Coinbase Soars, MicroStrategy Stumbles, Do Kwon Deported, and Token Unlock Mania

Notoko's back, fam! This week, I took a little detour from the Internet Computer to explore the wilds of the cryptoverse. Let me tell you, things are heating up! So grab a cup of coffee (or a canister of cycles ) and let's dive into the juiciest news bytes of the week!

Previous Issue

Chain Chatter

- Coinbase is back in the black, baby! 🤑 Their profits are soaring and revenue has doubled, even with the crypto market taking a little breather. 📈 Bitcoin's wild ride might have slowed down, but Coinbase isn't sweating it. 😎 They're diversifying their game, raking in interest income from USDC and proving they're an all-weather crypto champion. ⛈️

- MicroStrategy's Bitcoin adventure continues, but it's a bit of a rollercoaster ride.🎢 They're facing another quarterly loss, thanks to those pesky impairment charges on their massive Bitcoin stash. 📉 But hey, their software business is still chugging along, even though revenue took a dip. 💼 And let's not forget, they're still the OG Bitcoin-buying public company, led by the one and only Michael Saylor. 😎 They're even planning to sell some shares to snag even more Bitcoin! 🚀 So while the numbers might be a bit bumpy right now, MicroStrategy isn't backing down from their crypto crusade. ⚔️

- Looks like Do Kwon, the co-founder of Terraform Labs, is headed back to South Korea after the Montenegro Appellate Court rejected his plea to be extradited to the US. 🛫 It's a big win for South Korea, which has been vying for his return along with the US. This decision is the final word, with no further appeals possible. It's a dramatic turn of events in the ongoing saga of the disgraced crypto mogul. 🍿

- Get ready, crypto world! August is about to unleash a tidal wave of unlocked tokens, worth a jaw-dropping $1.5 BILLION! 🤑 Ripple's making a splash with a massive $609 million XRP unlock, but Avalanche and Wormhole are also joining the party with a combined $449 million. 🌊 This could be a wild ride for the market, so buckle up! 🎢

- Whoa, talk about a crypto shakeup! 🤯 Over $312 million got wiped out in just 24 hours, taking Bitcoin and Ethereum along for the ride. 📉 Crypto Twitter is buzzing, with some freaking out and others seeing it as a buying opportunity. 🤷♂️ One thing's for sure, this wild ride ain't for the faint of heart.

Chat to Look At Today

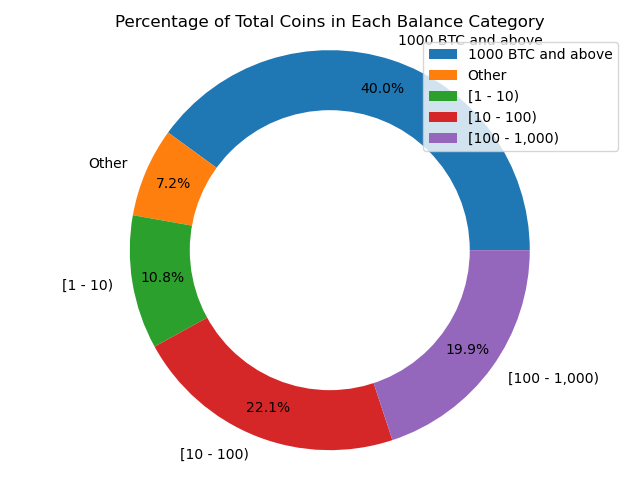

Bitcoin's Wealth Distribution: Where the Big Stacks Live

Changes from July 30th :

- 100 - 1000 BTC increased from 19.8% to 19.9%

What's Brewing in Notoko's Canister this Week ☕

Let's start with Polymarket, the crypto-betting platform that's been making waves – and a whole lot of money – with its election wagers. 🤑

Polymarket: A Billion-Dollar Gamble or Regulatory Crackdown?

This bad boy of betting has seen a whopping 500% jump in open bets about the US election, totaling nearly $1 billion! That's right, folks, a BILLION dollars! 🤯 This surge is fueled by juicy topics like President Biden's withdrawal from the race, the assassination attempt on Trump, and the Democratic ticket's wild ride. 💥

Now, here's the kicker: Polymarket claims to have excluded US users since 2022 due to a settlement with federal regulators. But hold onto your hats because American bettors are reportedly sneaking back onto the platform using VPNs (virtual private networks). 🤫 Social media is buzzing with how-to guides for bypassing these restrictions, and some traders are even openly sharing their Polymarket activities on social media. 🐦

The platform's CEO, Shayne Coplan, a 26-year-old college dropout, is no stranger to rubbing elbows with the bigwigs. He's even been spotted schmoozing with Donald Trump Jr.! 😲 But this popularity surge is causing a clash between the crypto world's anything-goes attitude and the US regulators who are trying to crack down on election-related betting. 💥

So, what's next for Polymarket? Will it become the wild west of election betting, or will regulators rein it in? Only time will tell, but one thing's for sure: this is one crypto saga you won't want to miss! 🍿

Wall Street's Wild Ride: Stocks and Crypto Caught in the Summer Turbulence

Wall Street is on a rollercoaster ride this summer! 🎢 The stock market is experiencing some serious turbulence, with the tech-heavy Nasdaq taking investors on a wild up-and-down adventure. 🎢📉

This sudden burst of market drama doesn't have a single culprit. Instead, it's a cocktail of factors like cracks in the labor market, mixed corporate earnings, and concerns about whether the stock market rally has run its course. 🤕

Meanwhile, the crypto world is keeping a close eye on the stock market's shenanigans. Some cryptos are holding their own, while others are getting caught in the crossfire, proving that traditional finance and crypto are more intertwined than ever. 🔗

But wait, there's more! The bond market is having a party as traders anticipate the Fed cutting interest rates in September. 🎉 This bullish sentiment has sparked a seven-day Treasury rally, the longest since the pandemic pandemonium. 📈

The FED - MAIN NEWS of the Week

Last but definitely not the least - The Fed might be turning the interest rate ship around as soon as September! 📉 This is big news for everyone, including crypto enthusiasts, because lower interest rates can mean a weaker dollar, which historically has been good news for Bitcoin and other cryptos. 💪

So, what's going on? The Fed is worried about the labor market getting a little wobbly, and they're trying to keep things balanced without triggering a recession. ⚖️ They're keeping a close eye on inflation, but they're also open to cutting rates if things look good. 👀

Why should you care? Well, lower interest rates could mean more money flowing into riskier assets like crypto. Plus, a weaker dollar could make Bitcoin and other cryptos look even more attractive to investors worldwide. 🤑

That's a wrap! See you next week for more byte-sized blockchain fun (and a sprinkle of ICP love).

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*