SUI vs. Aptos: Which Blockchain is Right for You?

Welcome to the second edition of "The Blockchain Explorer." In the first edition, we have briefly examined the two new blockchains that are quickly gaining popularity - Sui & Aptos. Both platforms offer a number of advantages, but there are also some key differences between the two. In this issue, we will compare SUI and Aptos on a number of factors, including speed, fees, developer activity, security & sustainability.

Brief Introduction

Aptos was created by the Aptos Foundation, a non-profit organization dedicated to developing and adopting Aptos. Sui was created by Mysten Labs, a blockchain infrastructure company that was founded by former Meta employees who worked on the now-defunct Libra project.

Both Aptos and Sui are based on the Diem blockchain, which Meta developed. However, Aptos and Sui have significantly changed the Diem blockchain, introducing a new consensus mechanism and a modified MOVE programming language.

Aptos and Sui are both designed to be scalable, secure, and energy-efficient blockchain platforms. They are well-positioned to become major blockchain players and power a wide range of decentralized applications.

Let's do a deep-dive comparison between the two ...

Blockchains in the Fast Lane: Unmasking Their Speeds

To compare the speed of different blockchains, we will primarily focus on three pivotal metrics - Transactions Per Second (TPS), Finality, and Block Time.

TPS measures the number of transactions a blockchain can process in a second, offering insights into the scalability and efficiency of the network. A higher TPS often signifies a more capable system of swiftly handling large volumes of transactions.

Finality, on the other hand, is the time taken for a transaction to become irreversible, which plays a crucial role in determining the security and reliability of a blockchain. The lesser the finality time, the faster the assurance of a transaction being permanently recorded.

Lastly, Block Time refers to the time required to generate a new block in the blockchain. Shorter block times can lead to faster transaction confirmations, enhancing the user experience. Together, these metrics provide a comprehensive view of a blockchain's speed, efficiency, and robustness, which is essential for any performance-oriented comparison.

| Metrics | SUI | Aptos |

|---|---|---|

| Real-Time TPS | 373 | 50 |

| Finality | 480 ms | Under 1 sec |

| Average Block Time | 2 sec | 4 sec |

*As of Oct 10 2024 (Source : SuiScan & Aptos Explorer)

Low Transaction Fees

The transaction fees on the SUI and Aptos blockchains are very low. The average transaction fee on the SUI blockchain is $0.0001, while the average transaction fee on the Aptos blockchain is $0.0002.

Consensus mechanism

Overall, Aptos and Sui are both scalable, secure, and energy-efficient consensus mechanisms. However, there are some key differences between the two mechanisms. Aptos uses a BFT consensus mechanism, while Sui uses a DPoS consensus mechanism. This means that Aptos is more decentralized than Sui, as anyone can become a validator on the Aptos network. However, Sui is more efficient than Aptos, as it requires less communication between validators.

| Feature | Aptos | Sui |

|---|---|---|

| Consensus mechanism | Byzantine fault tolerant (BFT) | Delegated proof of stake (DPoS) |

| Validators | Anyone can become a validator by staking APT tokens | Validators are elected by token holders |

| Security | Achieved through a combination of techniques, including stake slashing, leader election, and fast finality | Achieved through a combination of techniques, including stake slashing, block production, and consensus |

| Scalability | Designed to scale to a large number of validators | Designed to scale to a large number of validators |

| Energy efficiency | Designed to be energy-efficient | Designed to be energy-efficient |

key features of the Aptos consensus mechanism:

- Byzantine Fault Tolerance: The Aptos consensus mechanism is Byzantine Fault Tolerant (BFT), which means it can continue operating even if some of the validators are Byzantine faulty. Byzantine faulty validators are validators that are malicious or have failed.

- Scalability: The Aptos consensus mechanism is designed to be scalable so that it can handle many transactions.

- Efficiency: The Aptos consensus mechanism is designed to be efficient so that it can process transactions quickly.

The SUI blockchain consensus mechanism is a combination of Narwhal and Bullshark, which provides a high-throughput, low-latency, and secure consensus mechanism for the SUI blockchain. Narwhal is a high-throughput mempool that ensures the availability of data submitted to consensus, while Bullshark is an efficient BFT consensus protocol that achieves high throughput and low latency. This makes the SUI blockchain well-suited for a variety of applications, including decentralized finance (DeFi), gaming, and social media.

key features of the SUI blockchain consensus mechanism:

- High throughput: The SUI blockchain consensus mechanism can achieve a high throughput of up to 125,000 transactions per second.

- Low latency: The SUI blockchain consensus mechanism can achieve a two-second latency.

- Security: The SUI blockchain consensus mechanism is secure against a variety of attacks, including Byzantine attacks, selfish mining attacks, and denial-of-service attacks.

Block by Block: A Comparative Analysis of Security in Two Blockchains

| Feature | SUI | Aptos |

|---|---|---|

| Consensus mechanism | Delegated Proof of Stake (DPoS) | Byzantine Fault Tolerance (BFT) |

| Security against attacks | Byzantine attacks, selfish mining attacks, and denial-of-service attacks | Byzantine attacks, selfish mining attacks, denial-of-service attacks, and slashing attacks |

| Security against 51% attacks | More vulnerable to 51% attacks than Aptos | Less vulnerable to 51% attacks than SUI |

| Security against double spending attacks | Secure against double spending attacks | Secure against double spending attacks |

| Security against transaction malleability attacks | Secure against transaction malleability attacks | Secure against transaction malleability attacks |

Overall, the Aptos blockchain is more secure than the SUI blockchain. This is because - Aptos uses a more secure consensus mechanism (BFT) and is less vulnerable to 51% of attacks. However, both blockchains are secure against a variety of attacks, including Byzantine attacks, selfish mining attacks, denial-of-service attacks, and double spending attacks.

