Tokenomics Deep Dive: Solana, ICP, Avalanche, Cardano & Polkadot

Happy Weekend and Welcome to the Sixth edition of 'The Blockchain Explorer.' Remember, in the world of crypto, even your weekend relaxation might be disrupted by a surprise 'moon' or 'bear' visit!

In our previous issue, we delved into the intricacies of our Tokenomics Index. In this edition, we will apply this index's very principles to a selection of dynamic and fascinating blockchain projects: Solana, Internet Computer (ICP), Avalanche, Cardano, and Polkadot. Let's quickly revisit our guiding approach to refresh our understanding and set the stage for what's to come.

The index balances supply-side factors (token supply and inflation/deflation mechanisms) and demand-side factors (utility, governance, market perception).

Weighted Approach: Each component is weighed based on its effectiveness in preserving or enhancing token value. Initial weights might change over time.

Index Components:

- Circulating/Total Token Supply: A higher percentage suggests greater potential for future price appreciation.

- Inflation Mechanism: Lower inflation rates, indicating a slower increase in token supply, are generally better.

- Deflation/Burning Mechanism: Projects with such mechanisms can create token scarcity and drive up value.

- Token Distribution: Tokens should be distributed equitably to promote network stability and reduce the likelihood of market manipulation.

- Utility and Governance: Tokens that serve multiple purposes within their ecosystems will score higher.

- Market Perception and Adoption: This considers factors such as brand recognition, community support, partnerships, and adoption rate.

Token Distribution Analysis: The balance between various stakeholders in a blockchain ecosystem, including the community, early contributors, the foundation, investors, and specific groups, is evaluated to assess token decentralization and incentives alignment.

HHI for Token Decentralization: The Herfindahl–Hirschman Index (HHI), a widely accepted method for calculating market concentration, is used to calculate token decentralization.

Now that's out of the way. Let's look at the results ...

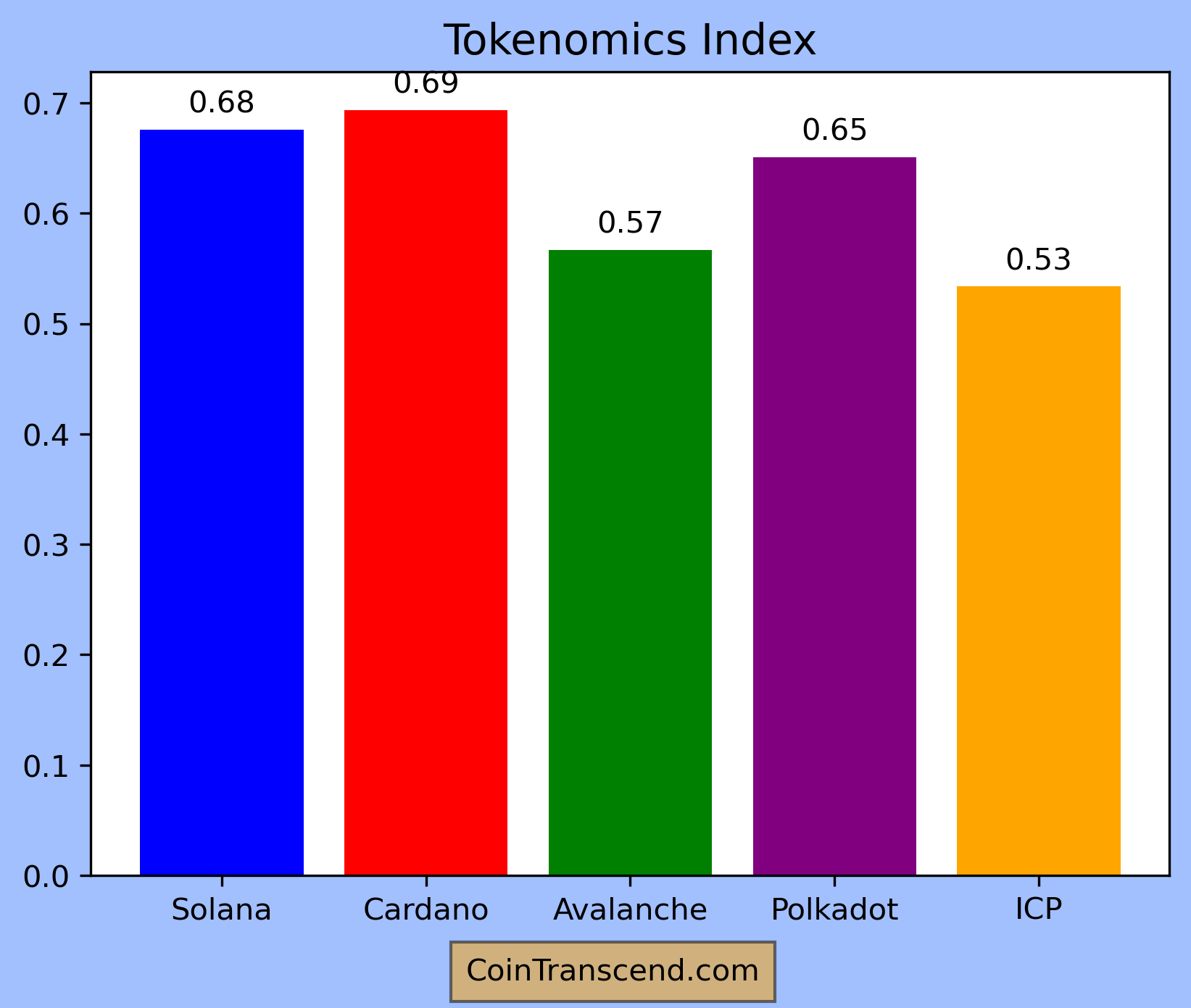

Tokenomics Index: Comparative Analysis between Solana, ICP, Avalanche, Cardano, Polkadot

We are assigning the value between 0 and 1, with 1 being the best Tokenomics. As you recall from the previous issue, Ethereum had a 0.83 Index reading.

Conclusion: What does it mean?

The calculated Tokenomics Index results for the given coins are as follows:

Solana: It has a robust circulating-to-total supply ratio and good market perception and adoption. However, the inflation rate is slightly high, reducing its overall score. Its overall Tokenomics Index is moderate.

Cardano: Cardano has the second-highest circulating to total supply ratio, one of the lowest inflation rates, and high market perception and adoption, which contributes to a high Tokenomics Index. Its deflation aspect could improve further.

Avalanche: Avalanche struggles with a relatively lower circulating-to-total supply ratio and inflation rate. It also has one of the lowest token distribution score, affecting its overall Tokenomics Index negatively.

Polkadot: Polkadot has the highest circulating-to-total supply ratio and a relatively high inflation rate as compared to Cardano.

ICP: ICP has the highest inflation rate, which affects its overall score negatively. However, it has one of the highest scores for governance.

These results indicate that while some cryptocurrencies have a higher circulating to total supply ratio and lower inflation rate, other aspects such as utility and governance, token distribution, and market perception and adoption can significantly affect their overall Tokenomics Index. The visualized Tokenomics Index provides an intuitive way to compare different cryptocurrencies based on these important aspects.

Please note that this analysis is just a rough estimation based on the provided data and should not be used as investment advice.

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The information and analysis provided in "The Blockchain Explorer" section are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within "The Blockchain Explorer" may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in "The Blockchain Explorer," you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*