Sahm-Bam! Recession Alarm Bells Ringing!

The digital gold rush might be hitting a speed bump as the market whispers of a looming economic slowdown. 📉

So all the number crunchers, crypto nerds and economic enthusiasts! 🤓 Gather 'round, because we've got some juicy data to spill about the state of our economy. 💼

Sahm Rule: The Unsung Hero of Recession Prediction 🦸

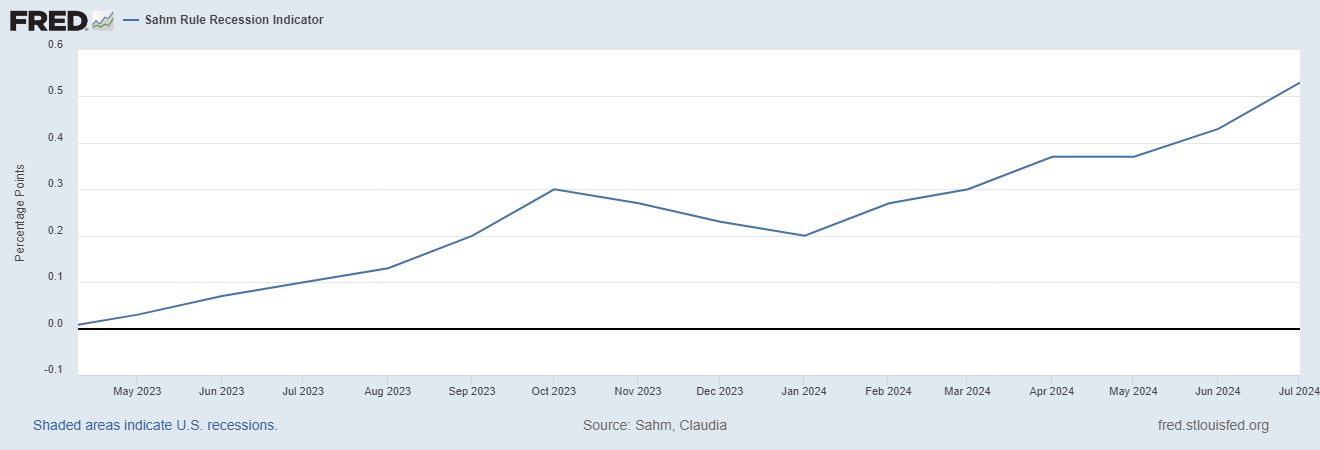

First things first, let's introduce the star of our show: the Sahm Rule. This clever little indicator, named after economist Claudia Sahm, basically says that if the unemployment rate (that pesky number that tells us how many folks are out of work) jumps up by half a percentage point or more over a certain period, we're likely headed for a recession. 📉

