The Ether ETF Extravaganza: First Week Wrap-Up!

The Ethereum ETF scene has been anything but dull in its debut week. It's been a whirlwind of big money moves and unexpected turns, leaving everyone on the edge of their seats. 🍿

The Big Splash: $340 Million Outflow 🚿

So, what's the scoop? In their debut week, the nine US ETFs holding Ethereum saw a whopping $340 million in outflows. Yep, you heard that right! Investors were quick to pull out their money from the high-fee legacy products that got converted into ETFs. It's like they saw a sale and decided to cash in! 💸

New Kids on the Block: $1.17 Billion Inflows 🤑

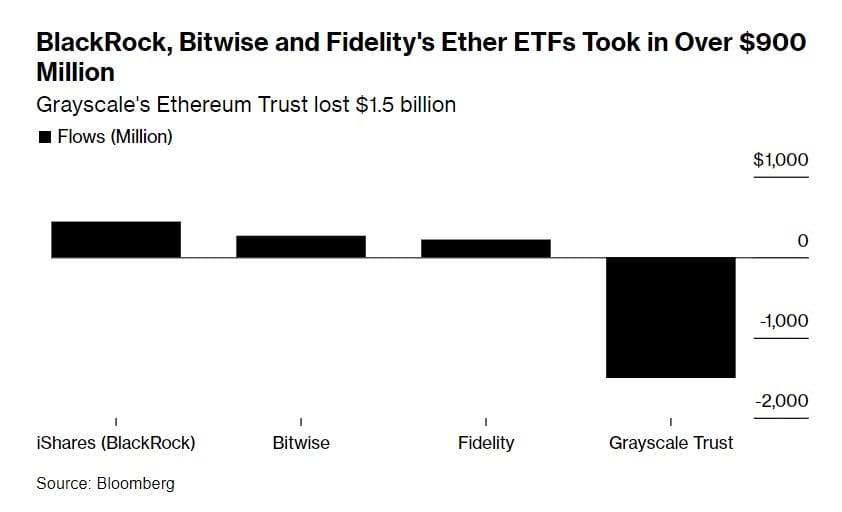

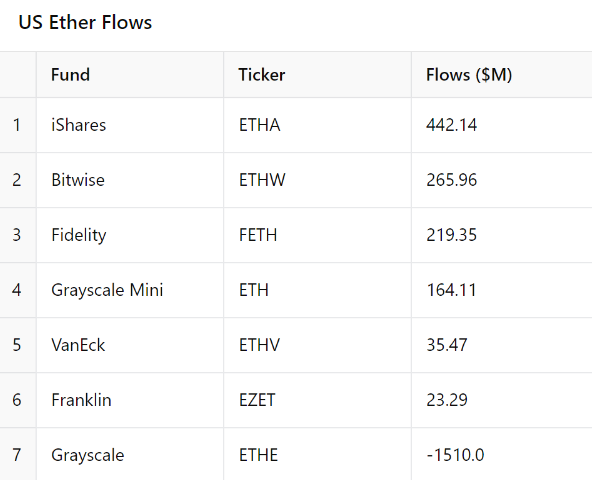

But wait, there's more! The eight brand-new Ether ETFs that hit the scene following the US Securities and Exchange Commission's nod last week raked in a cool $1.17 billion in just four trading days. Talk about a warm welcome! 🥳 Leading the pack were big players like BlackRock, Bitwise, and Fidelity, with inflows of $442 million, $266 million, and $219 million, respectively. Looks like these guys are the new hotshots in town! 🚀

Grayscale's Wild Ride: $1.5 Billion Outflow 🎢

On the flip side, Grayscale's Ethereum Trust had a bit of a rough patch, losing a staggering $1.5 billion. Ouch! This isn't the first time we've seen something like this; remember when Bitcoin spot ETFs launched in January? Investors did a similar pull-out from the Bitcoin Grayscale Trust. It's like déjà vu, but with Ethereum this time! 🤯

The Mini Trust: Small But Mighty 💼

In a savvy move, Grayscale also launched a new "Ethereum Mini Trust" with a current fee of 0%, compared to the original trust's hefty 2.5%. The mini trust managed to bring in $91 million last week. Not bad for the new kid on the block! It seems like investors are all about those lower fees. Can you blame them?

Now, let's talk Ether prices! Since the ETFs started trading on July 23, the price of Ether has dipped 4.6%, settling around $3,326 (at the time of writing, god knows where it is when you read this 😉). But hey, don't fret! The second-biggest cryptocurrency after Bitcoin is still up about 46% this year. Not too shabby, right? 🌟

The Future of Ether ETFs: What's Next? 🔮

With all this excitement in week one, one thing's for sure: the Ether ETF scene is one to watch. The crypto world is constantly evolving, and this is just the beginning of an exciting new chapter.

BlackRock's Samara Cohen spills the tea on iShares Ethereum Trust ETF (ETHA), predicting crypto ETF integration into model portfolios by year-end and into 2025! She did mention no Solana ETF is in sight though.

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*