cryptocurrency, how it's distributed, how it can be used, and the rules governing its use.

The major components of Tokenomics include:

- Total Supply: This is the maximum number of tokens ever. A finite supply often creates scarcity, potentially increasing a token's value over time, like Bitcoin's capped supply of 21 million coins.

- Circulating Supply: This is the number of tokens currently available and moving within the market.

- Token Distribution: This outlines how and when tokens are released into the ecosystem. It could be through mining, staking, sales events (ICO, IEO, etc.), or distributed to the development team.

- Utility: This refers to the functionality and use case of the token within its ecosystem. A token must have a purpose, such as governance power, staking benefits, payment for services, etc.

- Inflation/Deflation Mechanisms: Some cryptocurrencies have built-in mechanisms to increase or decrease the supply over time, influencing the token's value.

Effective Tokenomics is vital for a blockchain project's longevity and success. It must create an equilibrium between incentivizing positive participant behavior (such as providing network security or adding value) and maintaining the token's value.

Broad Strategy Behind the Tokenomics Index

The strategy behind the index is to consider both supply and demand sides of the equation, where supply-side factors include token supply and inflation/deflation mechanisms, and demand-side factors encompass utility, governance, and market perception.

Only balancing these factors can give a more holistic view of a blockchain's Tokenomics. My primary goal is to provide a meaningful and balanced measurement of the various factors that can influence a blockchain's long-term sustainability and token price.

The Blockchain Explorer Tokenomics Index: Deep Dive

I will be using a weighted approach. Each component can be weighed based on its effectiveness in preserving or enhancing the token's value. However, for easier comparison, the total score could be normalized to fall within a predefined range (for example, 0-1). For example, circulating token ratio and token distribution might have higher weights as these factors greatly influence a token's demand and price.

As with Developer Activity Index, the Tokenomics index will evolve, and the initial weights might change. Let's look at the components :

- Circulating/Total Token Supply: The percentage of tokens currently circulating against the total supply. A higher percentage may suggest a lower probability of a token dump.

- Inflation Mechanism: A lower inflation rate (which indicates a slower increase in token supply) is generally better for maintaining the token's value. This could also be inversely scaled.

- Deflation/Burning Mechanism: Projects with such mechanisms could be assigned higher scores, as these can create token scarcity and drive up value.

- Token Distribution: Evaluate the token distribution strategy. Are the tokens distributed equitably, or are there signs of excessive concentration? Fair distribution can promote network stability and reduce the likelihood of market manipulation.

- Utility and Governance: Tokens that allow users to use services within the ecosystem (utility) and influence the project's direction (governance) can create intrinsic value. Tokens that serve multiple purposes within their ecosystems, including staking, governance, and payment for services, will be given a higher score.

- Market Perception and Adoption: This considers how well the blockchain project is received in the market. It involves factors such as brand recognition, community support, partnerships, and adoption rate.

It's crucial to mention that such an index is purely quantitative and might not capture all aspects of a project's potential success or risk. Therefore, it should be used as a guide along with other qualitative factors, such as team quality, market competition, regulatory risks, etc.

A note on Token Distribution

Analyzing token distribution involves looking at the balance between the various stakeholders in a blockchain ecosystem, namely:

The community, early contributors/core contributors, the foundation, investors, and any other specific groups like community testers or airdrop recipients.

Such an analysis aims to assess how equitably tokens are distributed and how this might affect the long-term sustainability and success of the blockchain.

I will be focusing on two main principles

- Decentralization: The degree to which tokens are distributed to a broad range of stakeholders (especially the community), rather than concentrated in the hands of a few (like the foundation or investors). More decentralized token distribution can improve the blockchain's security, fairness, and resilience.

- Incentives Alignment: The extent to which the distribution incentivizes each stakeholder group to contribute positively to the blockchain's development. For example, early contributors and the foundation usually play crucial roles in the initial development and growth of the blockchain, so they should be sufficiently incentivized. On the other hand, giving too much to these groups could result in centralization or token dumping.

Given these principles, here's a potential strategy to compare the token distribution

- Community Reserve / Community: This is often seen as the most decentralized group. The higher the percentage, the better because it means more people have a stake in the blockchain's success.

- Early Contributors / Core Contributors: These individuals contribute to the project's development and success. A balance must be struck here – too little might fail to incentivize them, but too much might lead to centralization.

- Team / Foundation: This entity is usually responsible for the strategic direction and development of the project. Again, a balance is necessary.

- Investors: These stakeholders provide funding to the project but might not be involved in its daily operations. They should not have a disproportionally high allocation that could lead to centralization or manipulation.

- Specific Groups (Community Testers / Airdrop): These can contribute to stakeholders' overall decentralization and diversity. These can raise blockchain's popularity.

I will use HHI (Herfindahl–Hirschman Index) to calculate token decentralization. It is a widely accepted method for calculating the market concentration. So Let's apply the theory to one and ONLY Ethereum...

Ethereum Spotlight: An Inside Look at its Tokenomics Index

Launched in 2015 by a team of blockchain enthusiasts, including Vitalik Buterin, Ethereum ushered in a new era for blockchain technology. As the first blockchain platform to introduce smart contracts, Ethereum revolutionized the technology's potential applications, opening the door to a world of decentralized applications (dApps) and sparking the development of the decentralized finance (DeFi) sector.

