Is there any Correlation Between the Employment Situation Report and Bitcoin Price?

Welcome to the Issue I of Bitconometrics.

Bitcoin price fluctuations are a result of numerous intricate factors, each contributing to the intricate dynamics of the digital currency's value. We aim to isolate individual elements and utilize them to formulate an index that may predict the potential direction of Bitcoin prices with a certain degree of accuracy.

However, it's crucial to note that this index / economic indicator should not be used as the sole determinant for investment decisions. The series is created purely for educational purposes, aiming to enhance an understanding of Bitcoin's market behavior.

So now that's out of the way, Let's look at our first Economic Indicator :

Employment Situation Report

The Employment Situation Report, published by the Bureau of Labor Statistics (BLS), is a crucial economic indicator in the United States, providing data on employment, unemployment, and wages.

Let's look at them briefly -

Employment Situation Report: The Bureau of Labor Statistics (BLS) releases the Employment Situation Report monthly, providing valuable insights into the U.S. labor market. This comprehensive report offers data on unemployment, job growth, wages, and working hours, serving as a key barometer of economic health.

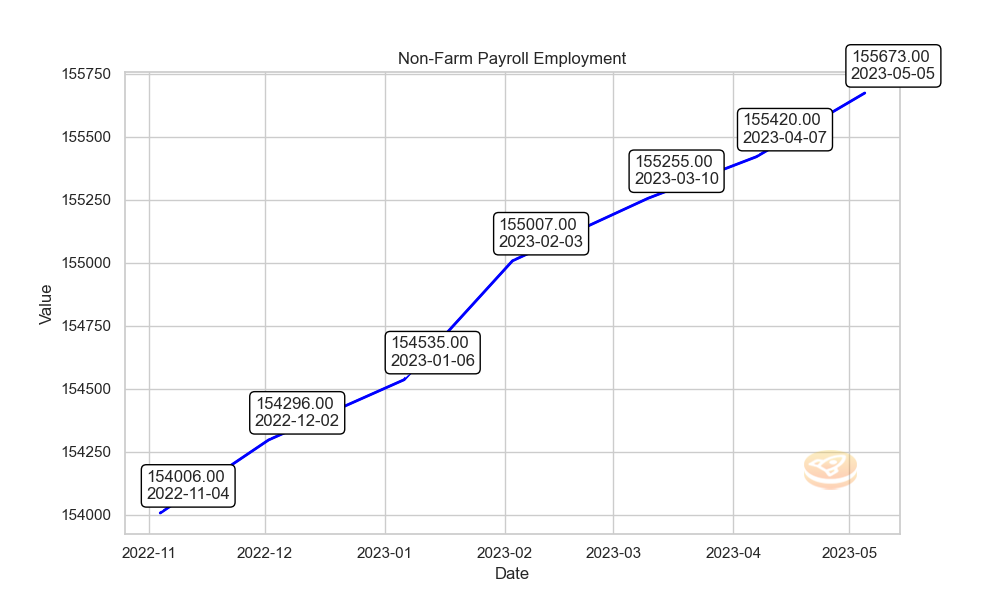

- Non-farm Payroll: The Non-farm Payroll is a critical component of the Employment Situation Report. It represents the total number of paid U.S. workers, excluding farm employees, private household employees, and non-profit organization employees. Trends in Non-farm Payroll data can signal changes in the economy, influencing economic policies and financial markets.