What the Numbers Say 📊

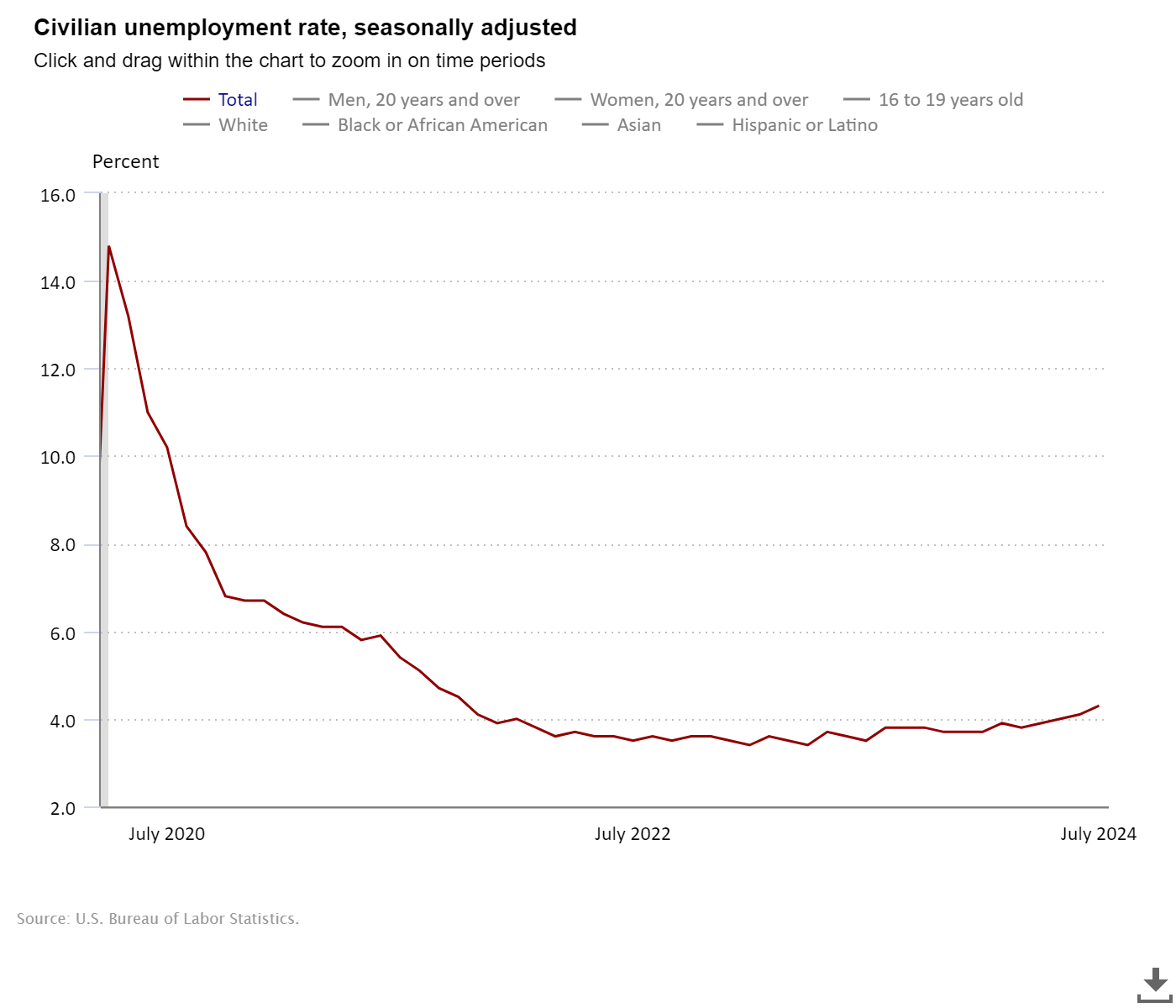

The latest unemployment data is in, and it's not looking pretty. 😟 According to the Sahm Rule, we've hit the dreaded threshold, folks. The unemployment rate has done a little hop, skip, and a jump over the past few months, signaling a potential recession.

Analysis of Real Unemployment Data

Here are the past 12 months Unemployment data for United States from BLS

Sahm Rule Calculation

To check for a recession signal using the Sahm Rule:

- Identify if the most recent three-month moving average is at least 0.50 percentage points higher than the lowest rate in the past 12 months.

Luckily FRED gives that in a nice format :

After the July BLS report, it's 0.53 🚨😨

So, What Does This Mean? 🤷♀️

Well, it's not exactly time to panic just yet, but it's definitely a sign that we need to pay attention. A recession means the economy is slowing down, which could mean less spending, less growth, and potentially even job losses. 😨. Even less money to pump the crypto !

Crypto Crash: Economy's Warning Shot Sends Shivers Down Digital Spine! 🚨

Global markets are in a tailspin! 📉 Stocks in Asia have taken a nosedive, with Japanese equities leading the plunge as the yen strengthens. The tech sector, previously fueled by the AI frenzy, is feeling the burn as investors reassess their positions. Even Bitcoin, the darling of the digital world, is taking a beating, tumbling 8% amidst the widespread risk aversion. Amidst the chaos, bonds are the shining beacon, offering a safe haven as investors flock to their relative stability.

The digital gold rush might be hitting a speed bump as the market whispers of a looming economic slowdown. 📉 Remember that Sahm Rule we talked about? Well, it's not just waving a red flag at the traditional economy, it's spooking the crypto world too! 👻

With the economy's brakes pumping, risk appetite is shrinking faster than a snowman in July, and crypto is getting caught in the crossfire. 🔥

The fear is real, folks. If the economy slows down, businesses might struggle, consumer spending could drop, and that could mean less money flowing into those digital wallets. 💸

Asian stocks are down, cryptocurrencies are tumbling and bonds are rallying amid concerns the Federal Reserve is behind the curve with policy support for a slowing US economy. Garfield Reynolds has more on "Bloomberg: The China Show." Read more here: https://t.co/kGRXGBxGCQ pic.twitter.com/AP91Xooxcu

— Bloomberg Asia (@BloombergAsia) August 5, 2024

But Hey, Let's Not Get Too Gloomy! 😊

Remember, economics is a complex beast, and there are always other factors at play. It's possible that we'll dodge this recession bullet altogether. 🤞 But for now, it's a good idea to stay informed, keep an eye on those unemployment numbers, and maybe stash away a few extra pennies just in case. 💰 Remember: even in a crypto winter, there's always a chance for a digital thaw! ❄️

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*