Trump Triumph! Crypto, Chaos, and a Wall Street Shakeup

Notoko, the blockchain's wildest child (and Motoko's mischievous twin!), is back from his crypto adventures with tales that'll make your head spin! 😵💫 He's explored the farthest reaches of the blockchain universe, but his heart always leads him back to #ICP. Get the juicy gossip in "Notoko Bytes"! ☕

And don't forget to smash that subscribe button to get the hottest crypto news delivered to your inbox every week!

Previous Issue

Inside this issue:

- Chain Chatter

- Chart of the Week

- Blockchain Spotlight: Illuminating the Internet Computer (ICP) 💡

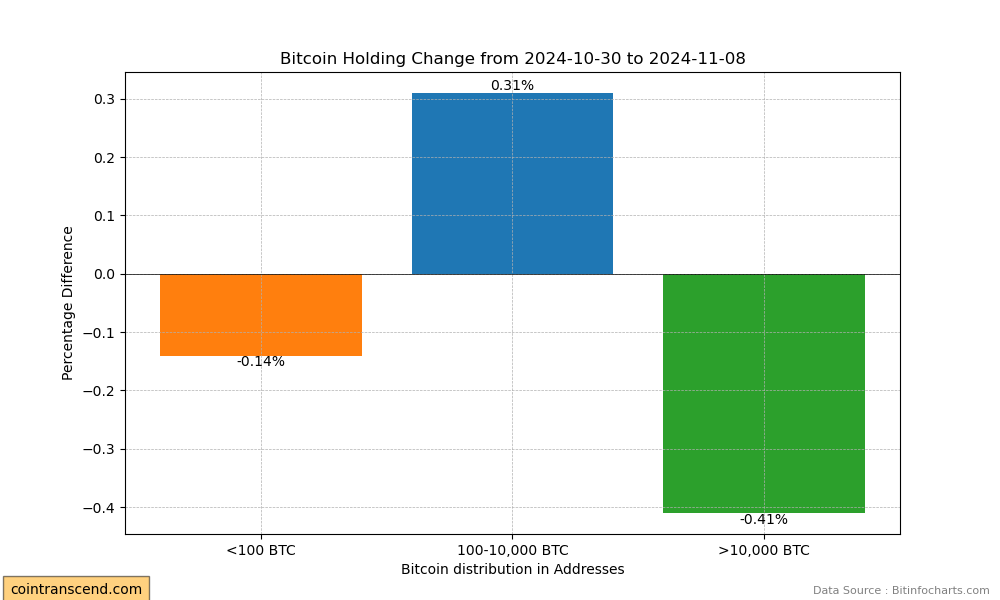

- Bitcoin's Wealth Distribution

- What's Brewing in Motoko's Canister ☕

Ready to jack in? Let's go! 🚀

Chain Chatter

- Picture this: Trump’s gearing up for a second-term whirlwind in the White House, and it’s got Wall Street and Washington buzzing. 🐝 Expect bold moves—tariffs 📈, tax cuts 💸, and a crackdown on immigration 🚫. Tariffs? He’s talking 20% on foreign goods and 60% on China 🚛. Taxes? Extending 2017 cuts and eyeing a no-tax-on-tips policy 💵. His loyalist-packed team is ready to roll 🎯, but he’ll need to tango with Congress to make it all stick. Market volatility, regulatory shifts 📉, and clashes with the Fed 💥 are on the menu.

- With Trump back in the Oval Office and crypto-loving politicians taking over Congress, the digital asset world is throwing a victory party! 🎉 And guess what's on the menu? Mergers and acquisitions, baby! 🤑 Crypto execs are doing the happy dance, hoping that Trump will finally give the SEC a much-needed makeover (and maybe even fire that party-pooper Gary Gensler). They're dreaming of a world where deals get done, innovation flourishes, and the US finally catches up with the rest of the world in the crypto game.

- With Trump’s win, the race to replace SEC Chair Gary Gensler is heating up, and it’s a power shuffle worth watching. Among the contenders? Richard Farley from Kramer Levin and Norm Champ from Kirkland & Ellis, plus Robinhood’s legal head Dan Gallagher, current SEC Commissioner Mark Uyeda, and ex-CFTC boss Heath Tarbert. Talk about a lineup ready to shake things up. ⚖️ Trump’s transition team wasted no time chatting up candidates, setting the stage for some major changes at the SEC. If the next chair tilts more crypto-friendly, we could see a serious rollback of Gensler-era regulations that had the digital asset world sweating bullets. 🚦