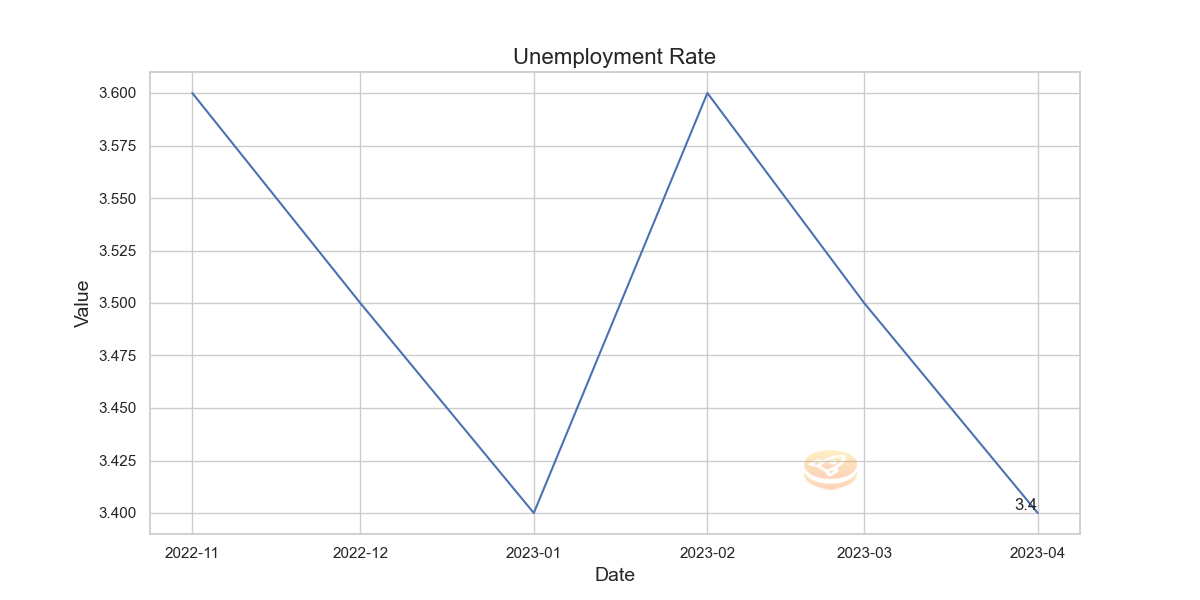

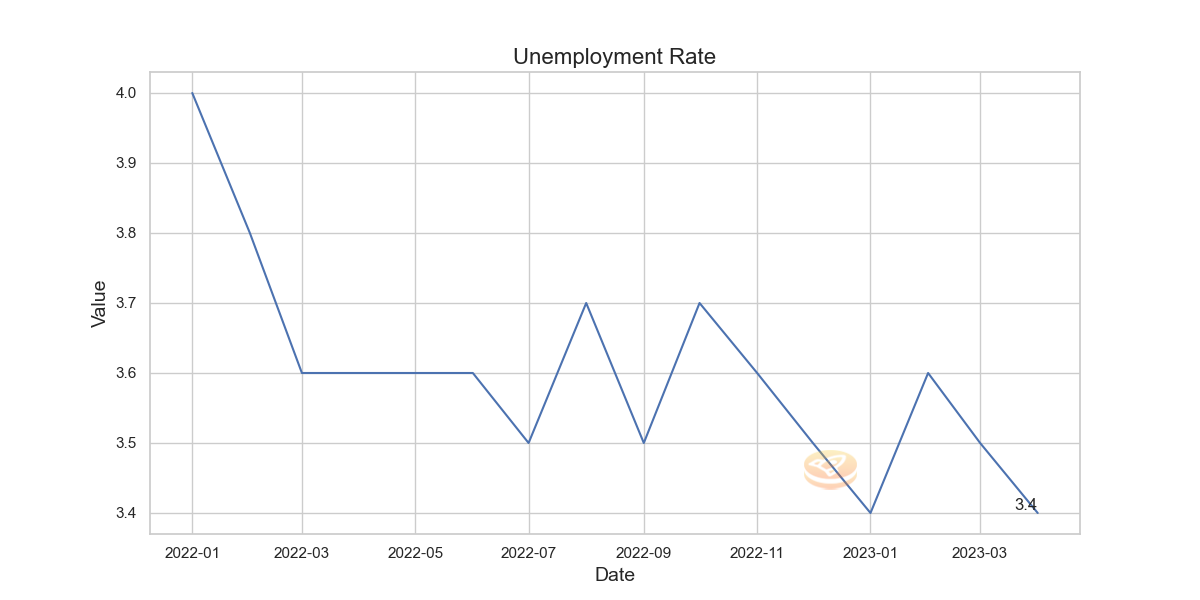

- Unemployment Rate: The unemployment rate is the percentage of the total labor force that is jobless and actively seeking employment. It is a significant indicator of economic well-being. A low unemployment rate often signifies a healthy economy, while a high rate could indicate economic distress.

