Reddit Sentiment Analysis: Crypto vs Stocks and Emerging Blockchains

Happy Weekend and Welcome to the Eighth edition of 'The Blockchain Explorer. In this issue, we will look at Reddit sentiment to gauge interest. After all, we're in a new age where the true pulse of sentiment isn't measured on Wall Street but on the digital main streets of platforms like Reddit!

Now, let's venture down this digital main street and dive into our sentiment analysis for the week...

Let's start with our methodology.

Methodology

To ensure a fair comparison, we gathered a sample size of 1000 comments from Top Posts (The last 30 days) in the respective subreddits for each category. However, Sui and Aptos have limited comments because of the limited number of members (few thousand).

Utilizing advanced Natural Language Processing (NLP) algorithms, these comments were analyzed and scored on a sentiment scale ranging from -1 (extremely negative) to +1 (extremely positive). This approach is highly effective in quantifying qualitative data, offering a holistic picture of the sentiment within these digital discussions.

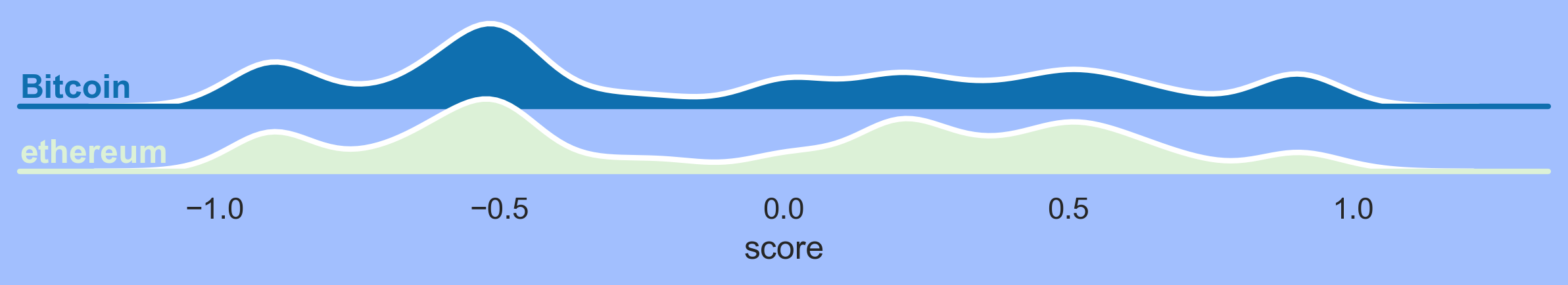

Bitcoin vs. Ethereum

The rivalry between Bitcoin and Ethereum has always been one of the hot topics in the crypto space. In light of the recent regulatory dramas involving Binance and Coinbase, a wave of negative sentiment washed over the communities of both Bitcoin and Ethereum. It seems the uncertainty in the regulatory environment struck a nerve, particularly within the Bitcoin community.

However, the tides of sentiment are as changeable as the sea. With renewed interest in Bitcoin ETFs, the digital main street has been abuzz with positive chatter. Interestingly, while these developments directly concern Bitcoin, it's the Ethereum side of the street that's experiencing a notable uptick in positivity.

It seems the potential for a Bitcoin ETF is not only improving sentiment for Bitcoin but also fuelling optimism for Ethereum. Perhaps the belief is that regulatory acceptance of a Bitcoin ETF could pave the way for similar developments in Ethereum, further integrating cryptocurrencies into mainstream finance.

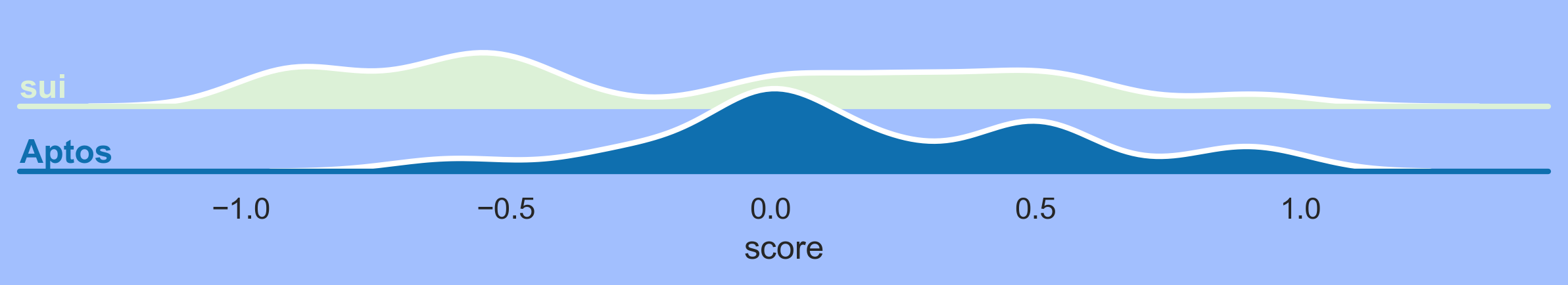

SUI vs. Aptos Blockchain

When it comes to the fresh faces of the crypto world, SUI and Aptos Blockchain, our sentiment analysis has a clear winner - Aptos Blockchain.