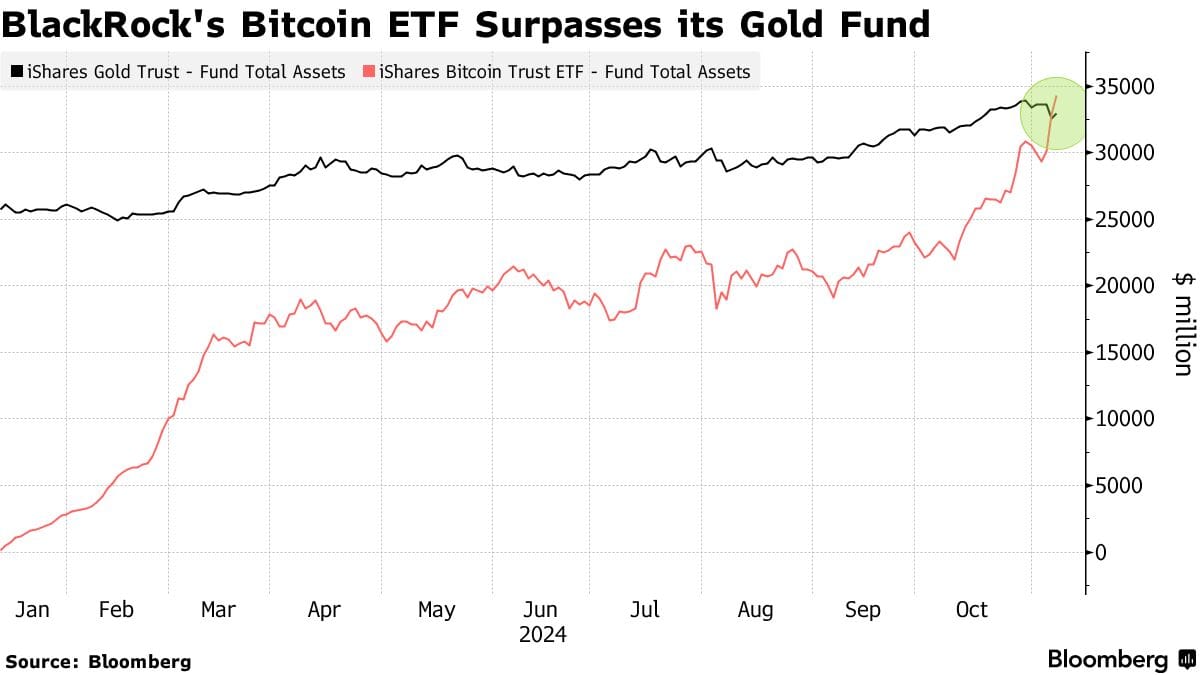

- Looks like BlackRock's Bitcoin ETF is the new golden child of Wall Street! After a record-breaking inflow of $1.1 billion, it's officially bigger than their own gold fund. Talk about a digital gold rush! This Bitcoin ETF has been a magnet for investors ever since it launched, and with Bitcoin hitting new all-time highs thanks to Trump's victory, it's showing no signs of slowing down. Could this be the beginning of the end for gold as we know it?

- Looks like Tether, the stablecoin king, is branching out! They just funded their first oil trade in the Middle East, helping a big-time oil company and a fancy trader move a whole lotta crude. Talk about a power move! Tether's CEO says this is just the beginning, and they're looking to shake up the world of commodities trading. Could this be the start of a "black gold" rush backed by stablecoins?

Chart of the Week

Blockchain Spotlight: Illuminating the Internet Computer (ICP)

Notoko's Take: ICP + AI = Web3 on Steroids!

🐸 You see, I was doing some late-night creeping on Dom's Twitter (don't judge me! 👀), and I stumbled across something that made my brain do a backflip. He's been dropping hints about this AI x internet revolution brewing on ICP, and let me tell you, it's gonna be wilder than a monkey on a moped! 🐒🛵

The AI x internet revolution coming on #ICP:

— dom.icp ∞ (@dominic_w) November 8, 2024

*Self-writing* sovereign web applications and internet services that owners can update in real-time by talking 💥

The Internet Computer has been designed for this and work has been ongoing for YEARS.

Today I want to explore this…

Imagine this: self-writing web apps and internet services that you can update just by talking! 🗣️✨ Yeah, you heard that right. No more coding bootcamps, no more debugging nightmares, just pure, unadulterated creation powered by the magic of AI. ✨ Want a custom website? Just tell the AI what you want, and boom! It's there. Need a killer game? Describe it, and it's yours. It's like having your own personal genie in a canister, ready to grant your every Web3 wish. 🧞♂️

But here's the kicker: these apps and services won't just be easy to create, they'll also be sovereign. That means you own your data, you control your code, and you're not beholden to any Big Tech overlords. It's like having your own little corner of the internet where you make the rules. 😎

And guess what? Only ICP can pull this off. Why? Because they've been busy reinventing the very foundation of computing with this crazy thing called "orthogonal persistence." Don't worry, I won't bore you with the technical details (even I don't fully understand them!), but just know that it's some seriously next-level stuff that makes building and updating apps smoother than a buttered dolphin. 🧠✨

So what does this all mean? It means that ICP is about to unleash a tidal wave of innovation, empowering anyone and everyone to create and control their own piece of the internet. It's like giving the keys to the kingdom to the entire world! 🗝️🌎

Forget those other blockchains that are just playing catch-up. ICP is the real deal, the OG innovator that's building the future of Web3, one mind-blowing canister at a time.

Bitcoin's Wealth Distribution: Where the Big Stacks Live

What's Brewing in Motoko's Canister ☕

DeFi: Back from the Dead (Thanks, Trump?!)

Remember DeFi? That wild west of crypto where you could earn triple-digit yields on tokens with names like "Magic Internet Money"? Yeah, things got a bit quiet after the whole Terra Luna fiasco and the SEC started cracking down on everything that moved. But folks, DeFi might be making a comeback!

Post-election, DeFi tokens like UNI (from Uniswap) and AAVE shot up faster than you can say “market pump.” The buzz? A Trump win might ease up crypto regulation, giving platforms some breathing room (SEC lawsuits? Maybe bye-bye). 🚀

The crypto world is feeling a lot more optimistic about the future of decentralized finance. The thinking is that a more crypto-friendly administration means less regulatory headaches and more room for innovation. Some folks are even predicting a "DeFi renaissance" with big institutions finally jumping in. Of course, not everyone's convinced – some say DeFi still has some serious issues to address before it can truly take on Wall Street. But hey, a little optimism never hurt anyone, right? Let's see if DeFi can rise from the ashes and reclaim its throne as the most exciting corner of the crypto kingdom! 🔥

That's a wrap! See you next week for more byte-sized blockchain fun (and a sprinkle of ICP love).

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*