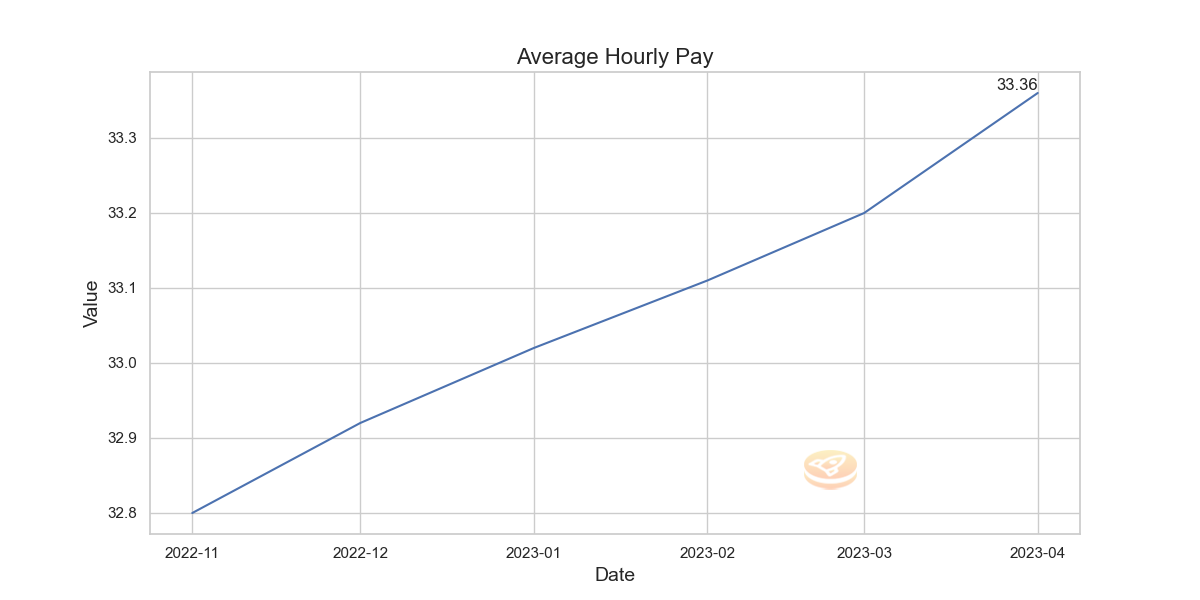

- Average Hourly Earnings: This metric in the Employment Situation Report reflects the average hourly pay for all employees on private non-farm payrolls. Changes in average hourly earnings can be a sign of inflationary pressures and impact decisions about interest rates.

Now about Correlation ...