Eco-Friendly Chains: Comparing the Sustainability of SUI and Aptos Blockchains

Aptos is less energy-intensive than SUI because it uses a BFT consensus mechanism. This is because BFT does not require validators to run nodes that are constantly validating transactions. Instead, BFT relies on a small number of validators to reach consensus on the order of transactions and the state of the blockchain.

| Feature | SUI | Aptos |

|---|---|---|

| Consensus mechanism | Delegated Proof of Stake (DPoS) | Byzantine Fault Tolerance (BFT) |

| Energy consumption | Higher energy consumption than Aptos | Lower energy consumption than SUI |

| Environmental impact | Higher environmental impact than Aptos | Lower environmental impact than SUI |

Tokenomics

The main difference between the two tokenomics is the distribution. The Aptos Foundation and Aptos Labs received a larger percentage of the APT tokens than the team and investors received of the SUI tokens. This means that the Aptos Foundation and Aptos Labs have more control over the Aptos blockchain than the team and investors have over the Sui blockchain. Also the circulating supply for SUI is just close to 5% since the token was launched in the early May 2023.

| Feature | SUI | Aptos |

|---|---|---|

| Token name | SUI | APT |

| Total supply | 10 billion | 1.34 billion |

| Circulating Supply | 528,273,718 SUI | 196,032,699.03 APT |

| Use cases | Staking, governance, payments, and DeFi | Staking, governance, payments, and DeFi |

| Token distribution | 50% to the community reserve, 20% to Early contributers, 10% to Mysten Labs, 6% to Community programs, 14% to investors | 51% to the community, 16.5% to the Aptos Foundation, 19% to the Core Contributers, and 13.48% to investors |

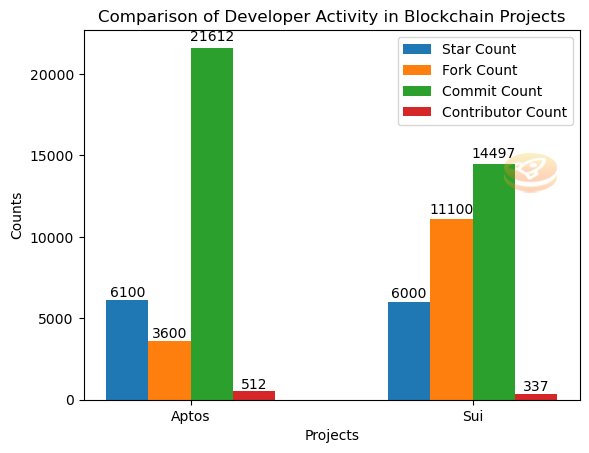

Examining Developer Engagement

We will use the metrics below to gauge their GitHub repository's activity and popularity.

- Star Count: The star count of a repository is the number of users who have "starred" the repository. Starring a repository is like bookmarking it for later reference and shows appreciation for the project. A high star count generally indicates a well-liked or useful project.

- Fork Count: The fork count is the number of users who have "forked" the repository. Forking a repository allows users to have a copy of the original repo where they can experiment, make changes, and contribute back to the original project with their changes. A high fork count generally means many users are interested in contributing to or modifying the project.

Aptos has a larger number of stars (6,100) than Sui (6,000), indicating a slightly higher level of interest or appreciation among the GitHub community. Aptos also shows a higher number of commits (21,612) compared to Sui (14,497), suggesting more active or long-standing development. The number of contributors to Aptos (512) also surpasses that of Sui (337), indicating a larger development community and a potentially broader range of input and expertise.

On the other hand, despite having fewer stars and contributors, Sui has a remarkably higher number of forks (11,100) compared to Aptos (3,600). This could suggest that while Sui has fewer contributors, those involved are highly engaged, creating their own versions of the project for experimentation or further development.

Conclusion

- Both Sui and Aptos offer scalable, secure, and energy-efficient solutions, aiming to power a wide range of decentralized applications.

- The evaluation focused on key performance indicators such as Transactions Per Second (TPS), Finality, and Block Time, with both blockchains showcasing impressive efficiency and robustness.

- While both blockchains have very low transaction fees, a primary difference between the two lies in their consensus mechanisms. Aptos employs a BFT consensus mechanism promoting decentralization, while Sui leverages a DPoS consensus mechanism for enhanced efficiency.

- Despite Aptos appearing more secure due to its BFT consensus mechanism, both blockchains resist various attacks, including Byzantine attacks, selfish mining attacks, and denial-of-service attacks.

- Aptos is considered less energy-intensive than Sui due to its reliance on BFT, which uses fewer validators for consensus, thereby promoting sustainability.

- The distribution of tokens varies between the two, with Aptos Foundation and Aptos Labs holding more control over the Aptos blockchain compared to the team and investors' control over the Sui blockchain.

- Circulation supply for SUI is less than APT which indicates that SUI might experience some price insatiability as more tokens get unlocked.

- Developer engagement, analyzed via GitHub metrics, revealed a larger community and higher activity for Aptos, though Sui, despite fewer contributors, showed a remarkably high level of engagement evident through its high fork count.

In conclusion, Both Aptos and Sui have proven to be scalable, secure, and efficient blockchain platforms, with Aptos showcasing a broader developer community and Sui demonstrating high engagement levels. Despite differences in consensus mechanisms and tokenomics, both platforms hold significant potential to power diverse decentralized applications.

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The information and analysis provided in "The Blockchain Explorer" section are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within "The Blockchain Explorer" may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in "The Blockchain Explorer," you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*