XRP ETFs, Stablecoin Takeovers, and Crypto Hedge Fund Wins

Notoko's back, baby! 🎤 After a whirlwind blockchain adventure, he's ditching those "meh" chains and returning to his beloved ICP. 💻 Think of it like a backpacking trip through Europe, but for crypto – except instead of hostels and questionable street food, it's gas fees and rug pulls. 😅

And don't forget to smash that subscribe button to get the hottest crypto news delivered to your inbox every week!

Previous Issue

Inside this issue:

- Chain Chatter

- Plot of the Week

- Blockchain Spotlight: Illuminating the Internet Computer (ICP) 💡

- Crypto IPOs: Waiting for the Election Dust to Settle

- Bitcoin's Wealth Distribution

- What's Brewing in Notoko's Canister ☕

Ready to jack in? Let's go! 🚀

Chain Chatter

- Brad Garlinghouse, the big cheese 🧀 at Ripple, says an XRP ETF is about as inevitable as your uncle's questionable dance moves at the family reunion. 🕺 After all, the SEC finally caved and approved a Bitcoin ETF, and look at it now! 🚀 $17 billion flowing into the crypto party! 🎉 With Bitwise and Canary Capital already throwing their hats in the ring for XRP ETFs, it's only a matter of time before you can trade XRP like it's your favorite meme stock. 💎🙌. Just remember: institutional money loves a good ETF, and that's good news for XRP's price. 📈 Cha-ching! 🤑

- Komainu, the crypto custodian with Nomura's backing 💼, is on a shopping spree! 🛍️ They're snatching up Singaporean rival Propine Holdings like it's the last pair of limited-edition sneakers. 👟 This takeover is just the first of many, according to Komainu's co-CEO Paul Frost-Smith, who's probably got his eye on a few more shiny crypto companies. 👀 With this acquisition, Komainu's snagging a Capital Market Services license in Singapore 📜, which is like the golden ticket to crypto wonderland in Asia. 🌏 They're also gunning for a Major Payment Institution license, basically the VIP pass to offering payment services. 💳

- Stripe's snatching up stablecoin platform Bridge for a cool $1.1 billion! 💰 It's like they saw the future of finance shimmering in those stablecoins and just couldn't resist. ✨ Stripe's CEO, Patrick Collison, even called stablecoins "room-temperature superconductors for financial services," which sounds super smart and stuff. 🤓 Basically, Stripe's building the ultimate stablecoin playground for businesses to issue and accept them like candy. 🍭 This comes hot on the heels of Stripe letting US merchants accept USDC, so they're clearly all-in on this stablecoin revolution. 🚀

- London's crypto hedge funds are raking in the cash! 🤑 Nickel Digital, led by ex-Goldman Sachs hotshot Anatoly Crachilov, is up over 24% this year, while Fasanara Digital's boasting an 18.5% gain. 📈 It's like they've got a magic touch with those digital assets! ✨ Bitcoin's mooning, nearing its all-time high, and these hedge funds are riding the wave like pros. 🏄♂️ Even traditional finance giants are getting in on the action, with nearly half of them now holding crypto. It's official: crypto's gone mainstream! 🕺

- Norway's central bank is taking its sweet time deciding on a digital currency, and they're totally cool with it. 😎 It's like they're saying, "We're Norway, we do what we want!" 🇳🇴 Deputy Governor Pål Longva says there's "no urgency" for a CBDC, even though other countries are jumping on the bandwagon. Maybe they're just enjoying being the most cashless country and don't want to mess with a good thing? 🤔 They're still exploring both retail and wholesale versions, but they're leaning towards wholesale, which is like a CBDC for banks only. 🏦

- Tigran Gambaryan, Binance's head of financial crime compliance, is finally a free man! 🎉 After being detained in Nigeria since February on money laundering charges, the court dropped the case due to his health. Apparently, Nigerian prisons aren't exactly known for their 5-star accommodations. 😅 While his lawyer's request for a full acquittal was denied, Gambaryan's probably just happy to be out of there. ✈️

Plot of the Week

Blockchain Spotlight: Illuminating the Internet Computer (ICP)

Tired of wrestling alligators in the Web3 swamp? 🐊 ICP is paving the way to a smoother ride with its developer roadmap! Beryllium's dropping THIS MONTH with canister snapshots (like a "Ctrl+Z" for your dApp!), user-friendly logging, and error messages that won't make you cry. 😭➡️😄

Read the full complete here :