The Employment Situation Report and Interest Rates

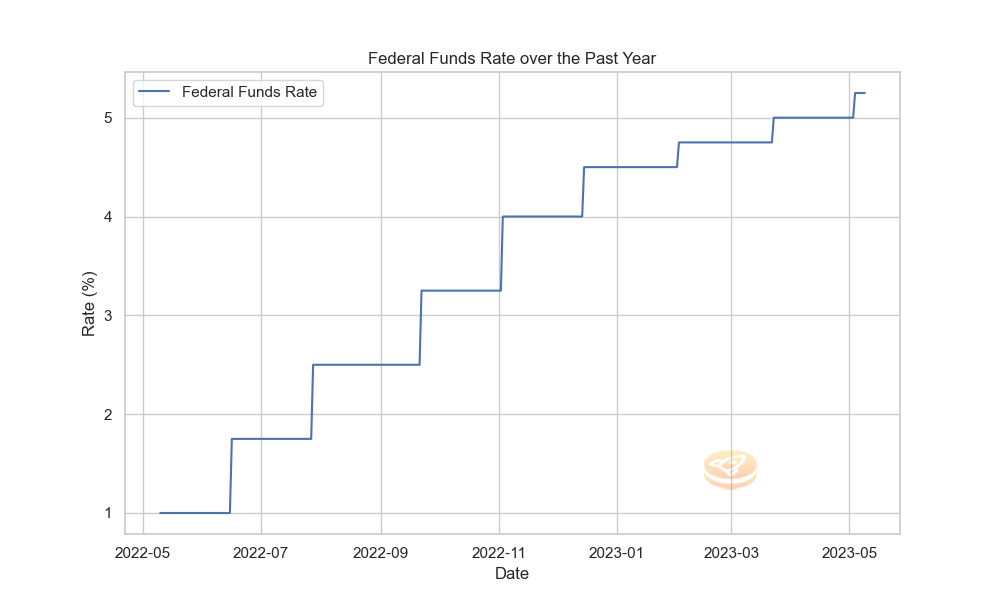

The Federal Reserve monitors the Employment Situation Report closely, using the data to inform decisions about monetary policy. A strong employment report, characterized by low unemployment and increasing wages, can signal a healthy economy. In such situations, the Federal Reserve may raise interest rates to prevent the economy from overheating and control inflation.

On the other hand, a weak employment report, with high unemployment or stagnant wages, may prompt the Federal Reserve to lower interest rates, stimulating economic growth and job creation. As a result, the Employment Situation Report can have significant implications for interest rates and, by extension, financial markets.

Bitcoin Price and Interest Rates

Bitcoin, a decentralized digital currency, has been gaining traction as an alternative investment option since its inception in 2009. As a relatively new asset class, Bitcoin's price can be sensitive to changes in interest rates. Higher interest rates generally lead to an increased cost of borrowing, making riskier investments like Bitcoin less attractive to investors. Conversely, lower interest rates can make traditional investments less appealing, prompting investors to seek alternative options like Bitcoin.

Correlation Between the Employment Situation Report and Bitcoin Price

Given the relationship between the Employment Situation Report, interest rates, and Bitcoin prices, it is plausible that a correlation exists between the employment report and Bitcoin. A strong employment report could suggest that interest rates will remain high for an extended period, making Bitcoin less attractive to investors and potentially leading to a decrease in its price. Conversely, a weak employment report may result in lower interest rates, boosting Bitcoin's appeal and increasing its price.

The main takeaway is

Bitcoin's price variation can be directly related to Fed's interest rate policy and since FED is data dependent (meaning they will raise or cut interest rate , based on the incoming data), incoming data like employment situation report (and other economic indicators) can be use to speculate Fed's next policy action , therefore Bitcoin's price.

Enough about the theoretical conclusions. Let's throw in some real-time data and test this theory. Here we will be focussed on the day when the Employment Situation data is released and Bitcoin's price action, along with the broad direction.

Real-time Correlation

On May 5th, 2023, BLS released the Employment Situation Report for April. To summarize the strong numbers for April -

In April, the U.S. saw a rise in total nonfarm payroll employment by 253,000, with the unemployment rate (staying fairly steady)at 3.4%. Job growth was noted in professional and business services, health care, leisure and hospitality, and social assistance sectors. Average hourly earnings for all employees on private nonfarm payrolls rose by 16 cents to $33.36, a 4.4% increase over the past year.

Data points towards a generally positive direction for the labor market over this six-month period. - From November 2022 to April 2023

- The unemployment rate has experienced a slight decrease, with fewer people being unemployed.

- The non-farm payroll, which reflects the number of paid U.S. workers excluding farm employees, government employees, private household employees, and nonprofit organizations, has seen a mild increase in job creation.

