Binance's Troubles, Visa's Stablecoin Splash & More!

Legends say that Notoko, Motoko's mischievous brother, set out to explore blockchains far and wide. But his heart always beats for ICP, his true home. Now, he shares his discoveries in "Notoko Bytes"!

And don't forget to smash that subscribe button to get the hottest crypto news delivered to your inbox every Tuesday and Thursday! 🔥

Previous Issue

Inside this issue:

- Chain Chatter

- Bitcoin's Wealth Distribution

- Crypto & Elections

- Blockchain Spotlight: Illuminating the Internet Computer (ICP) 💡

- Crystal Ball Bitcoin Time 😜

- What's Brewing in Motoko's Canister ☕

Ready to jack in? Let's go! 🚀

Chain Chatter

- Okay, so Web3 is facing a bit of a "revolving door" situation! 🚪🔄 It's like a super-hyped party where everyone rushes in for the free swag (tokens!), but then they bounce as soon as the goodies run out. 🪅💨 This "tokenomics-as-a-product" thing is making some folks feel like they're the product themselves! 🤖 But hey, there's still hope! ✨ Optimism's Urvit Goel says killer apps with awesome user experiences are the real MVPs. 💪 And Everest Ventures Group's Allen Ng is channeling his inner Steve Jobs, saying "start with a vision, people!" 🍎 So basically, Web3 needs to offer more than just free tokens to keep the party going. 🎉 It's time for some real-world value and user-friendly experiences! 🚀

- Oof! Looks like Binance is having a bit of a rough patch! 🤕 Their market share took a tumble in September, hitting its lowest point in four years. 📉 CCData says they're down to 36.6% – guess all those regulatory hurdles and that whole kerfuffle with the DOJ are taking their toll. 😬 It seems like CZ stepping down and doing time hasn't totally calmed the storm. ⛈️ But hey, new CEO Richard Teng is a former regulator himself, so maybe he can smooth things over with the authorities. 🤞 Let's hope Binance can bounce back and regain its footing!

- Whoa, Visa is diving headfirst into the stablecoin game! 🏊♀️💰 They're launching a shiny new platform called VTAP that lets banks mint their own digital tokens like it's nobody's business! 🪙✨ Think of it as a digital dollar printing press, but on the blockchain. ⛓️🖨️ BBVA is already on board and testing things out on the Ethereum network. 🇪🇸🧪 Visa's Vanessa Colella says they're basically setting the pace for the whole industry. 🥇 With PayPal and Stripe also in the mix, it looks like stablecoins are about to become the cool kids on the block. 😎 Who knows, maybe we'll all be paying for our lattes with bank-issued tokens soon! ☕️💸

- Woohoo! PayPal just hit a major milestone in the stablecoin world! 🎉 They completed their very first business payment using their own PYUSD stablecoin. 🤝 It's like sending a wire transfer, but with a crypto twist! 🔄✨ They teamed up with Ernst & Young and SAP to make it happen, proving that stablecoins can streamline those clunky old business transactions. 💨 Jose Fernandez da Ponte, PayPal's crypto guru, says this is just the beginning for stablecoins in the business world. 💼🚀 Faster, cheaper, and less risky cross-border payments? Sign me up! ✍️ Looks like PYUSD is ready to take on the corporate world! 🏢

- SEC vs. Ripple saga just took another wild turn! 🎢 The SEC is throwing a bit of a tantrum and appealing that $125 million judgment against Ripple. 😡 Remember, they wanted a whopping $2 billion! 🤑 It seems they're still salty about Judge Torres' ruling that XRP isn't always a security. 🙅♀️ Ripple CEO Brad Garlinghouse is basically like, "Give it up already, SEC! You lost!" 😂 But the SEC is digging in their heels, claiming the decision goes against decades of precedent. 🏛️ This crypto courtroom drama is far from over, folks! 🍿 Stay tuned for the next episode! 💥