Crypto IPOs: Waiting for the Election Dust to Settle

While the world watches the US election unfold, venture capitalists are eagerly awaiting the after-party: a potential surge of crypto IPOs. 🎉 With big names like Circle, Kraken, and Fireblocks rumored to be eyeing the public markets, the election outcome could be the green light they've been waiting for. 🚦 The current SEC chair, Gary Gensler, hasn't exactly been crypto's best friend, with his crackdown on industry giants. But with a potential change in leadership on the horizon, things could be looking up. 🤔

Both presidential candidates offer a glimmer of hope for crypto IPO hopefuls. Trump's vowed to fire Gensler and embrace the industry, while Harris might replace him with someone a bit more moderate. Either way, it could mean a smoother path to IPO for companies like Fireblocks and Chainalysis. 🚀 But those who've tangled with the SEC in the past might still face some hurdles, even with a new sheriff in town. Still, with Bitcoin riding high and risk appetites returning, the post-election landscape could be ripe for a crypto IPO boom. 📈 VCs are surely hoping to cash in on those stock market dreams! 🤑

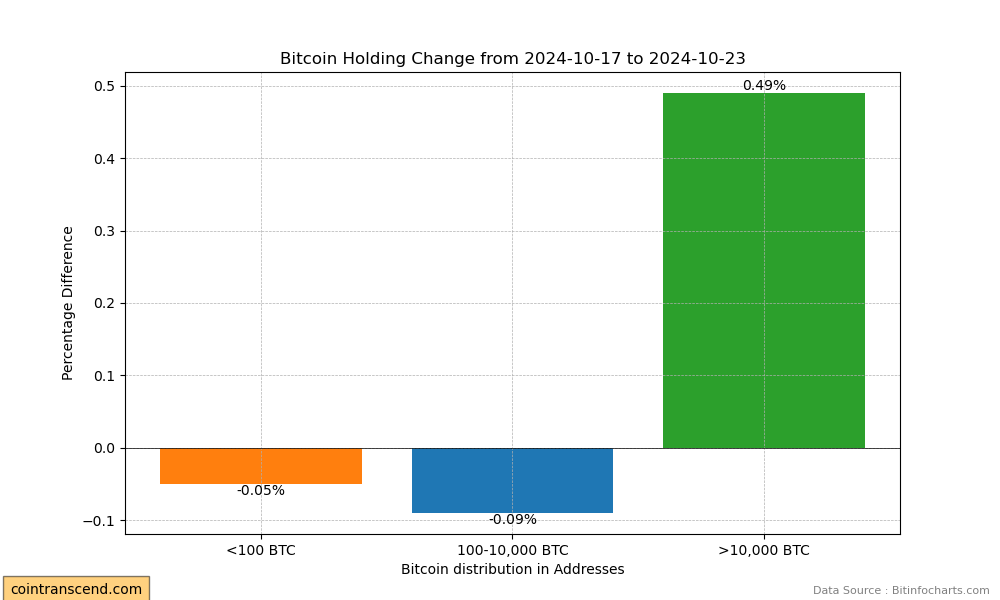

Bitcoin's Wealth Distribution: Where the Big Stacks Live

What's Brewing in Motoko's Canister ☕

Curious to know what’s Notoko Thinking About This Week? Let's dive in...