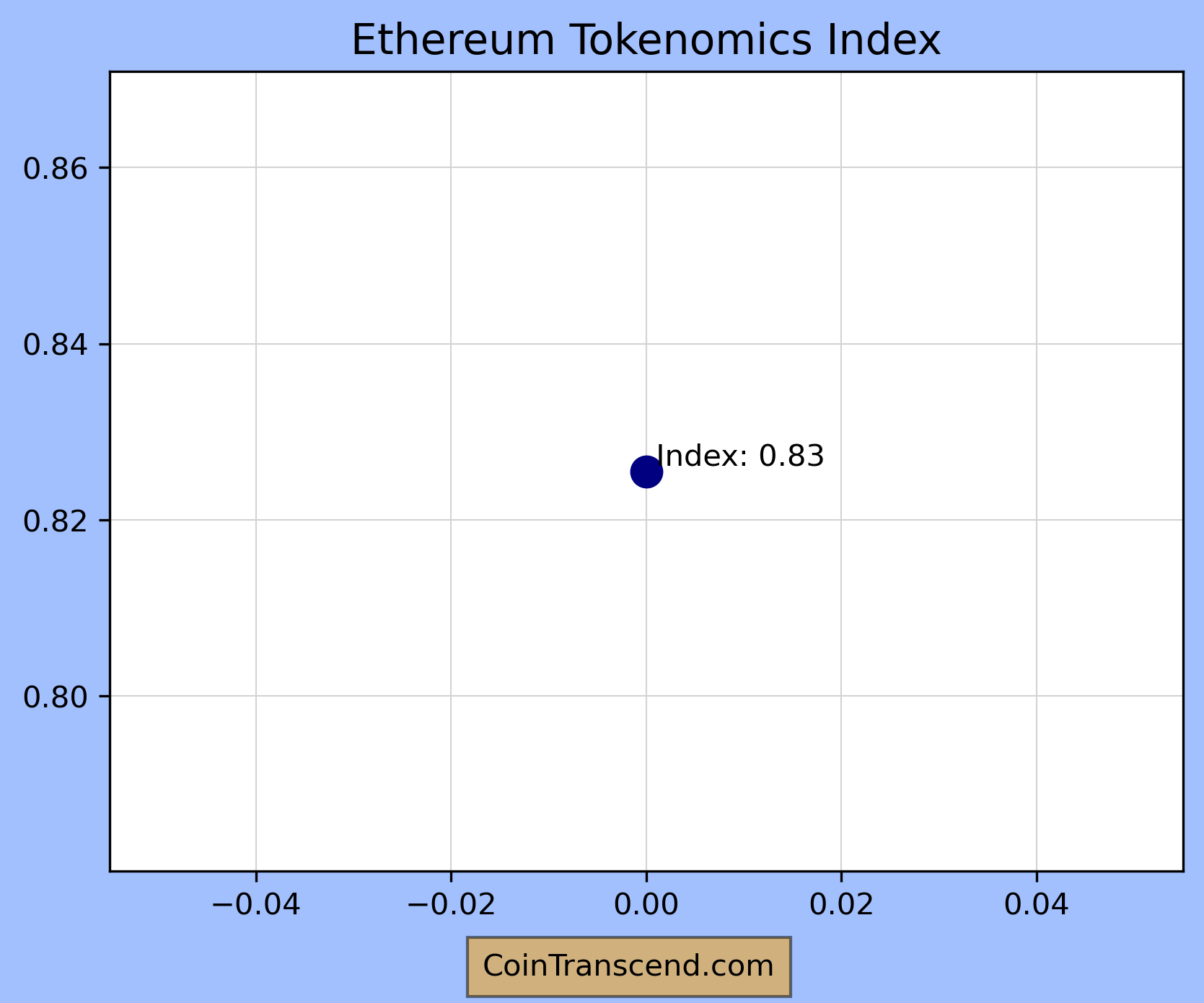

What Does Ethereum Tokenomics Index Reading Mean?

- The Ethereum Tokenomics Index score came out to be 0.83 on a scale of 0 to 1, which indicates a very strong Tokenomics structure.

- It signifies that Ethereum has an efficient distribution mechanism and a healthy balance between inflation and deflation, which are crucial components in the sustainability and growth of a blockchain project.

- The "circulating supply / total supply" ratio is close to 1, indicating a high degree of tokens in circulation, contributing positively to the index score.

- Ethereum's inflation mechanism, while present, is not excessive, contributing to the sustainability of the system and its economic model. The introduction of Proof-of-Stake (POS) has also introduced a deflationary mechanism that balances the inflation rate.

- The token distribution across Ethereum indicates a fairly decentralized distribution. A lower Herfindahl-Hirschman Index (HHI) score shows a more competitive and less concentrated market, and Ethereum fares well in this aspect.

- The utility and governance score was high as Ethereum's token (Ether) provides various utilities within the ecosystem, and the Ethereum platform gives token holders governance rights.

- Ethereum has a high market perception and adoption rate, reflected in its widespread use, large community support, numerous partnerships, and high transaction volume.

However, as always, it is important to note that while the Tokenomics Index provides a strong indication of a blockchain project's economic structure and potential sustainability, it does not guarantee future success or immunity from market volatility. It should be used as one of many tools when evaluating and comparing different blockchain projects.

Conclusion

The Blockchain Explorer Tokenomics Index offers an innovative and concise way to assess the Tokenomics of any blockchain project. Providing a standardized measure empowers investors and enthusiasts alike to understand the economic structure of these projects. It simplifies Tokenomics, turning complex variables into understandable scores and bridging the gap between complex blockchain ecosystems and everyday users.

Stay tuned for the next issue, where we delve into "The Blockchain Explorer Tokenomics Index" for top L1 blockchain projects like Solana, Avalanche, ICP, Polkadot, and Cardano...

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The information and analysis provided in "The Blockchain Explorer" section are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within "The Blockchain Explorer" may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in "The Blockchain Explorer," you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*