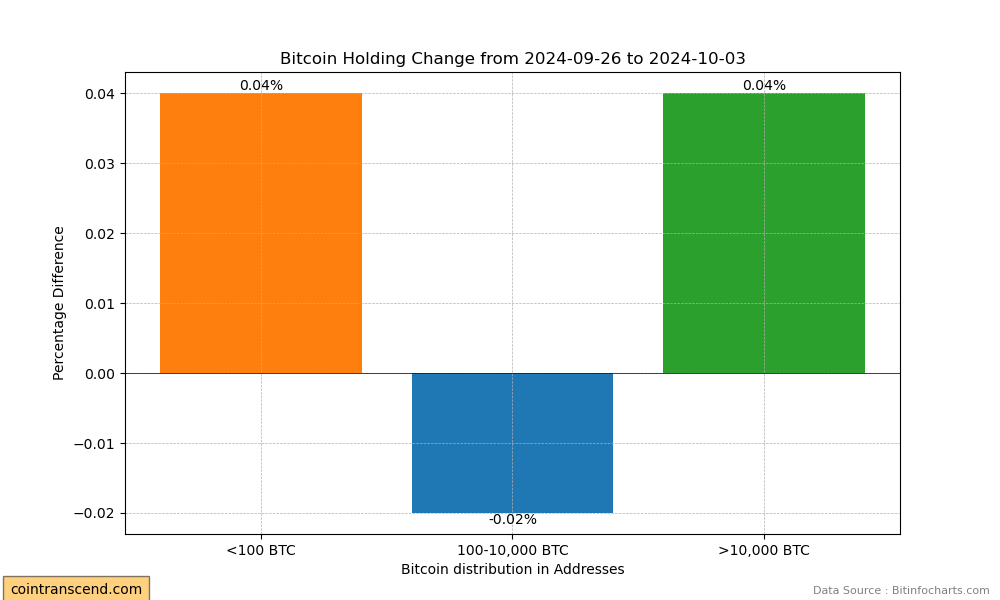

Bitcoin's Wealth Distribution: Where the Big Stacks Live

Crypto & Election

Crypto’s Silent Win in the 2024 Election 🎉

While crypto isn't stealing the spotlight in the 2024 presidential debates, it's quietly positioning itself for a win no matter who takes office. Venture capital giants like Pantera Capital and Dragonfly are betting big that clearer regulations are on the horizon, especially with Trump hyping up the industry and Harris giving a nod to innovation. With regulatory clarity potentially on the way, the doors could swing wide open for new projects that have been hesitant to launch in the US. 🚀

The SEC may have been tough on crypto lately, with lawsuits flying at Binance, Coinbase, and Ripple, but political winds are shifting. Founders who’ve been waiting on the sidelines are now seeing a glimmer of hope. As Franklin Bi from Pantera Capital puts it, this shift could be the tide that lifts all boats—both in the US and abroad. 🌊