- A positive change in the average hourly pay rate, indicating a strong labor market

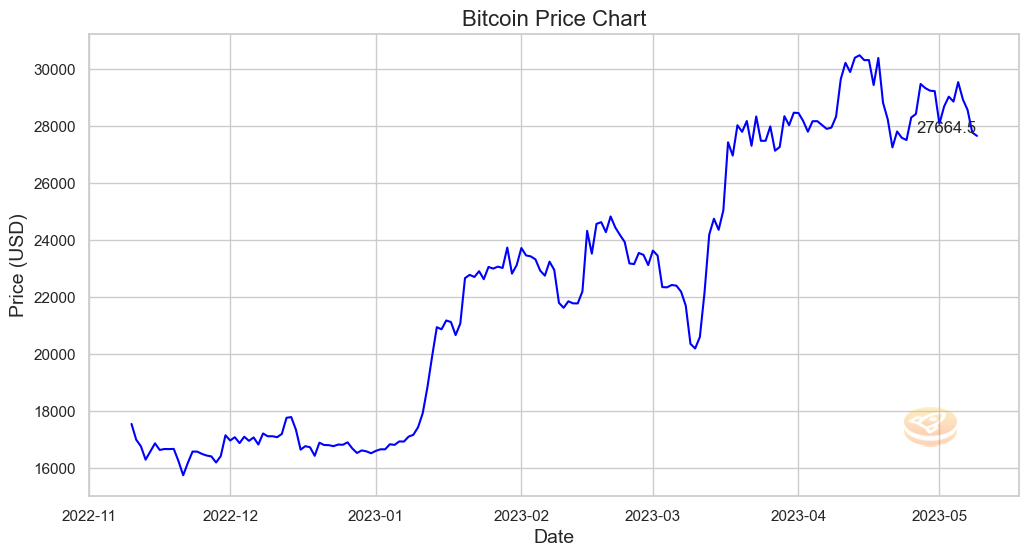

This is in line with FED increasing rates rapidly, so why did Bitcoin price go nuts from $ 18k to almost $ 30k in these six months? Since a stronger employment situation, hence higher rates make Bitcoin less attractive.

This is because, Since August 2022, the unemployment rate has been relatively stable, staying within a narrow range. This stability in the labor market could have contributed to the overall market confidence, affecting Bitcoin prices.

Also, note that the pace of the Federal Reserve's rate hikes was greater in 2022 compared to the current year.

Conclusion

Based on the data presented, we can draw the following conclusions:

Improving Employment Situation

The six-month period from November 2022 to April 2023 saw positive trends in the labor market. This is evidenced by a decrease in the unemployment rate and an increase in non-farm payroll jobs, highlighting overall job creation. However, the Labor market was much stronger in the second half of 2022 than in 2023.

Monetary Policy

Concurrent with these positive labor market trends, the Federal Reserve has been raising interest rates. Similarly, the rate of increase was higher in 2022 than in 2023.

Bitcoin Price Surge

Despite these conditions, Bitcoin experienced a significant price increase, from $18k to nearly $30k. This could be due to the speculation that the FED hiking cycle is ending since the employment situation report indicates somewhat softening (as compared to previous months).

In conclusion, since the Employment situation report is a leading indicator, we will mark it as a "B" economic indicator for our Bitcoin price index.

Please share your thoughts on the article by clicking below Emoji ...

Disclaimer

*The content provided in the Bitconometrics: Decrypting Crypto Correlations section is intended for informational and educational purposes only. It should not be construed as financial, investment, or trading advice. The opinions, analysis, and forecasts expressed in this section are those of the authors and do not necessarily reflect the views of the entire Bitconometrics team or any associated entities.

The information provided on this cryptocurrency blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. The authors, contributors, and administrators of this blog are not licensed financial professionals and do not hold any formal qualifications in the fields of finance, economics, or cryptocurrencies

Cryptocurrency markets, including Bitcoin, are highly volatile and can fluctuate significantly in a short period. The information presented in this section is based on historical data, current market conditions, and the authors' interpretation of various economic indicators. Although we make every effort to provide accurate and up-to-date information, there is no guarantee that any analysis, prediction, or projection will materialize or prove accurate.

Before making any financial or investment decision, we strongly recommend that you consult with a qualified financial advisor, conduct your own research, and assess your personal risk tolerance. Bitconometrics, its authors, and affiliates will not be held liable for any direct, indirect, or consequential loss or damage incurred as a result of the use or reliance on the information presented in this section.

By accessing and using the content in the Bitconometrics: Decrypting Crypto Correlations section, you agree to assume full responsibility for any investment or trading decisions you make based on the information provided herein.*