Interestingly, despite being newer to the scene, Aptos has managed to garner a significant amount of positive sentiment on the digital main street.

On the flip side, SUI, while showing promise, has been the center of controversy recently. The indicated airdrop turned public sale has rubbed the community the wrong way. Such incidents can heavily impact the sentiment of a relatively new player in the market, and this appears to be what has happened with SUI.

Remember, sentiment is a powerful indicator but is not the sole determinant of a project's success. While Aptos is currently in the lead in terms of positive comments, the world of blockchain is fluid and fast-paced. Things can change swiftly. We'll continue to keep an eye on how these two newcomers evolve and how their respective communities respond.

Stocks vs. Cryptocurrencies analysis

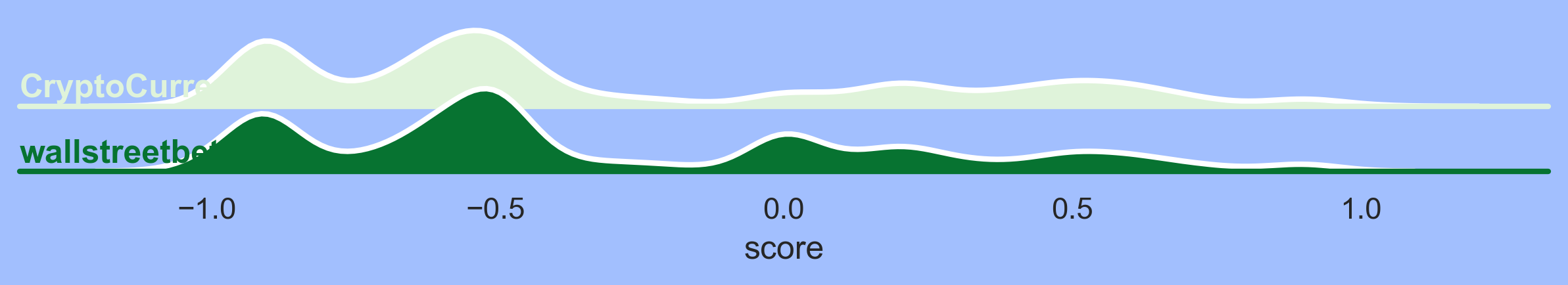

In our final analysis between traditional Stocks and Cryptocurrencies, we focused on discussions in the WallStreetBets and Cryptocurrency subreddits.

Ever since BlackRock filed for a surprise Bitcoin ETF on June 15, the cryptocurrency world has been buzzing like a beehive. The effects of this monumental move were immediately felt, with Bitcoin soaring an astonishing 22% in just seven days after the news. Consequently, the Cryptocurrency subreddit is lit up with positive sentiments; the enthusiasm and excitement are palpable.

On the other hand, while the Stocks subreddit, particularly WallStreetBets, remains a hub of robust discussions and analyses, the energy seems a bit more tempered compared to its cryptocurrency counterpart. Although positive sentiments remain, the heat and fervor seen on the Cryptocurrency subreddit are currently unmatched.

It's a testament to how impactful institutional acceptance and interest, like BlackRock's ETF filing, can be on market sentiment. As we move forward, the key question remains - will this heightened positivity in the cryptocurrency space maintain its momentum? Only time will tell.

Conclusion

In today's interconnected digital world, the main street has moved online. Platforms like Reddit and Twitter have become a bustling marketplace for ideas, discussions, and, most importantly, sentiments that can move markets.

In the past, the voices of retail investors often got lost in the cacophony of institutional noise. But times have changed. With the advent of social media platforms and the democratization of investing, retail investors have found a powerful platform on Reddit. The platform's influence in shaping sentiment and its ripple effects on market movements can no longer be ignored. One noteworthy example - GameStop.

Moreover, the recent events surrounding BlackRock's ETF filing and the subsequent upswing in the crypto market have shown how quickly sentiment can change and how rapidly it can affect the market. These shifts in sentiment on Reddit often serve as a precursor to larger market movements.

In conclusion, this Reddit sentiment analysis reaffirms the importance of understanding market sentiment in this digital age.

That's all for this week, explorers! Stay tuned as we continue our journey through the captivating world of blockchain and finance.

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The information and analysis provided in "The Blockchain Explorer" section are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within "The Blockchain Explorer" may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in "The Blockchain Explorer," you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*