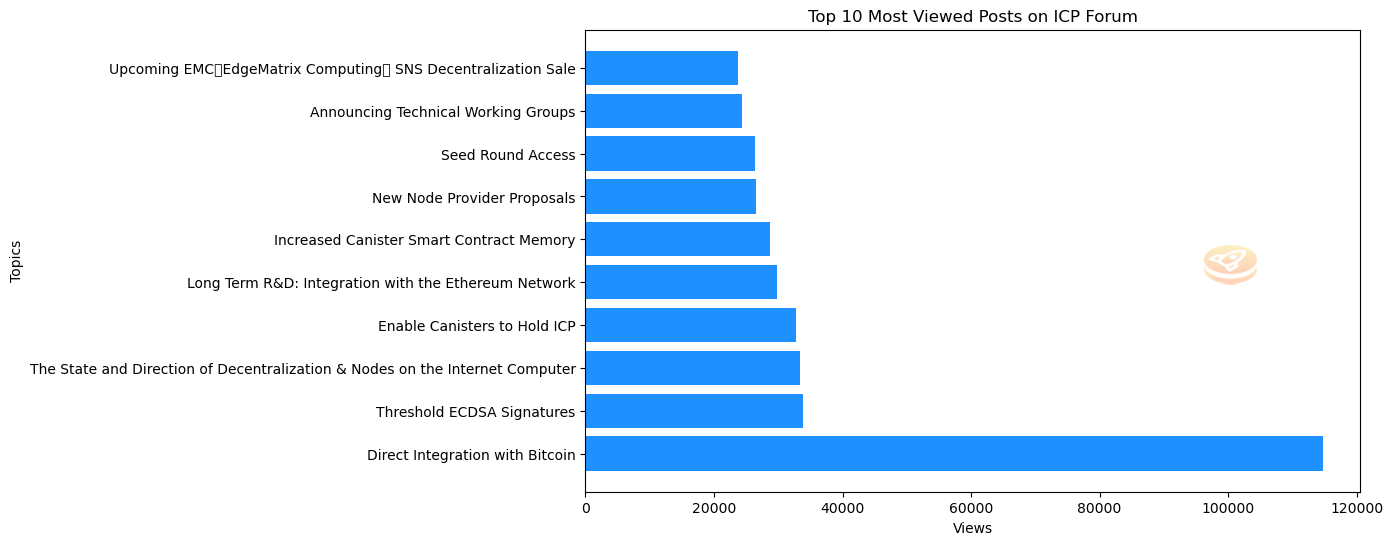

Blockchain Spotlight: ICP ♾️

What we wrote

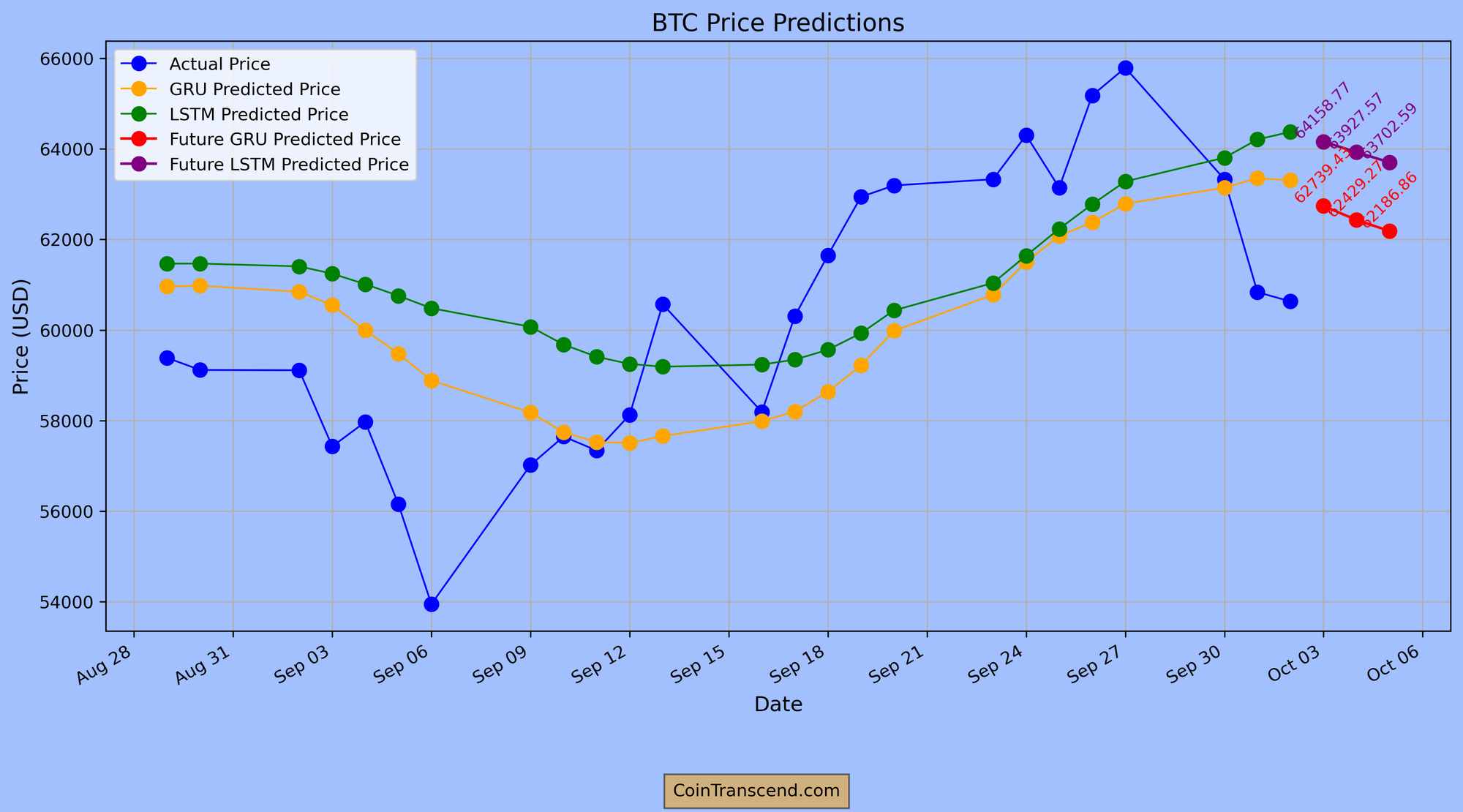

Crystal Ball Bitcoin Time 😜(Just for fun, not financial advice!)

For all the Crypto Geeks , Read the Strategy behind the Price prediction

What's Brewing in Notoko's Canister ☕

Ghost in the Machine: Jobs Report and the Crypto Fam 👻📊

Hey Crypto Fam! ✊ Tomorrow's US jobs report 📰 is dropping, and you should be paying attention 👀. Why? Because it's like a system diagnostic 🩺 for the US economy 🇺🇸, and that impacts crypto 💰 in a big way.

Here's the deal:

- Fed's Next Move 🕹️: The jobs report tells the Federal Reserve how the economy is doing 📈📉. Strong report 💪 = 🚀 economy, and they might raise interest rates 💹 to fight inflation 🔥. Weak report 🤕 = 🐌 economy, and they might cut rates ✂️.

- Interest Rates = Crypto Ripple Effect 🌊: Interest rates are like gravity 🌎 for money 💸. Higher rates pull money towards "safe" investments 🏦 (like bonds), maybe away from crypto 📉. Lower rates do the opposite 🔄, making risky assets like crypto more attractive 🚀.

- Dollar Power 💪: Jobs report can pump up the dollar 💵. Strong report = strong dollar 💪, which can push crypto prices down 👎 (since most crypto is priced in USD).

- Market Vibes ✨: Good jobs report = good vibes 😊 in the markets, more confidence ✨, more investment 🚀 (including crypto!). Bad report = fear 😨 and selling 📉.

Bottom line: The jobs report is a window 🪟 into the US economy 🇺🇸, and that affects crypto 🌐. Stay informed 🧠, crypto fam, and make smart moves! 🤓

That's a wrap! See you next week for more byte-sized blockchain fun (and a sprinkle of ICP love).

Disclaimer

*The information and analysis provided in this article are intended for educational and informational purposes only and should not be considered as financial, investment, or professional advice. While our team strives to ensure the accuracy and reliability of the content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information presented.

The content within this article may include opinions and forward-looking statements that involve risks and uncertainties. The blockchain and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Any reliance you place on the information presented is strictly at your own risk. Before making any investment decisions, we highly recommend consulting with a qualified financial advisor or conducting your own thorough research.

By accessing and using the information provided in this article, you acknowledge and agree that neither the authors, publishers, nor any other party involved in the creation or delivery of the content shall be held liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to loss of profits, goodwill, or data, arising out of your use or inability to use the information provided or any actions you take based on the information contained within this section.*