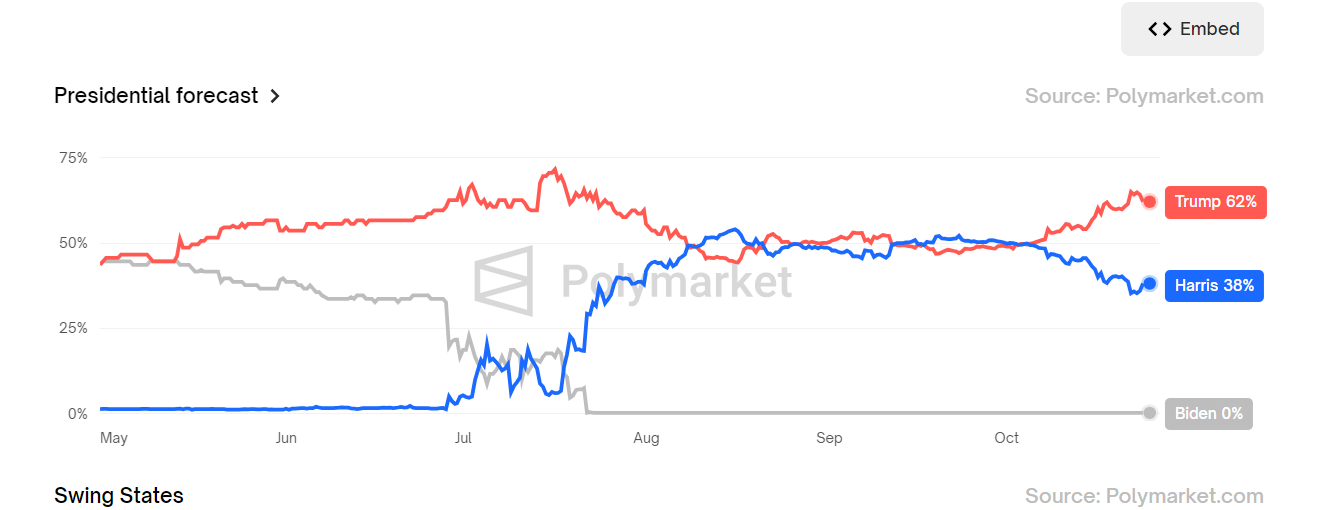

Bets, Whales, and Polls: Polymarket’s Wild Ride to Election Day

With the US presidential election just around the corner, Polymarket has been catching all the buzz. Traders are going wild with their bets on Trump, even though technically, US users aren't allowed on the platform. (Cue the VPNs and secret instructions flooding social media. Sneaky, sneaky! 👀)

Big Whale Alert: There’s a user called Fredi9999 who's already thrown down $18 million in bets on Trump, with more than $13 million of that on just one market! But it doesn’t stop there – blockchain detectives over at Arkham Intelligence think Fredi might actually control four different accounts that have collectively bet $43 million on Republican outcomes. 🐳💰

But here’s the kicker: The odds on Polymarket say Trump has a 64% chance of winning, while mainstream political polls have him trailing Harris by the slimmest of margins: 48.5% to 49.3%. Huh? Are the bettors seeing something the polls aren’t, or are they just flexing their wallets to shift the narrative? 🤨

We call this the “Money = Conviction” theory. Why donate to a campaign when you can bet on your favorite candidate and potentially make some cash if they win? Brilliant… or diabolical? Depends who you ask. 😎

Meanwhile, platforms like PredictIt and Kalshi show slightly different odds, and let’s not forget that Polymarket already had a run-in with regulators, promising to block US users after a slap on the wrist from the Commodity Futures Trading Commission back in 2022. Seems like rules are more like “guidelines” for these election gamblers. 🕵️♂️. Mark your calendars, fam. 📅

And now...

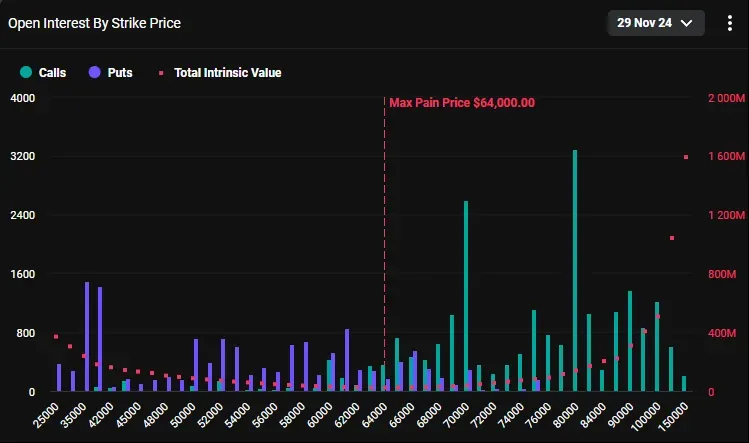

Bitcoin: To the Moon, No Matter Who's President?

Okay, so basically, Bitcoin options traders are feeling super bullish about Bitcoin hitting a new all-time high of $80,000 by the end of November, and they're not too worried about who wins the US election. They're placing their bets (literally!) that Bitcoin will go up, no matter what happens with Trump or Harris.

There are a few reasons for this optimism. First, both candidates seem pretty crypto-friendly, so there's no fear of a regulatory crackdown. Second, the Fed might cut rates again, which could be good news for Bitcoin. And finally, Bitcoin has already been on a tear this year, so traders are feeling confident that the momentum will continue.

That's a wrap! See you next week for more byte-sized blockchain fun (and a sprinkle of ICP love).

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*